AUD/CAD buyers confront key resistance amid mixed market sentiment

Market overview

The AUD/CAD pair has shown an upward movement on the four-hour chart, driven by a mix of market factors. Despite weak economic data from China, which weighs on the Australian dollar, recent gains have been supported by speculation around the Bank of Canada accelerating its rate cuts. The dovish stance from the Bank of Canada’s governor, coupled with falling oil prices, has weakened the Canadian dollar (CAD), giving the Australian dollar (AUD) room to strengthen.

The pressure on CAD is compounded by concerns over lower oil demand, particularly in light of the global economic slowdown. Meanwhile, AUD continues to face challenges due to its strong correlation with Chinese economic performance, although it has managed to outperform CAD in the short term.

Technical analysis

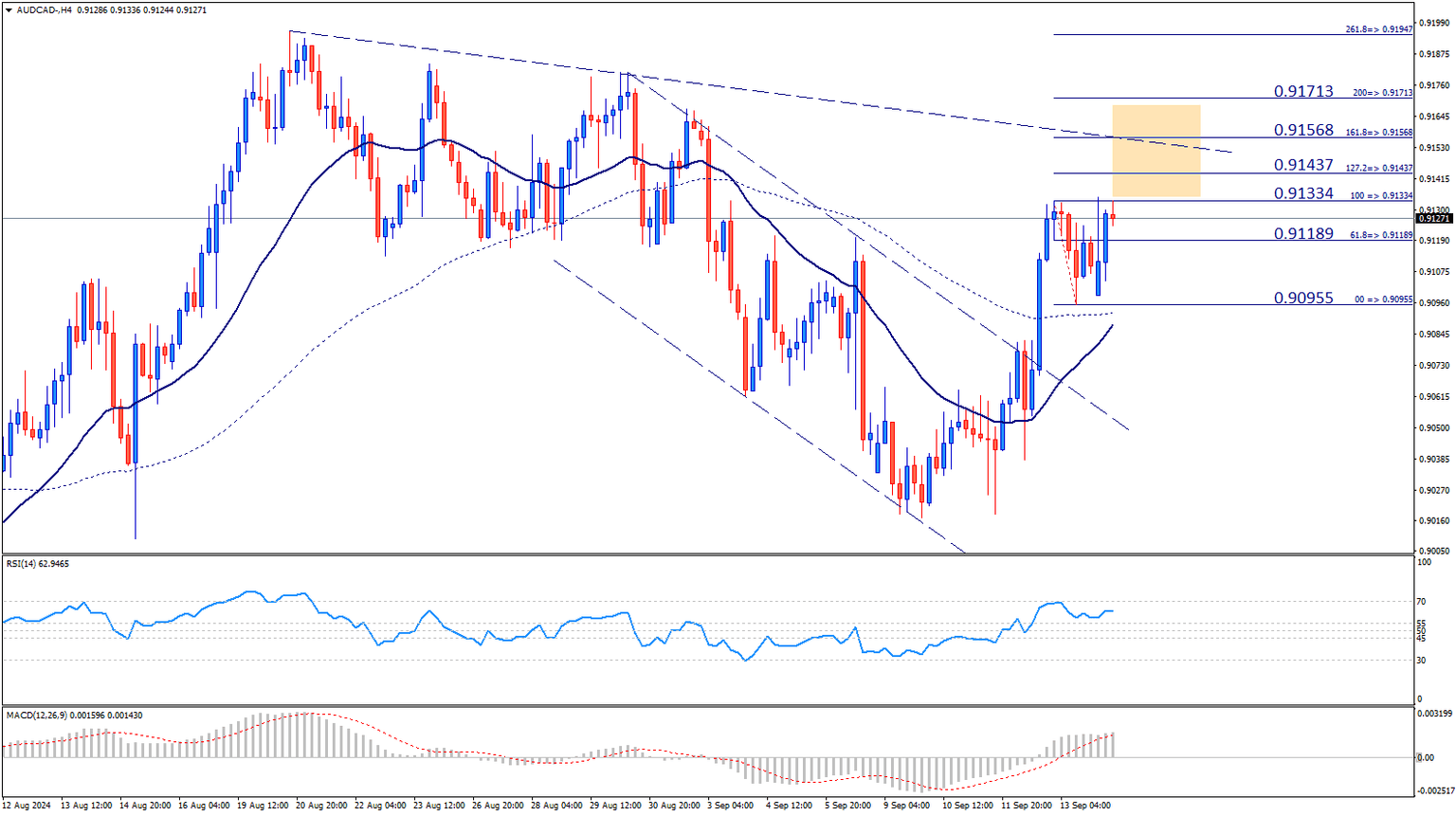

On the four-hour chart, AUD/CAD has broken out of its downward channel, rising above key moving averages, signaling that buyers currently have control. The pair is trading between immediate support at 0.90955 and a key resistance at 0.91334. Momentum oscillators further suggest buyer dominance. The RSI is hovering near the overbought zone, close to 70, indicating sustained buying pressure, while MACD histograms are positive and crossing above the signal line, showing continued bullish momentum.

If buyers can maintain this momentum and break the 0.91334 resistance, the price could move higher to 0.91437 and 0.91568, which corresponds to the 161.8% Fibonacci extension of the last downward swing. Beyond this, 0.91713 emerges as the next significant target.

Oscillator confirmations

RSI: Currently near the overbought level, reflecting strong buying momentum.

MACD: Positive momentum as MACD histograms continue to rise above the signal line, confirming bullish strength.

Moving Averages: Both the short-term and long-term moving averages are trending upward, reinforcing the ongoing uptrend.

Alternative scenario

Should sellers regain control, breaking below 0.90955 would invalidate the bullish outlook. A sustained move beneath this level could expose the pair to further downside pressure, leading to a possible decline toward deeper support levels.

Key levels overview

- Resistance levels:

- Resistance 4: 0.91713.

- Resistance 3: 0.91568.

- Resistance 2: 0.91437.

- Resistance 1: 0.91334.

- Current Price: 0.91271.

- Support levels:

- Support 1: 0.91189.

- Support 2: 0.90955.

Key events to watch

Both the Canadian dollar (CAD) and Australian dollar (AUD) are poised for potential volatility this week due to key economic releases. For CAD, all eyes are on the CPI inflation data for August, which will provide insights into the Bank of Canada's future policy stance. Any signs of a slowdown in inflation or housing starts could weaken CAD further. Bank of Canada Governor Macklem's speech on September 20 will also be critical, especially in light of weak core retail sales data showing a -0.5% decline month-on-month, hinting at potential weaknesses in consumer spending.

On the AUD side, the employment change data for August fell short of expectations, with only 25.8k jobs added versus the forecasted 58.2k. However, the unemployment rate held steady at 4.2%, potentially mitigating some of the negative sentiment around the weak jobs report. Still, this combination of weak employment data and speculative net-short positioning on the Australian dollar may subject AUD to downside pressure in the short term.

Author

Ali Mortazavi

Errante

BEc, CMSA, Member of IFTA - International Federation of Technical Analysis, Associate Member of STA - Society of Technical Analysis (UK).