ADP Employment Preview: Weak data may trigger quick correction, set stage for next figure

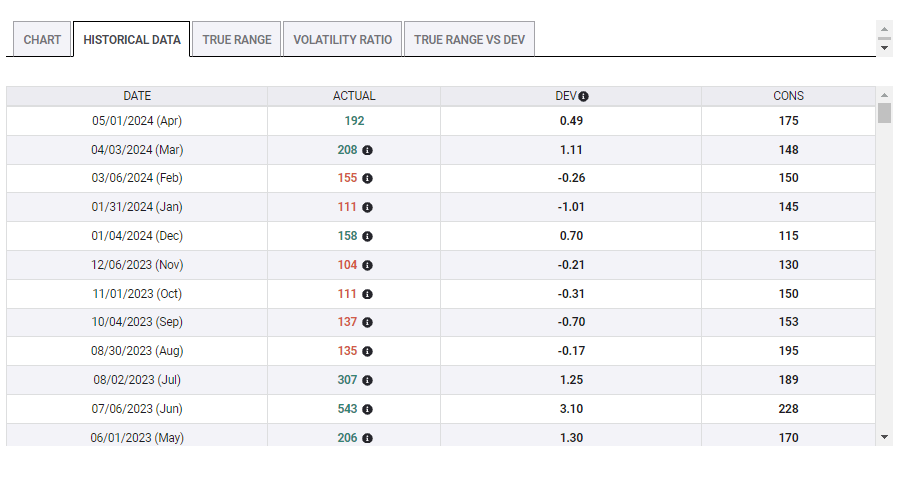

- Economists expect ADP's private-sector jobs report to show a gain of 173,000 in May, a small decrease.

- ADP's report correlates poorly with Friday's Nonfarm Payrolls but causes a knee-jerk reaction in markets.

- A miss is more likely than a beat and will shape positioning ahead of the ISM Services PMI.

An early insight – that is the promise of ADP's US private-sector jobs report, making markets shake. The upcoming report comes at a sensitive time, after two other high-tier indicators point to a more substantial slowdown in the US economy.

Roughly every sixth payroll in the US is handled by ADP, America's largest payroll provider, giving it insights into the labor market. A big surprise compared to expectations changes estimates toward the official Nonfarm Payrolls release on Friday – yet that is not always justified.

A disappointing ADP figure is often followed by a surprisingly solid official jobs report, and vice versa. The first to react to ADP's release are algorithms, which push assets toward the outcome, either boosting the US Dollar and hurting others on a positive release or buoying Gold and stocks if the figure misses estimates.

However, these surprises tend to be limited, and other traders come in, pushing assets back to pre-release levels. That provides traders with an opportunity to be contrarian, assuming the difference between the outcome and estimates is not major.

Source: FXStreet

The economic calendar points to an increase of 173,000 jobs in May, below the 192,000 recorded in April. A deviation of roughly less than 30,000 from estimates would likely trigger a knee-jerk reaction and the consequent mean reversal. It would take a bigger surprise for assets to react strongly and hold at new levels.

I expect a weak figure, in line with recent downbeat statistics such as the April JOLTs—which showed the weakest hiring since 2021—and the ISM Manufacturing PMI. That could temporarily send the US Dollar down.

ADP jobs as an expectations-setter for ISM Services PMI

The ISM Services PMI is released less than two hours after the ADP release. This forward-looking survey of America's largest sector rocks markets. If ADP misses estimates, it will cause fear of another weak figure.

If the ISM Services PMI follows with further weakness, the reaction will be more limited than normal, given the preparation investors had from the ADP release. In case the ISM Services PMI beats estimates, the US Dollar will leap, as this would be the less expected outcome.

The mirror-image scenario is of a strong ADP release. In that case, a robust ISM Services PMI would have limited impact, while a weak one would have a stronger one.

All in all, the ADP jobs report may trigger a short-term response which offers an opportunity to go contrarian – and has a role in setting the stage for the ISM Services PMI.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.