Asia week ahead: A hawkish Bank of Korea pause plus key releases in China and Japan

We expect the Bank of Korea to carry out another hawkish pause at its meeting next week as concerns over a recent reacceleration in inflation linger. We'll also see PMIs out from China, Australian inflation data, third-quarter GDP figures in India and possibly more upbeat data from Japan.

China PMIs to show recovering manufacturing activity

After a surprise decline in manufacturing activity for China last month, we are expecting the official manufacturing PMI to bounce back to the expansion region at 50.1 and the non-manufacturing PMI to accelerate to 51.2. Last month’s retail sales growth beat the consensus at 7.8% year-on-year, which might hint that the non-manufacturing sector is doing better than expected.

The weak global economic outlook continues to weigh on China’s export orders. This will probably keep the Caixin manufacturing PMI below 50 and indicates contracting manufacturing activities at 49.8. Activity data in the past few months has shown modest progress in China’s recovery aside from anything property-related. It's therefore unlikely that the manufacturing PMI will stay in contractionary territory for long.

Inflation out from Australia

Hawkish comments from the Reserve Bank of Australia (RBA) Governor Michele Bullock yesterday stated that inflation is increasingly induced by strong domestic demand, hinting at the possibility of headline inflation remaining above target. The inflation number should be still above the RBA’s target, but could edge lower in October to 5.0% YoY.

Meanwhile, we're inclined to believe that retail sales are still going strong – but that they should decline by -1.0% month-on-month due to the end of the holiday season.

India GDP could moderate but stay above RBI projections

India’s GDP is likely to moderate to 7.1% YoY, down from 7.8% in the first quarter. Nonetheless, this result should surpass the Reserve Bank of India's projections, as domestic economic activities remain robust and services and capital expenditure continue to drive growth.

BoK to carry out another hawkish hold alongside activity and sentiment data

The Bank of Korea is set to move forward with another hawkish pause, concerned about the recent reacceleration of inflation and faster-than-expected household debt growth. A key area to watch will be evidence of any minority views among board members on rate-cutting possibilities in the near future after data suggested sluggish consumption and investment.

Elsewhere in Korea, we believe consumer sentiment should continue to deteriorate with higher borrowing costs and poor performance in asset markets (property, KOSPI, the KRW). On the other hand, business sentiment is set to improve on the back of a better outlook for IT and chip markets. We believe this upbeat assessment will be confirmed by a recovery of exports, which is expected to rise for a second month mainly due to recovery in chips and autos.

For monthly activity data, October industrial production is expected to rise based on the previous month’s strong export results. However, domestic demand-driven retail sales and investment are likely to decline.

Upbeat data likely out from Japan

We expect Japan’s production and consumption numbers to improve in October. Despite high inflation, consumption should record a gain for last month, backed by tight labour market conditions.

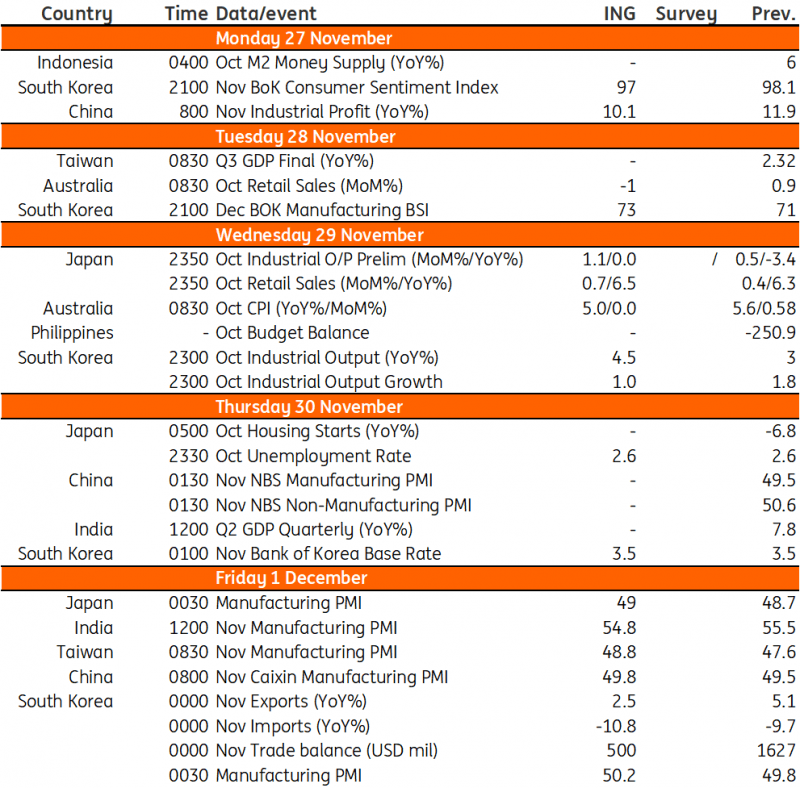

Key events in Asia next week

Source: Refinitiv, ING

Read the original analysis: Asia week ahead: A hawkish Bank of Korea pause plus key releases in China and Japan

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.