Analyzing Saudi Arabia’s impact on Oil prices

Heading into the recent OPEC+ meeting, oil prices faced challenges primarily due to supply constraints rather than demand dynamics. In response, Saudi Arabia took proactive measures to address this issue by reducing its supply to 9 million bpd. Additionally, all other OPEC+ producers agreed to extend their earlier cuts until the end of 2024. The key question now is how this strategic move will impact oil prices moving forward.

Historical context

It is important to consider the historical context surrounding Saudi Arabia’s previous surprise oil cuts in April. During that time, oil prices initially surged but quickly retraced their gains. This indicates that supply adjustments alone, without corresponding demand factors, may have a limited influence on price movements.

The second half of the year

As we enter the second half of the year, market observers have been anticipating tighter oil markets, which could drive prices upward. However, the uncertain outlook for China’s recovery has kept oil bulls cautious and tempered their optimism.

Investment bank opinions

Let’s delve into the insights shared by major banks regarding the recent production cut, as reported on Bloomberg.

ANZ Group Holdings anticipates even tighter oil markets in the latter half of the year. This aligns with Goldman Sachs’ perspective, as they believe the production cut mitigates some of the downside risks to their previous December forecast of $95 a barrel. It underlines Saudi Arabia’s unwavering commitment to doing “whatever is necessary” as evidence of its resolve to resist pressure from short sellers.

RBC Capital Markets considers the production cut to be highly credible, emphasizing that Saudi Arabia has historically demonstrated a strong track record of delivering on its agreed-upon cuts. It is worth noting that while production cuts are often agreed upon by all participating countries, not all of them consistently adhere to the agreed quotas. Given higher oil prices, this discrepancy arises from its incentive to maximize production for optimal revenue.

Contrasting views

However, Vanda highlights a potential concern, noting that the Saudi energy minister had to reiterate warnings to short sellers. Speculators may swiftly return to the market if the global economy shows signs of weakness. It is crucial to monitor these market dynamics closely.

Future outlook

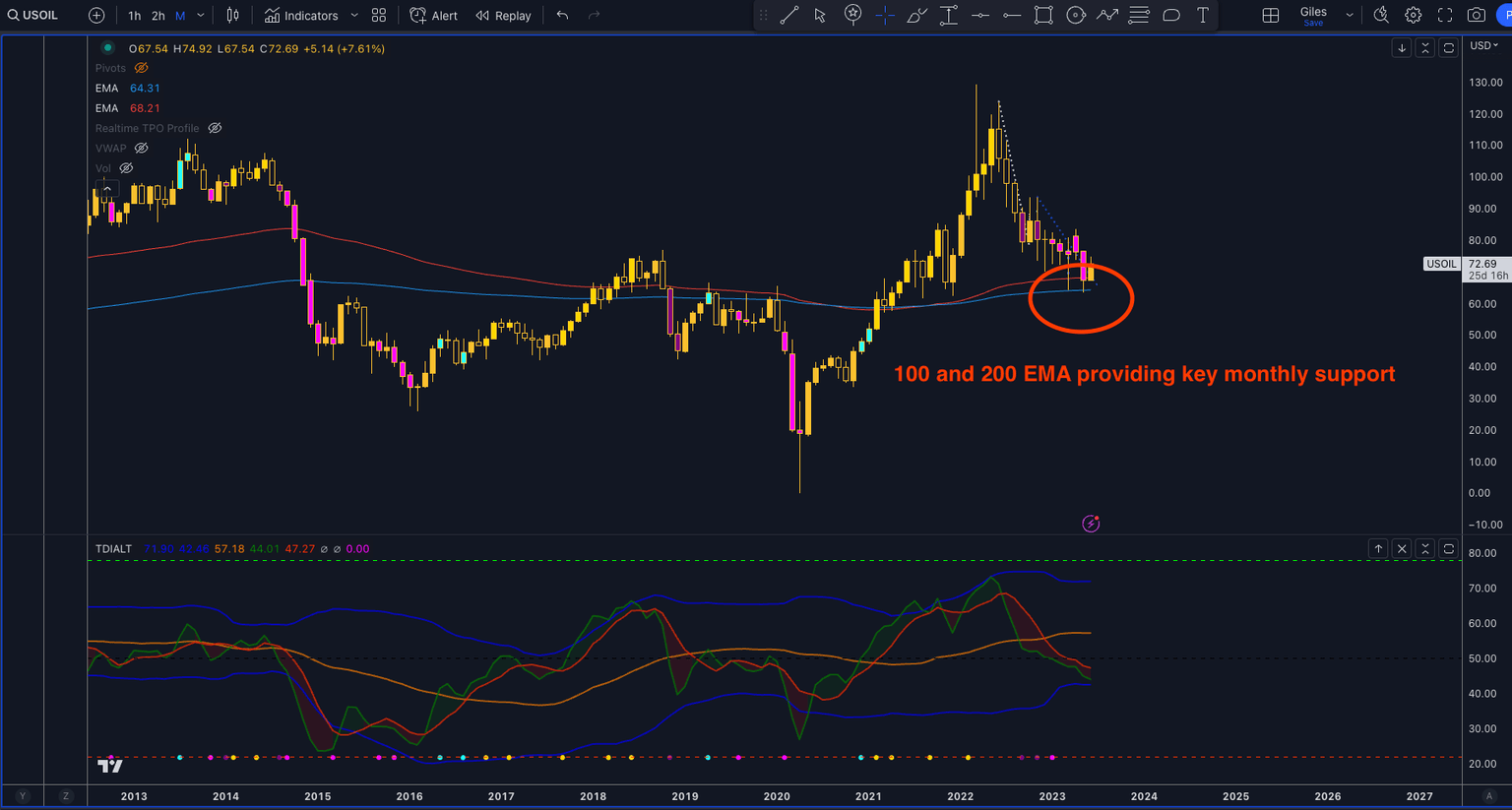

Looking ahead, market participants should closely monitor a critical technical level—the support of the 100 and 200 EMA on the monthly chart. Should prices dip below this level, it is highly likely that Saudi Arabia will take further measures, such as implementing additional production cuts, to bolster oil prices. Investors operating in these volatile markets, must prioritize robust risk management strategies as they navigate the ongoing battle to establish a stable market footing.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.