After an impressive New Year rally, what does 2020 hold for gold?

Gold has been on a tear lately, reaching heights not scaled since 2013 to temporarily breach the $1600 an ounce level. However, with risk appetite also riding high on the back of easing trade frictions, and US and Iranian tensions appearing to have been defused for now, what is keeping the popular safe haven at such elevated levels and can the rally be sustained in 2020?

Trade war and central bank easing have been positive for gold

The price of gold had been actively supported during 2019 by a number of ongoing uncertainties – primarily, the trade war and Brexit. Gold tends to benefit from increased geopolitical tensions or economic stress as investors flee into safe assets. A fresh round of monetary easing by central banks around the world also contributed to gold’s uptrend that picked up speed in late May before entering a consolidation phase in September. But towards the end of the year, as the global economic outlook started to brighten somewhat, it was dollar selling and year-end hedging that spurred the precious metal’s breakout from its bullish flag.

Gold closed 2019 with gains of 18% and after initially peaking at $1583/oz in early January, it received another shot in the arm when tensions flared in the Middle East, with the United States and Iran exchanging hostilities. The fear of an all-out war in the region drove the yellow metal to an almost 7-year high of $1611/oz on January 8. Those tensions have since de-escalated and while prices have retreated closer to $1550/oz, the medium-term outlook for gold remains fairly bullish.

High demand despite easing tensions

So what is keeping gold in demand when the imminent threat of a conflict with Iran has receded, things are finally looking up on the trade front and there’s even positive progress with Brexit? One answer is none of those risks have completely dissipated.

Iran may have backed away from taking further retaliatory action against the US for the killing of its top military commander, but the region remains highly volatile and could easily escalate again. Geopolitical tensions are not confined to the Middle East, however. The ongoing protests in Hong Kong and the threat of new missile tests by North Korea add to the list of things that can go wrong in 2020.

Moreover, the trade war is far from resolved and with ‘phase one’ out of the way, the most crucial aspects of the trade dispute will be discussed in ‘phase two’ and could prove even more tumultuous. As for Brexit, the risk of a no-deal scenario will once again rear its ugly head at the end of 2020 as Britain pushes the EU for a swift trade deal.

Plenty to worry about in 2020

A blow-up of one or more of those risks would endanger the fragile recovery of the global economy, which if the hit is substantial enough, it could force the US Federal Reserve and other central banks to once again increase monetary stimulus. Expectations of Fed rate cuts triggered the gold’s upsurge during the summer and there was a further boost at the end of 2019 when policymakers signalled rates are likely to stay on hold throughout 2020.

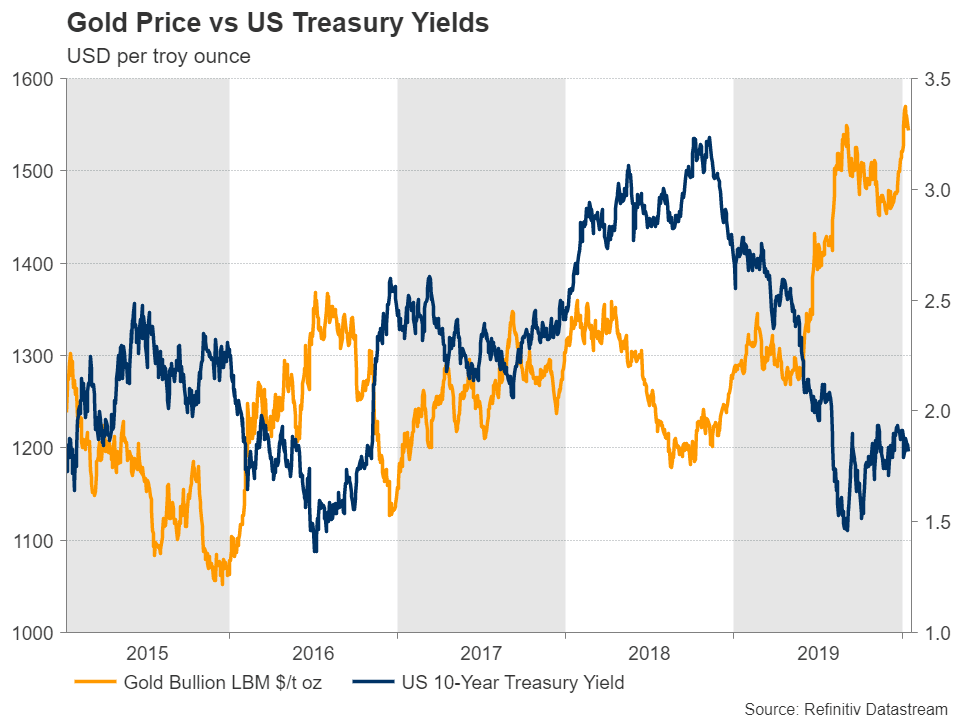

The Fed’s neutral stance has put a lid on Treasury yields, which have not rallied despite the improving prospects for global growth. Bond yields move negatively with gold prices as investors dump the precious metal in favour of higher yielding sovereign bonds when interest rates are rising, and vice versa. Any deterioration of the growth picture could further increase the attractiveness of gold if investors begin to reassess their expectations of policy easing by the Fed in 2020.

In the midst of the aforementioned risks, there has been another development that’s been boosting gold prices: de-dollarization. Over the past year, central banks have stepped up their diversification of their holdings away from dollar reserves in an effort to weaken the US’s political grip on international transactions, with gold being the main alternative. If that trend continues in 2020, it could provide underlying support for the commodity, softening any potential selloffs.

Equities market and US presidential election an upside risk

Looking further ahead into the year, aside from the existing uncertainties, there are a couple of new major risks for financial markets that could help extend gold’s current uptrend. The first is the rally in equity markets, which is looking worryingly overstretched in the US. Even if the American economy was to strengthen in the coming months, Wall Street would still be in danger of a negative correction as it’s unlikely that corporate earnings will be able to keep up with the present high valuations. Although the probability of a big stock market crash is low without any unforeseen shocks, especially given the abundance of liquidity in the markets, gold still stands to gain substantially from a correction in stock prices.

The other big risk is the US presidential election in November. Markets have yet to price in the possibility of a Democrat winning the presidential race, especially if a left-wing liberal such as Bernie Sanders was to win the party’s nomination. A Democratic win would almost certainly be negative for US stocks and perhaps on the immediate growth outlook as well, which in turn would be positive for gold.

Under such scenarios, the bulls could push the yellow metal as high as the $1733 level, which is the 78.6% Fibonacci retracement of the 2011-2015 downtrend. In the more near term, however, the $1630 level is a more realistic target, which happens to be the 261.8% Fibonacci extension of the November downleg.

Will a growth rebound materialize?

But while it’s easy to remain cautious about the outlook with so many uncertainties lingering in the background, those same variables could also have a positive outcome and we may yet see a strong rebound in the global economy by year end. Improving growth around the world could be the worst thing that could happen to gold prices in 2020, as it would spell the end of the global easing cycle.

Twenty-twenty could also be the year that inflation makes a comeback, with some early signs of price pressures building in the US economy. The services component of the US consumer price index rose sharply in the second half of 2019 and commodity prices have also been trending higher. The question is, if overall inflation does start to pick up, will it be persistent? The Fed is unlikely to raise interest rates if higher inflation is not accompanied by higher growth unless the increase in price pressures proves to be more than a just temporary phase.

If the outlook for interest rates started to change, whether from faster growth or inflation, or both, gold could initially seek support around $1515 – the swing high from November. However, a bigger test for gold’s bullish run would come around $1480 which is the 50% Fibonacci of both the 2011-2015 long-term down move and the November slide.

Gold vs dollar

In general, though, as some or all of those risks come into play, gold’s outlook will stay closely tied to the performance of the US dollar and the extent to which the greenback holds onto its appeal versus its rivals. The dollar’s and gold’s inverse relationship ‘broke down’ around the middle of 2019 as both rallied simultaneously. It will be interesting to see whether or not that relationship is restored in 2020.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl