Riding the wave of a weaker yen, Japan's stocks led the charge in Asia on Friday, with the Nikkei 225 surging over 3%, setting the stage for its best week in four years. This rally followed Wall Street's overnight gains, spurred by robust economic data that eased fears of a looming recession and hinted that the U.S. economy might be on track for a soft landing.

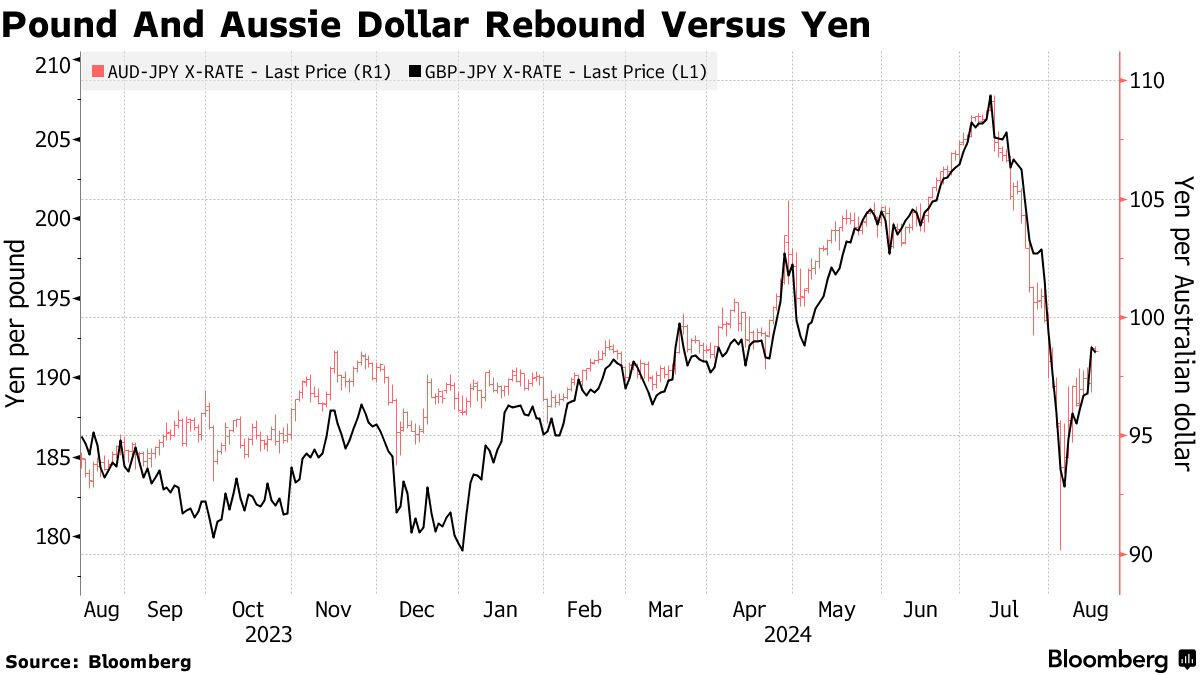

While well-known business publications hint at a return to the carry trade, it’s not quite the case. It is how FX markets work. Since 2006, both human and algorithmic traders have closely watched the yen, reacting in real-time to the twists and turns of the global risk markets. When the stock market dives, so does X/JPY; when risk assets soar, so does X/JPY. This behaviour has turned the yen's movements into a self-fulfilling prophecy—a cycle where expectations drive reality. In other words, it reflects a risk on trade that can create overshoots on USDJPY. That said, we will likely see some “Johnny come lately" demand moving into cyclical currencies funded by the yen, keeping USDJPY supported today.

However, the plot thickens after the Bank of Japan's (BoJ) dovish waxing last week stabilized market conditions and might nudge the BoJ to consider further policy normalization, especially as the yen edges above the 150 level.

Indeed, the rules have changed, and those in the know understand that what might seem like a market crisis is often just another golden opportunity, courtesy of central banks’ uncanny ability to steer market sentiment.

While a rate hike in September seems unlikely—especially after the recent shockwaves in Japanese equities—the odds of a hike by the end of 2024 have jumped from 0% to 30%, by my calculations. The market is starting to factor in the possibility that the BoJ could shift gears sooner than anticipated as the economic landscape continues to evolve.

The yen's trajectory remains a pivotal storyline in the global financial narrative, and all eyes are on the BoJ’s next move. This could limit the USDJPY topside move.

I suspect the USD/JPY saw an overshoot via the risk on X/JPY demand rather than a calculated move. Unfortunately, for a full-on bear assault on the dollar, the surprisingly strong US data may have put to rest talk of a 50bp cut in September; hence, we could hold off until the Jackson Hole pow-wow or NFP.

SPI Asset Management provides forex, commodities, and global indices analysis, in a timely and accurate fashion on major economic trends, technical analysis, and worldwide events that impact different asset classes and investors.

Our publications are for general information purposes only. It is not investment advice or a solicitation to buy or sell securities.

Opinions are the authors — not necessarily SPI Asset Management its officers or directors. Leveraged trading is high risk and not suitable for all. Losses can exceed investments.

Recommended Content

Editors’ Picks

Gold gives away some gains, slips back to $2,980

Gold retraced from its earlier all-time highs above the key $3,000 mark on Friday, finding a footing around $2,980 per troy ounce. Profit-taking, rising US yields, and a shift to a risk-on environment seem to be putting the brakes on further gains for the metal.

EUR/USD remains firm and near the 1.0900 barrier

EUR/USD is finding its footing and trading comfortably in positive territory as the week wraps up, shaking off two consecutive daily pullbacks and setting its sights back on the pivotal 1.0900 mark—and beyond.

GBP/USD remains depressed, treads water in the low-1.2900s

GBP/USD is holding steady in consolidation territory after Friday’s opening bell on Wall Street, hovering in the low-1.2900 range. This resilience comes despite disappointing UK data and persistent selling pressure on the USD.

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.