Talking heads and politicians laud the “resilience” of American consumers. They managed to keep spending despite rapidly rising prices thanks to post-pandemic price inflation.

But these pundits and politicos rarely talk about how Americans have weathered the inflationary storm. When you look at the big picture, it’s not a story of resilience but one of desperation.

In a nutshell, Americans blew through their savings and now they’re running up their credit cards.

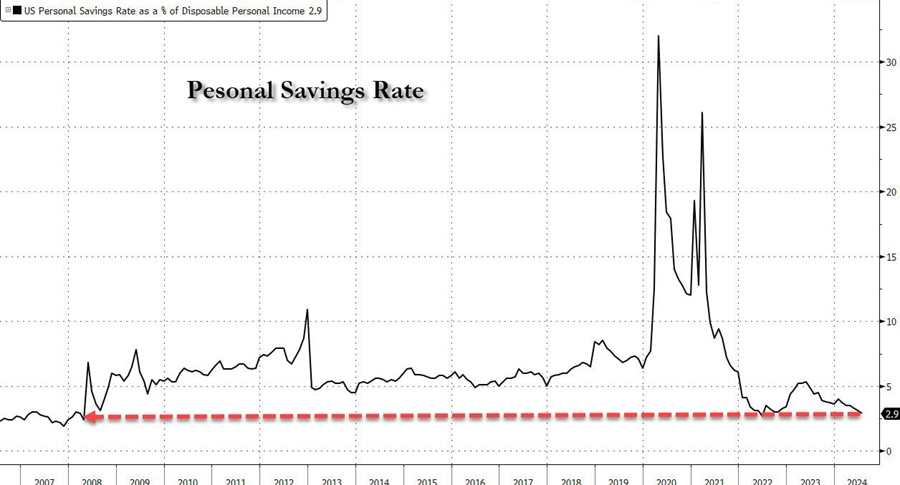

The personal savings rate plummeted in July, dropping to 2.9 percent. That was down from 3.1 percent the prior month. It was the lowest savings rate since the COVID crash.

The current savings rate is roughly in the same ballpark as it was just before the Great Recession, as you can see from this graph courtesy of ZeroHedge.

With most people locked down in their homes receiving government stimulus checks, savings spiked during the pandemic.

Now it’s all gone.

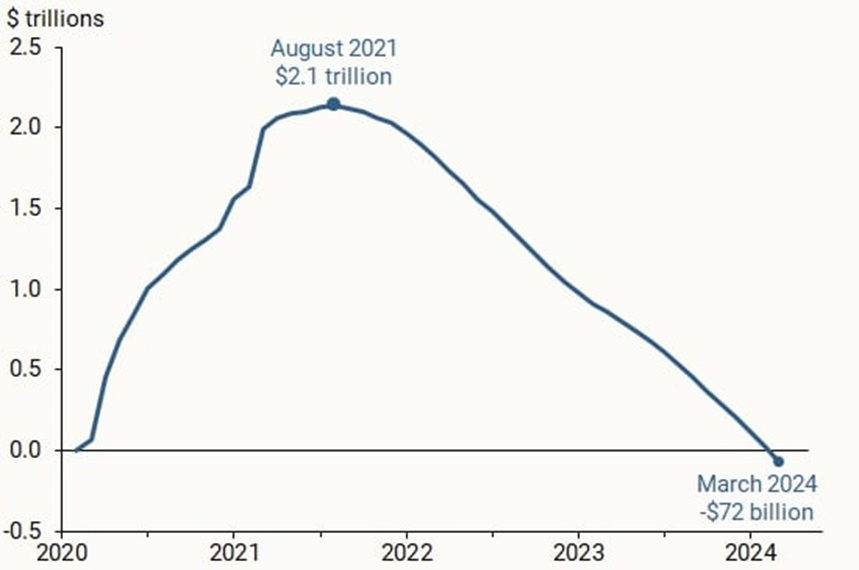

According to the San Francisco Federal Reserve, Americans have blown through all of the $2.2 trillion in excess savings accumulated during the pandemic years. Excess savings are now $72 million below pre-pandemic levels.

“Households drew down their excess savings at an average pace of $70 billion per month since September 2021, although this drawdown accelerated to about $85 billion per month since last fall relative to the average pace for the entire period.”

Now what?

Enter Visa and Mastercard.

With savings depleted, consumers turned to credit cards.

Americans not only saved money during the pandemic, but they also used their stimulus checks to pay down credit card balances. Revolving credit dipped below $1 trillion during the pandemic period.

But as prices started rising in the wake of COVID, Americans turned to plastic. Revolving debt currently stands at a record of $1.36 trillion.

And Americans continue to use credit cards despite interest rates as high as 28 percent. In July, non-revolving credit, primarily made up of credit card balances, surged by 9 percent ($10.6 billion).

Some pundits claim that increasing credit card debt is a good sign. They claim American consumers are “confident” and therefore willing to buy on credit. But spending patterns tell a different story. Citigroup recently noted that more and more consumers are using credit cards to pay for “basic needs,” and there has been a notable slowdown in “non-vital” purchases.

In other words, people are using credit cards with 28 percent interest rates to pay for groceries.

This isn’t the behavior of a “resilient” consumer. These are desperate consumers trying to keep pace with rising prices.

This is a looming problem for a country that depends on consumers buying stuff to keep plodding along. What happens when Americans hit their credit card limits?

Something to keep in mind as you hear government officials and their cheering section in the media trumpeting the “soft landing” narrative.

Money Metals Exchange and its staff do not act as personal investment advisors for any specific individual. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. Readers and customers should be aware that, although our track record is excellent, investment markets have inherent risks and there can be no guarantee of future profits. Likewise, our past performance does not assure the same future. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing through Money Metals, you understand our company not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. This Website is provided “as is,” and Money Metals disclaims all warranties (express or implied) and any and all responsibility or liability for the accuracy, legality, reliability, or availability of any content on the Website.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.