Are metals about to explode?

The arrival of the Russian-Ukraine war sent commodities higher, especially energy. However, metals found their peak soon after that and continue to fall. Is the bottom near, or we’ll see another selloff?

Everything depreciated

2022 is one of the worst years in financial history, as all types of assets suffered heavy losses. Major American and European indices declined, with Nasdaq -30%, S&P 500 -20%, and DAX -18% from their all-time highs (ATH).

Cryptocurrencies were hurt the most as Bitcoin, along with Ethereum, are -70% from their ATH. On the other hand, energies are one of the few assets that actually rose. Now, what about metals?

Gold outlook

Gold is approximately -10% so far this year and -21% from its peak at $2,072 in March. Many investors expected a u-turn on gold to happen, but it keeps moving lower. Gold is forming several divergences as it is moving down, but there is still no sign of a reversal signal.

The support $1,615 was tested two times, and it is possible gold will move below this level soon. If the level is broken, another selloff could occur, drawing the yellow commodity to $1,458 in the next few months.

As gold created several lower highs and lower lows, it is signaling new low could be created soon. If the price of $1,600 is crossed, gold traders could be looking at another support of $150 lower. However, the market is pretty oversold, and divergences point out that a move upward could come any time.

That is why there are two main probable scenarios for the next few weeks. Gold will break the support and move down to the already-mentioned support, or it will be a false breakout. In that case, a significant short squeeze could occur, moving gold back into an uptrend. If gold moves above the trend line, it will be a final confirmation signal to enter a long position.

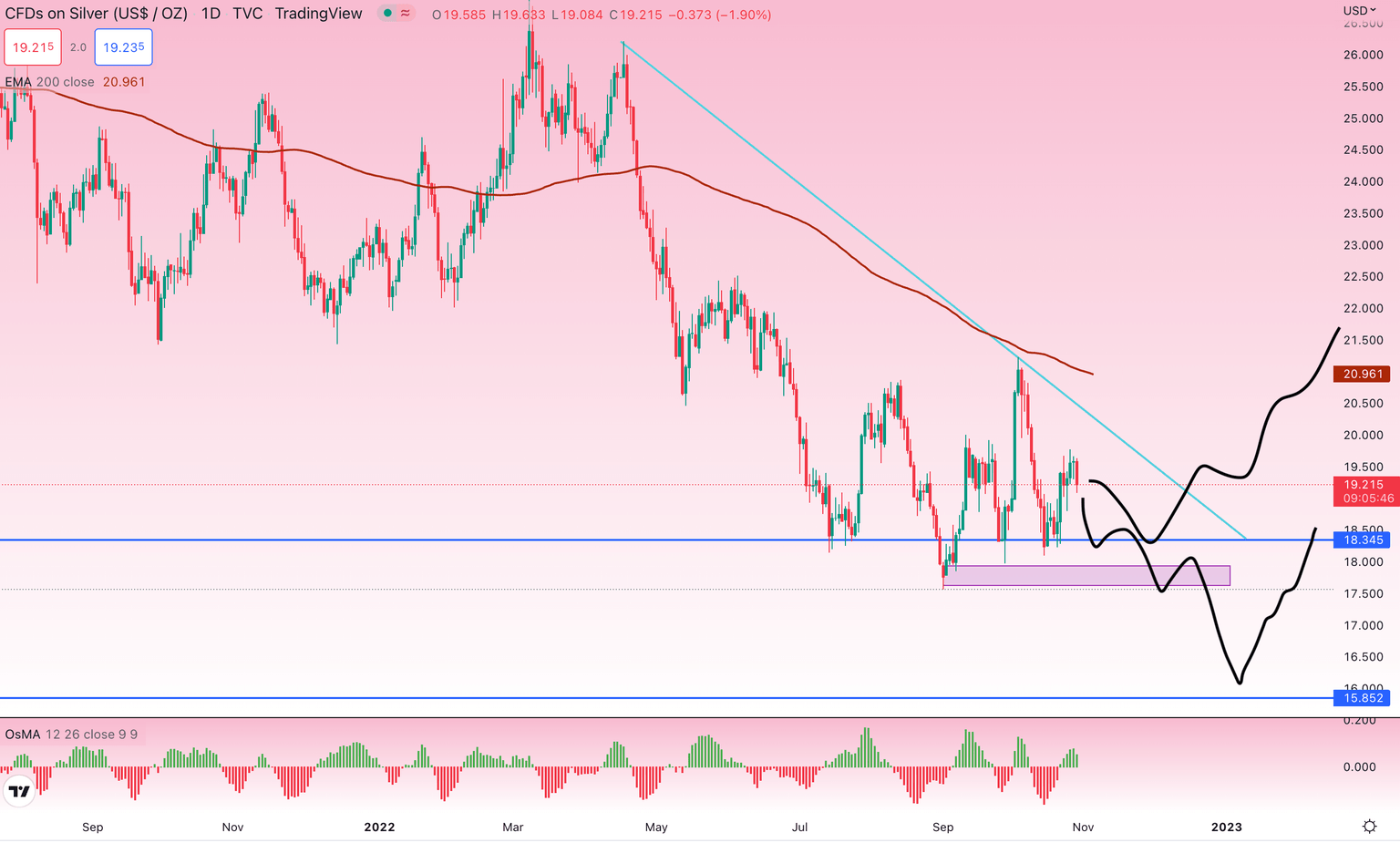

Silver outlook

Silver is -18% in 2022 but -29% from its top in early March. The second most favorite metal has been sitting on a crucial level for several weeks, confusing many traders. There is a noticeable gap below this support which could be filled soon.

However, another leg up is likely if the trend line is broken. So unless the trend line is broken, it is similar to gold. There is still space to fall lower by 15% in total. The downward move to the COVID-19 low from early 2020 is unlikely.

The daily chart clearly shows how silver struggles to decide its next direction. That is why investors should be cautious and for a confirmation signal. This could either be a downward move to approximately $16 or a trend line breakout. Either way, both metals look bullish in the mid-term.

Bottom line

Rising interest rates and inflation are hurting all asset classes, risky or not risky, but it is only a matter of time before a bottom is formed. Both gold and silver are significantly oversold because they are seen as safe-haven investments and actually did the opposite. So it might be time to buy the dip soon. Very soon.

Author

Rene Remsik

Investro

Rene got into financial markets by accident in 2012 and started with Forex trading. Later in 2017, he started investing in stocks in cryptocurrencies and began writing articles professionally.