Are falling commodity prices a warning sign or a boost for equities?

The commodity price sell off is gathering pace. Brent crude oil fell more than 3% on Tuesday and is at its lowest level of the year so far, and is heading towards $75 a barrel. Growth fears and the prospect of Opec+ production cuts are weighing on commodity prices, and there are other steep declines across the commodity spectrum today, including gasoline, iron ore futures and copper. Investors look at commodity prices for signs about what will happen to the global economy. Can they also give us a clue about what will happen with stocks?

Why stocks could be vulnerable

If you believe that commodities are sending a signal that an economic slowdown is coming that will hurt corporate profits, then stocks look vulnerable to a sell off, especially because stock markets in both Europe and the US are at, or close to, record highs.

Have stocks decoupled from commodity prices?

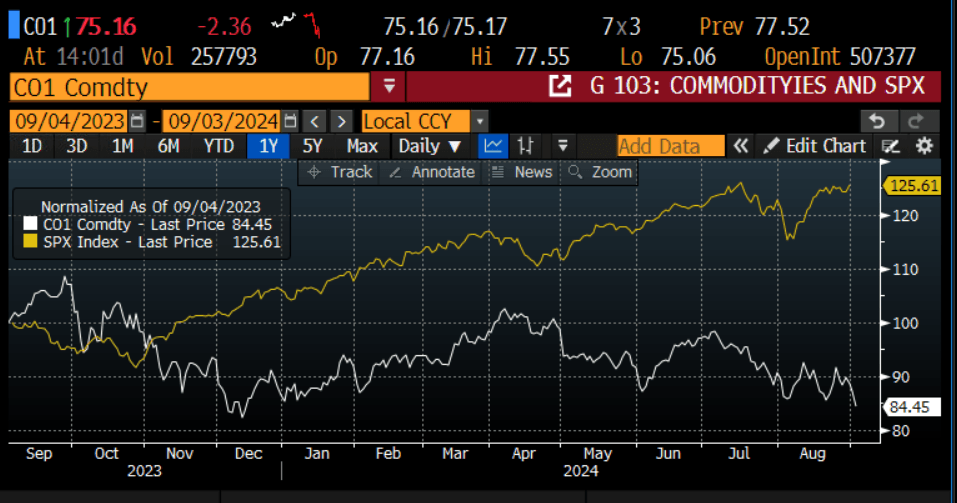

Stocks and commodity prices do not have a strong, historical positive correlated, in fact they are barely correlated at all. Due to this, there is an alternative way to read the impact of declining commodity prices and they could be a sign that the future is positive for stocks. As you can see in chart two below, the S&P 500 and the Brent crude oil price. don’t share a particularly strong correlation over the long term, but the S&P 500 and the Brent crude price have tended to move in opposite directions in recent weeks. Thus, as the oil price has fallen sharply since July, this has not stopped the S&P 500 from rallying, albeit with some pullbacks in early August.

On a more granular level, the gasoline price is correlated to the global economy, yet even as it has fallen sharply, the S&P 500’s consumer discretionary sector has rallied strongly in recent weeks and is only 4% away from the highs of the year, as you can see in chart 1.

Why the sell off in equities may be short lived

Falling commodity prices can be good news for the consumer: they help to reduce inflation, boost real incomes and increase the prospects of interest rate cuts from the Federal Reserve. This is why equity markets are not reacting as some would expect to falling commodity prices.

If the sell off in commodity prices deepens, or if there are signs that interest rates will not be cut as expected, then we could see stock market volatility rise sharply. However, for now, we think that the bulk of the sell off in commodities is due to a supply problem and not a demand problem. For example, copper and steel have seen excess stockpiling in China, and Opec + production cuts are weighing on the oil price. Since we do not think that the commodity price decline is due to demand, then any sell off in equities could be short lived.

S&P 500 and Brent Crude Oil, normalized to show how they move together

Source: XTB and Bloomberg

S&P 500 discretionary retail sector and copper, normalized to show how they move together

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.