Again straight down, but NFPs

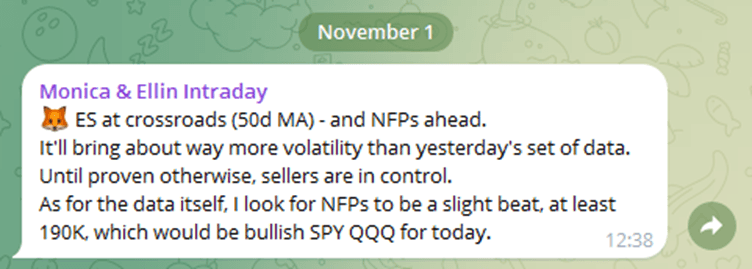

No upswing after the bell to trap in ES bottom pickers – selling across the board, risk-off continuing now also clearly in bonds. While AMZN earnings I expected to turn out good in our channel, AAPL outright disappointed. Much depends upon today‘s NFPs figure – I‘m looking for at least 190K (beating lowball expectations), and that would result in a bullish day for equities. The actual undershoot will be explained away by weather events, not changing the directional implication.

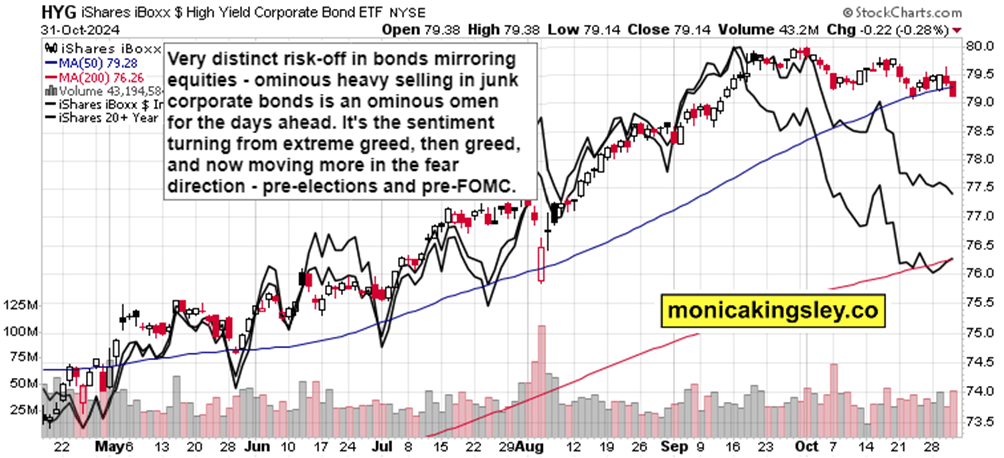

The bond market is though clear, see it accompanied by snapshot from our channel. I‘m opening up today‘s analysis (intended to be as brief as possible) for everyone.

Tired of seeing those red boxes instead of way more valuable information? Try the premium services based on what and how you trade.

S&P 500 and Nasdaq

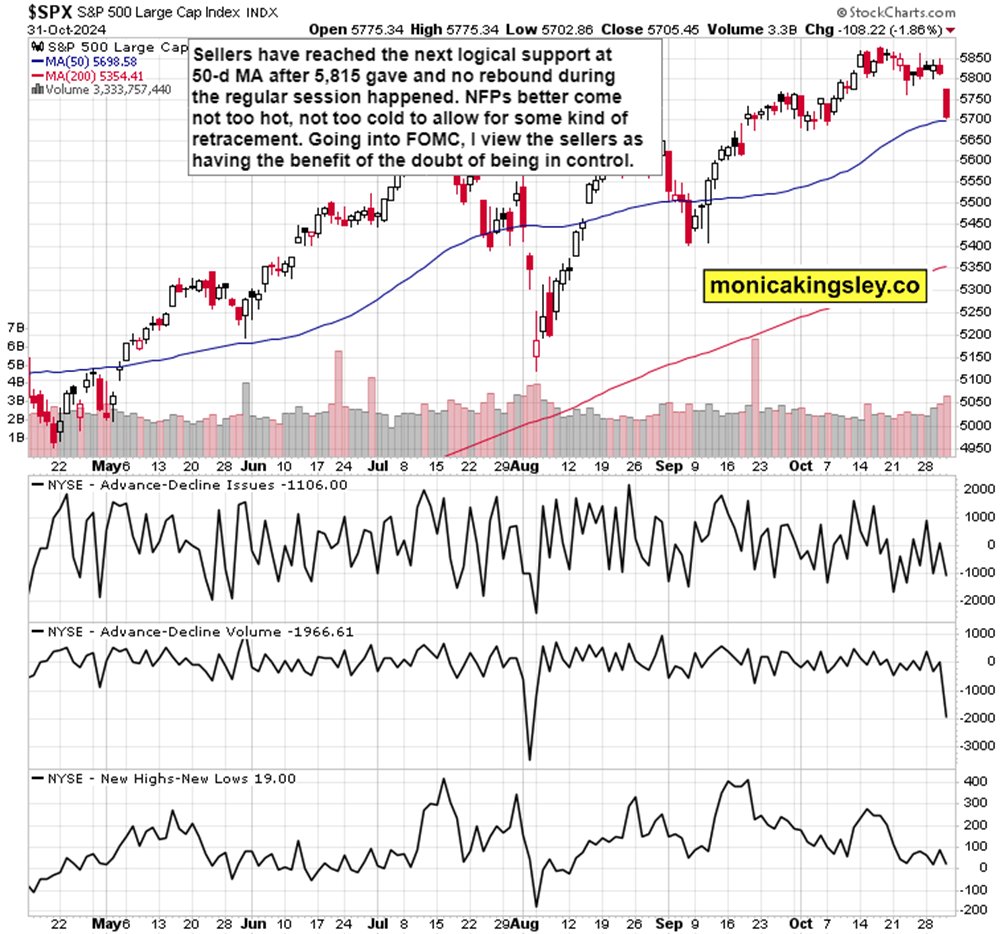

S&P 500 sold off hard, and institutions have to make a decision whether they would get in here back on the long side, or not yet. The pattern of selling into the close did prevail as it did the last couple of days, and 5,767 is the nearest resistance on the upside, followed by 5,805 (this one provided more support than 5,815).

In the coming editions I‘ll be talking individual tickers more – the purpose of today is to get the analysis to you asap. Suffice to say that AAPL won‘t be the savior of the market, semis are heavily challenged (as in breaking – the SMCI auditor EY news is very significant), and the sectors the buyers must be looking to most, are XLC, XLF and XLY, all with good reason.

Having said that, bottom formation will take a couple of days, and it can‘t be yet stated whether yesterday‘s closing lows hold or not.

Gold, Silver and Miners

The gold with silver downswing came, and miners will also rebound in a tepid way at best. This is not yet the time of miners making a flushing bottom that isn‘t followed up by actual metals, and getting invalidated – I suspect it‘ll take a couple of days more at least to see that.

Crude Oil

Crude oil long upper knot doesn‘t spook me – the buyers have further to go, and I‘m looking for the 50-day moving average to be overcome before too long.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.