Are currency markets shifting to comparative economics?

- Vaccine promise upends equity and credit markets over two days

- Equities race higher on Monday setting new records

- Dollar rises reversing its risk-on, risk-off trading posture

Monday's announcement from the US drug-maker Pfizer and German biotech company BioNtech that their COVID-19 vaccine proved 90% effective in a large scale trial sent the Dow soaring to new all-time intra-day highs as investors rotated into companies beaten down by the pandemic and out of those who have profited from the economic dislocation.

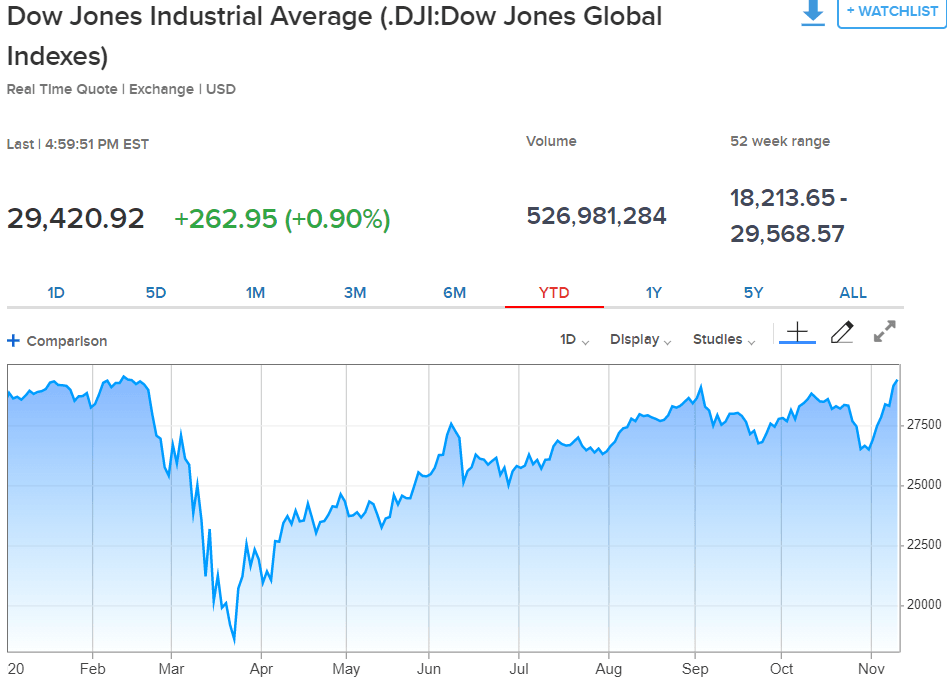

The Dow closed on Monday at 29,157.97 up 834 points, but at one point in the day it was up 1,610.42 points to a new record of 29,933.83. An additional 262.95 points on Tuesday brought the close to 29,420.92 just 130 points below the all-time close at 29,551.42 on February 12th of this year. The Dow is up 3.09% year-to-date and 6.28% over 12 months.

CNBC

Treasury yields also accelerated from 0.82% at the finish on Friday to 0.96 % on Monday and Tuesday for the highest close since March 18.

CNBC

Equities and bonds were on a well-traveled and familiar route mirroring the ups and downs of the pandemic. It is a reflection markets have seen many times in large and small amounts over the past nine months. When COVID-19 cases rise equities and bond yields fall and as they ebb equities and yields return.

The long-awaited and unexpected success of this trial, released a volcanic surge of equity buying and a lesser degrees of bond selling, but the rationale is a familiar one. COVID-19 down, stocks and Treasury rates higher.

Currency markets

Currency markets, however, abandoned the dollar's risk-on, risk-off trade that has dominated trading since May. The dollar against the euro closed on Friday at 1.1879. After two days of excellent vaccine news and the dynamic equity and credit resurgence, the EUR/USD closed modestly lower at 1.1812.

To shamelessly paraphrase 'It wasn't the amount of the move, but that the direction happened at all.'

Instead of the dollar falling as risk sentiment improved, as has been the case for four months, the dollar booked a standard and somewhat quaint reaction relating to the likely success of the US economy, it strengthened.

Let's back-track a bit to the late spring.

As the pandemic waned into the summer, the dollar fell. The euro rose from 1.1000 in the beginning of June to 1.1900 two months later. Throughout the summer the case loads in Europe and the United States had fallen sharply. The good news was treated as a reversal of the pandemic risk-off trade to the dollar that had lasted from mid-March until June.

That dollar pandemic premium versus the euro was filched in two sharp runs higherin the EUR/USD from May 26 to June 4 and then from July 14 to July 30.

Since then the EUR/USD had traded in a 1.1600-1.1900 range but the movement logic remained unchanged from the high days of the crisis--pandemic waning, risk-on and dollar lower, pandemic rising, risk-off dollar higher.

This week's dollar recovery on the vaccine news, while not large, was directly opposite the pandemic trading logic. A successful vaccine, even if it takes six months to prepare and distribute is a return to normal, however long it takes.

Comparative economics

The American and European economies, just to take the sides of the EUR/USD, have been tremendously battered by the pandemic. The second wave and third waves have brought a new national lockdown in the UK and many lesser closures on the continent.

The US, while it has fast rising COVID-19 diagnoses and new total of hospitalizations, does not seem inclined to shut its economy. Even the state governors who were most draconian in their restrictions in New York, Michigan and California have not threatened similar actions this time. The presumed new president, Joe Biden has said a national lockdown could be needed, but he would not be in power for almost three months with inauguration on January 20th. The Trump administration has already said there will not be a national lockdown order.

The dollar reaction to the vaccine is a tentative return to the notion that if and when this wave of the pandemic retreats the US economy will, as it historically has, make a faster and stronger recovery.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.