Don‘t think the Fed would like to risk disappointing the market demands

Premarket S&P 500 pump was readily sold into – who wants to face elections risk? The session though delivered great intraday gains of +24 ES pts and +72 NDX pts, and +39 ES pts for swing traders on my site (I timed selling into Friday‘s spike for the clients). Also the individual chart requests per popular demand that I handled on my Youtube channel, turned out great for already the first stock I started with – PLTR going into earnings. Check out PYPL, TSLA and LLY that were also requested – and forget not telling me next what you would be interested in while intraday clients‘ gains are already growing today again ;)

There is little reason or additional insight provided by yesterday‘s moves – the disbalances described in extensive fully free Sunday analysis, didn‘t deepen or ameliorate themselves.

(…) Apart from elections uncertainty (notice how precious metals are sold off alongside bonds? A bit weird, but I called for gold and silver turning down before Friday). We‘ll get FOMC (after a panicked Sep 50bp cut that I predicted, now we have by and large positive economic surprises apart from the job market and manufacturing – the latter has low share of US economy that‘s primarily a services one, the former can be used as a fig leaf to not stun the markets and deliver the 25bp that has the added benefit of not saying „oops, we panicked in Sep after falling asleep in Jul“) and SMCI earnings (yeah, no EY around this time).

Cutting when economic policies aren‘t yet set in stone, and e.g. in bonds, the perceived impact of both candidates wildly divergences (Trump is viewed as bearish Treasuries, Harris is taken as bullish Treasuries), which would of course decide as well the USD at crossroads moment of the now.

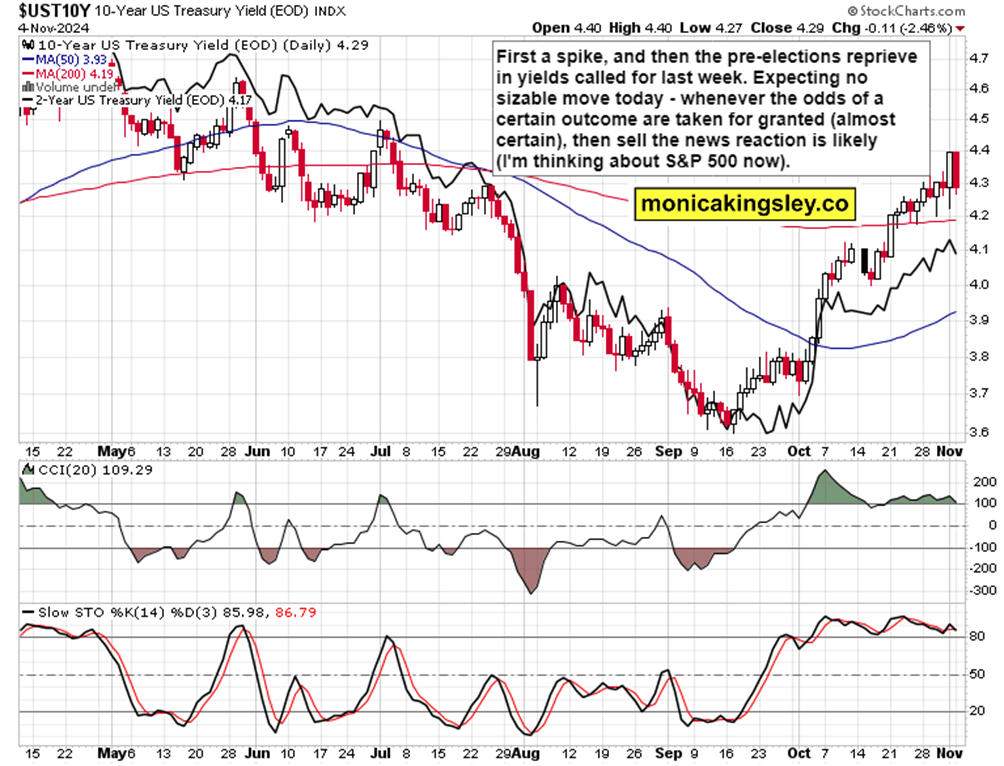

The positioning is a little similar to the one before Sep FOMC – rates are rising while a rate cut is being expected. The current odds of 1% that there is no cut, is wildly underappreciated, inaccurate – that‘s what the bond market is telling us, regardless of the steepening and term premium rising. At the same time, I don‘t think the Fed would like to risk disappointing the market demands.

In line with past week‘s theme of rubber band snapping back, we‘re seeing that unfolding in the yields reprieve as per the below chart while options metrics don‘t offer prevalining positioning either way – making me think there is a very decent possibility of the result broadly anticipated by the betting markets, attracting sell the news reaction first.

Enjoy the premium peek under the hood continuing, for free – this is how much you could have been benefiting through following closely, or tweaking to fit your trading style whether with or without individual 1:1 support.

Let‘s mve right into the charts.

S&P 500 and Nasdaq

S&P 500 had the upper resistance od 5,773, and today‘s one is at 5,755 – given the contradictory signs (XLU decline though can be attributed to nuclear energy for data centers new development around AMZN, and that bucked XLRE upswing as rate cut odds for this week further rose, and I don‘t think Powell would dare to disappoint) and XLC, XLY and XLK mildly negative with XLE the greatest winner (energy itself cannot sustain bull markets indefinitely), I favor the sellers, especially should 5,755 break down with conviction during the regular session – pretty trendless thus far.

Much live coverage as always on Telegram and Twitter.

Gold, Silver and Miners

Gently bullish bias in first gold, then silver, followed by a pronounced move – that‘s how today is shaping up. Downside protection of recent gains – if you hadn‘t protected them late last week before the slide as I urged you to do – is going to be the winning recipe as well, because in gold too there has been elections positioning evident.

As for copper, I called for its slow basing turning into upswing, to go on – and here we are, it has accelerated yesterday, and continues today.

Crude Oil

Crude oil won‘t truly retreat today, the balance of all news (OPEC+ included) favors slow grind higher.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.