As the Dollar attempts a comeback, are markets wrong about the Fed? [Video]

![As the Dollar attempts a comeback, are markets wrong about the Fed? [Video]](https://editorial.fxstreet.com/images/Macroeconomics/CentralBanks/FED/the-federal-reserve-building-in-washington-dc-usa-67160227_XtraLarge.jpg)

The US dollar is showing signs of life again, notching up its best week since September of last year and reaching a five-week high against the euro. From a technical perspective, the dollar index – a gauge measuring the US currency against a basket of six peers – has a few more hurdles to climb before it can claim to have emerged from its bearish phase, while from a fundamentals standpoint, the Federal Reserve is getting closer to hitting the pause button on its rate hiking cycle. So, is this latest bounce a false signal or are the groundworks being laid for a trend reversal?

The elusive Fed pivot

Markets started betting on a Fed pause long before policymakers even hinted that they were approaching the end of their tightening cycle. Speculation about the timing of a Fed pivot dominated the market theme in late 2022 and has reached fever pitch in 2023. Some might argue that the Fed has already pivoted, having downshifted twice to smaller increment rate hikes. The next step therefore might well be the long-awaited pause.

The biggest clue to wrapping up the rate increases came at the May policy decision when the clause “The Committee anticipates that some additional policy firming may be appropriate” was removed from the FOMC statement. However, this wasn’t quite the pause signal that impatient traders had been hoping for. Whilst opening one door, Chair Jerome Powell refused to shut another, keeping both a hike and pause options firmly on the table.

The message from other policymakers had similarly been that the Fed is entirely data dependent. But in the last few days, things started to take an interesting twist.

A hawkish pause may not be what markets asked for

Several policymakers decided to raise the stakes by expressing their dissatisfaction at the slow progress in core inflation coming down. Fed governors Michelle Bowman and Philip Jefferson, who has been nominated by President Biden to become the next Vice Chair, were among those casting doubt on the prospect of an imminent end to the tightening process. But others, like the Atlanta Fed’s Raphael Bostic, flagged an inclination to pause.

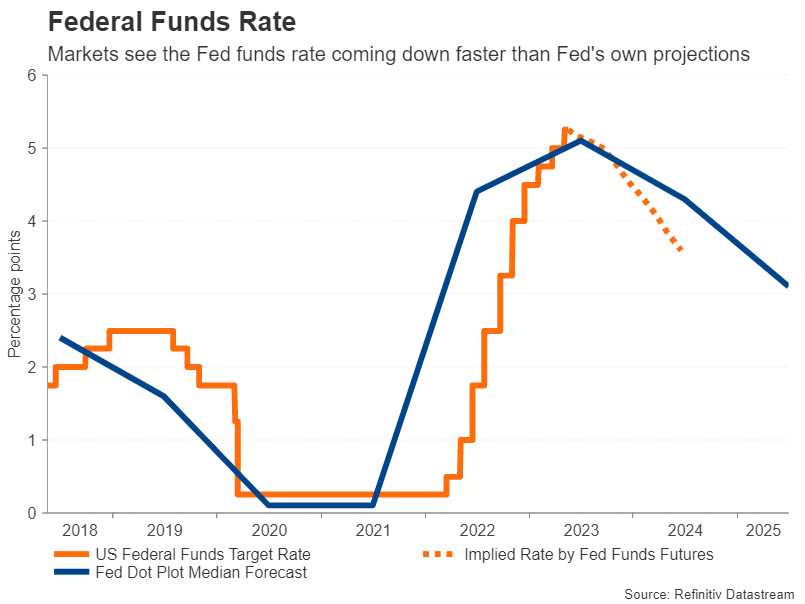

The problem for the dollar is that although it has gained some ground from the renewed hawkish tone, Fed fund futures have barely responded. Investors are currently pricing in a slightly less than 20% probability of a 25-bps rate rise at the June meeting and expect the Fed to deliver at least two cuts of the same size by December.

Such misalignments between the market view and the Fed’s rarely ends well and investors should be worried. Even if the Fed does pause in June, one thing is clear – policymakers will be doing so with a bias to tighten again should inflation remain sticky. This then almost certainly rules out a rate reduction this year. So why are investors convinced that the Fed will cut rates?

Is the US headed for a credit crunch?

Markets initially started to price in a lower Fed funds rate over fears that the central bank will overtighten and induce a recession. But more recently, it is concerns about America’s fragile banking system that is driving those fears rather than overtightening. There is some evidence to suggest that credit conditions have tightened significantly following the turmoil in March that led to the failure of several regional banks.

With the Fed far from being ready to switch away from restrictive policy, investors are anticipating the worst. There is one notable flaw to this reasoning as it assumes that the Fed will start slashing rates as soon as the US economy hits recession regardless of whether or not inflation has fallen fast enough by then. Yet, all the indications are that Powell is willing to sacrifice short-term pain to get inflation back to the Fed’s 2% goal as quickly as possible.

Safe haven boost

This also doesn’t explain why dollar bulls have been reawakened. Although it is true that the dollar has been attracting support lately from a mixed run of data, which have been inconclusive when it comes to how fast the economy, and the labour market specifically, is cooling, the main factor pushing it higher has been safe-haven flows.

Fresh concerns about China’s post-pandemic recovery and a real possibility of a recession in Germany have alarmed investors in recent days, while the ongoing stalemate over a bi-partisan deal in the US Congress to raise the debt ceiling has also contributed to the increased risk aversion over the past week.

But none of these are solid foundations for a bullish reversal in the dollar, hence, it is too early to draw any conclusions, even as the dollar index is flirting with its 50-day moving average.

The problem of sticky inflation

Much of the dollar’s slide this year had been based on expectations of a transatlantic divergence in monetary policy, with the European Central Bank and Bank of England raising rates into the summer and the Fed’s May hike being the last.

But investors have seemingly gotten carried away by the improving inflation picture. As impressive as the drop in America’s headline CPI rate has been, underlying inflation remains elevated. The decline in both the CPI and PCE core measures appears to have stalled, and this hasn’t gone unnoticed at the Fed. There is also the continued resilience of the jobs market that the Fed just can’t get its head around.

Policymakers will want to see a lot more progress on both fronts before they can even start thinking about cutting rates. The question now is, what’s it going to take for traders to reassess their rate cut bets, or is it the Fed that will have to align its dot plot with the market-implied path?

The Fed vs the markets

After all, the risk of a credit crunch has not completely dissipated and it may take months for the fallout from the banking crisis to fully unravel, in which case, rate cuts would not be so implausible. Unfortunately, the scenario where the Fed isn’t forced to lower rates isn’t particularly appealing either.

Whereas at the start of the tightening campaign, it was the markets telling the Fed that the price hikes were not transitory, the tables have turned and it is investors who now seem to be ignoring the danger that high inflation is proving to be a lot stickier than anticipated.

If core inflation stays stubbornly high over the next few months, there would be nothing stopping the Fed from resuming its rate increases even after a pause, raising the prospect of a prolonged period of stagflation.

US Dollar: More downside than upside?

For the dollar, given that the Fed has already been more aggressive than other central banks, some limited upside is probably the best that the bulls can hope for in the event that a credit squeeze does not materialize and the Fed is able to keep rates higher for longer. Such an outcome could see the dollar index revisiting the highs from March right before the banking episode to test its 200-day moving average.

However, the scale of any downside moves may be a little more difficult to predict. As things stand, the uncertainty around the outlook for the global economy and Fed policy is putting a floor under the greenback. But should some of the clouds start to lift and the monetary divergence paths become clearer, with the Fed pivoting before the ECB and the Bank of Japan only just starting to tighten policy, the dollar could suffer more substantial losses.

But even then, the road to all the way down to the January 2021 trough is a very long stretch for the dollar index. The 61.8% Fibonacci retracement of the uptrend that began from this low and ended at a two-decade high in September 2022 may be a more realistic target for the bears.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl