Always spread the risks

It is Friday, so I thought I would do something a little different from my usual weekday letter. A personal story.

S2N spotlight

The humble trading desk above was my first attempt at seeding traders in 2004.

I had been trading on the proprietary desk of an investment bank. For various reasons, a bunch of traders, me included, decided to go out on our own. I managed to raise some money from a wealthy investor to back me. The deal was 50:50 profit splits, and I would wear 40% of the losses and he 60%. He put up the capital.

Definitely a rude awakening from trading a bank’s money. Gone were the company café cappuccinos, lunch on the house, and many other perks. Things were so tight that beggars were offering me a dollar.

There was a guy who left with me who had done very well; he was going to trade his own capital. He was an Elliott Wave trader; I was a budding Elliottician, and we really got on well. I told him to work from my office, so I could learn from him.

After a few months, I convinced my backer that we should invest in Grant.

For those unfamiliar with how the investment banking prop desks worked at the time. At least this was how it was for us. You got a salary, and you got trading limits. The typical for us was a $2 million stop loss. Plus, we got 10% of the profits.

Grant had worked for a couple of investment banks before I knew him. He had made $15m at one bank one year, a few decent years of $2-5m, and then got stopped out. He joined another well-heeled bank and had a similar story. A few years of making about $1 million a year, then a really big year; he made $25 million, and then he got stopped out. Remember he was collecting 10% on all these winnings, and sharing none of the downside. He is the one who taught me that getting a job as a prop trader was like having a free call option on the bank.

Grant was the best trader I knew. He was so chilled, at least on the outside. Smart. A devout Christian. A good guy. It took me another year and a sizeable dollar loss for me to realise that my backer and I weren’t a bank.

When you are Citibank, Morgan Stanley, or any of the big investment banks, you have 100 Grant’s. If you have talented traders who have a $2m stop loss and the ability to make many times that, then most times you have a net winning strategy. A positive expectancy. My backer and I fell in love with Grant’s massive years of making $15 and $25 million, the greed sound familiar? Our focus was on the upside, and because we didn’t have the money to back a lot of Grant’s, we ended up putting most of our eggs in one basket.

The message from my story is diversification. I have gone on to seed many more traders, but my approach after that lesson has always been to invest in many talented traders just like the successful investment banks and prop trading firms do.

The same applies to investments; always spread the risks.

Grant went on to work for another 2 investment banks, blowing up at each bank eventually. There are no more investment banks willing to employ Grant as a trader. Grant is now head of treasury at a large bank, watching out for other Grants.

S2N observations

Some random observations.

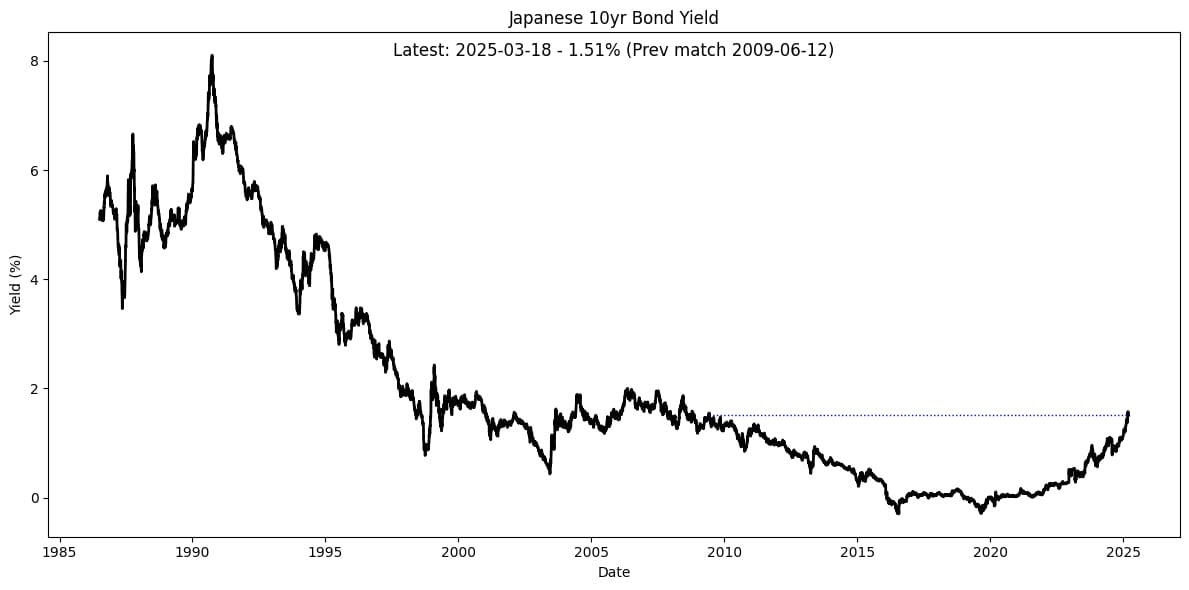

Japanese 10-year bond yields are continuing to climb. With their mountain of debt, this will no doubt slow down economic growth.

I am seeing potential for further Yen strength on the back of higher yields. That means the price will go down. I am watching the trendline in the chart below.

The Fed Fund futures continue to price in a few more cuts for 2025 and 2026.

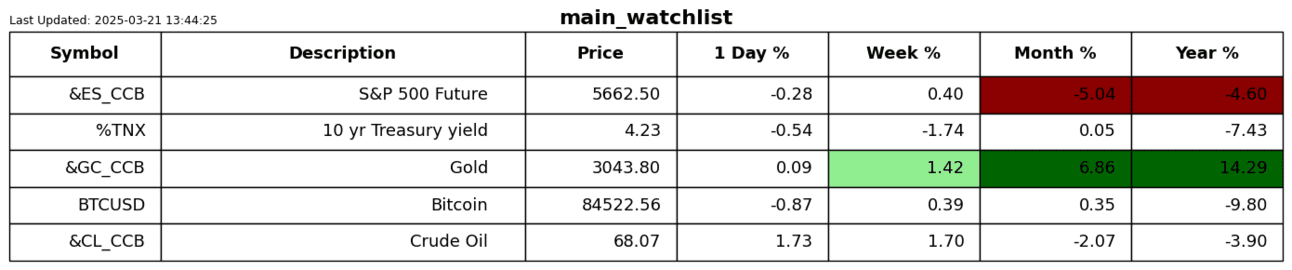

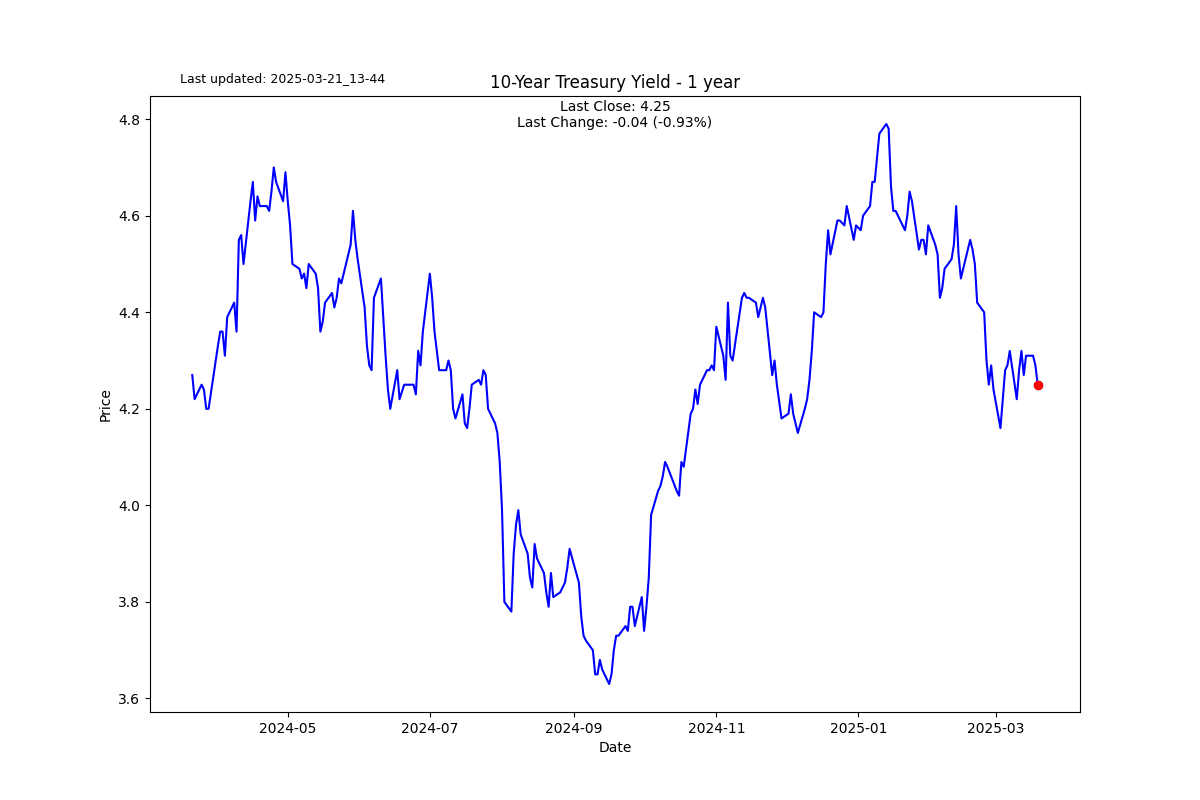

I am more attracted than ever before by my yield steepener trade. Go long 3 month Treasuries and short 10-year Treasuries.

S2N screener alert

Gold futures up 8 days in a row. This has only happened 33 times in 47 years.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.