Asia week ahead: PMIs and CPI data take centre stage

PMIs and CPI data will be in focus across the region over the coming week, alongside a rate decision in India and Japan’s labour cash earnings.

China: PMI in focus

PMI data will be in focus in the week ahead. The National Bureau of Statistics (NBS) will publish the official manufacturing and non-manufacturing PMI on Saturday morning. We are currently expecting a slight uptick in the manufacturing PMI to 50.3 from 50.1, which would send another positive signal for recent growth stabilisation. The Caixin manufacturing PMI is set for release on Monday.

Korea: CPI, PMI and exports data

We expect export growth for Korea to rise 4.4% year-on-year in November compared to the previous month’s 4.6%. Strong chip and vessel exports will be the main driver of the growth while car, petroleum, and home appliances decline. As import growth is likely to stay flat on the back of falling global commodity prices, the trade surplus is expected to widen modestly. The manufacturing PMI release will be closely watched – this has been below 50 for two months and it is expected to decline further in November.

Meanwhile, consumer price inflation is expected to rebound to 1.9% YoY in November from 1.3% in October, mostly related to the fuel subsidy programme and its base effects. We expect inflation to stay below 2% throughout 2025.

India: Rate decision

We expect the Reserve Bank of India (RBI) to leave the Repo rate unchanged at 6.5% given the recent surge in CPI inflation to the RBI’s tolerance limit of 6%. Lower food inflation pressures should help CPI inflation ease in the first quarter of 2025, creating room for rate cuts.

Indonesia: CPI

November's CPI reading is expected to ease further to 1.5% YoY, near the lower end of Bank Indonesia's target range of 1.5%-3.5%, from 1.7% previously. However, the bar for BI to ease rates in December remains high given the recent weakness in the local currency.

Japan: Labour cash earnings

Real cash earning growth may return back to positive terriority with a 0.1% YoY gain in October. With healthy labour cash earnings, we expect the Bank of Japan to deliver a rate hike in December.

Taiwan: PMI and CPI inflation

Taiwan’s PMI data is set for release on Monday morning, where markets will watch to see if manufacturing can stay in expansion for the eighth consecutive month after last month’s PMI fell to 50.2. Additionally, Taiwan’s November CPI inflation is set for release on the coming Thursday, where we are looking for inflation to stay more or less stable at around 1.7% YoY.

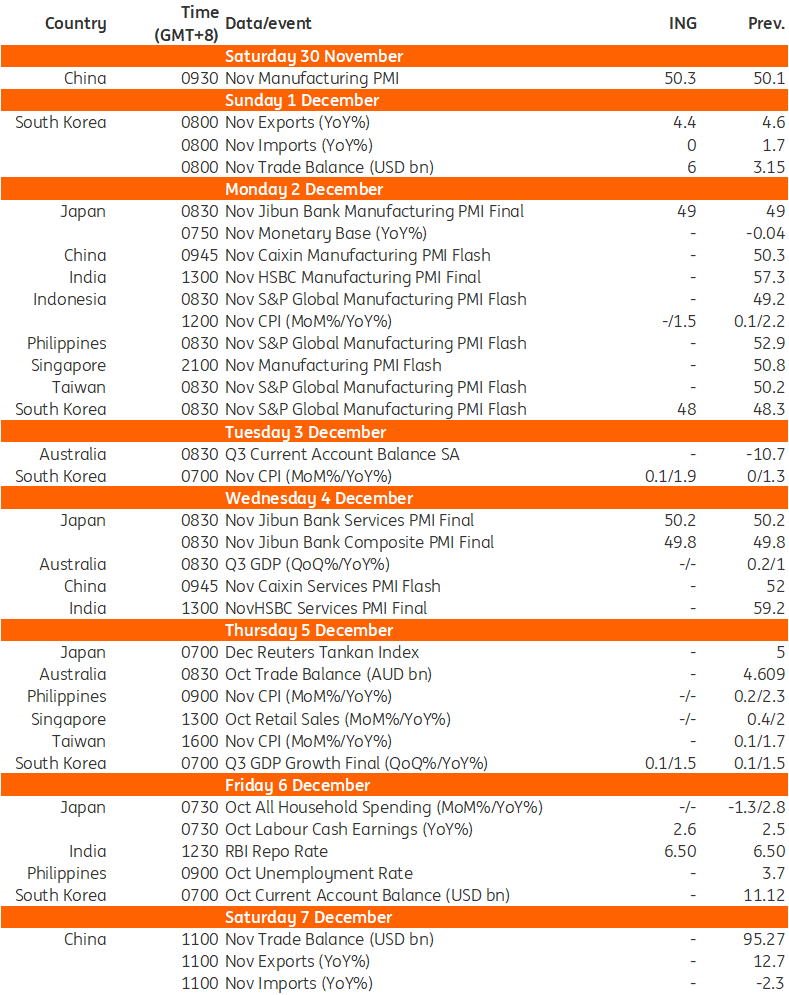

Key events in Asia next week

Source: Refinitiv, ING

Read the original analysis: Asia week ahead: PMIs and CPI data take centre stage

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.