Ada Lovelace

S2N spotlight

I am sure many of you are asking, Who is Ada Lovelace?

She was a 19th-century English mathematician who is arguably the world’s first programmer. Her main contribution was identifying Charles Babbage’s mechanical general-purpose machine had applications beyond just number crunching.

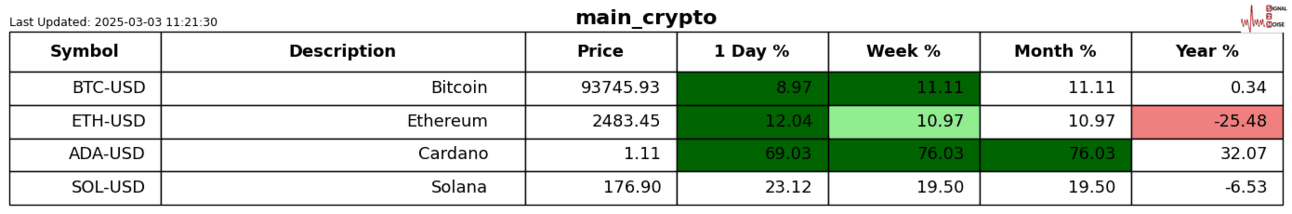

For those who know a little about the crypto ecosystem, you will have heard of ADA, which is Cardano’s token, named after Ada Lovelace. I was a longtime fanboy of this crypto token, studying everything about it. I exited last year as it climbed above 0.66 tired of their perennial underperformance relative to the big boys.

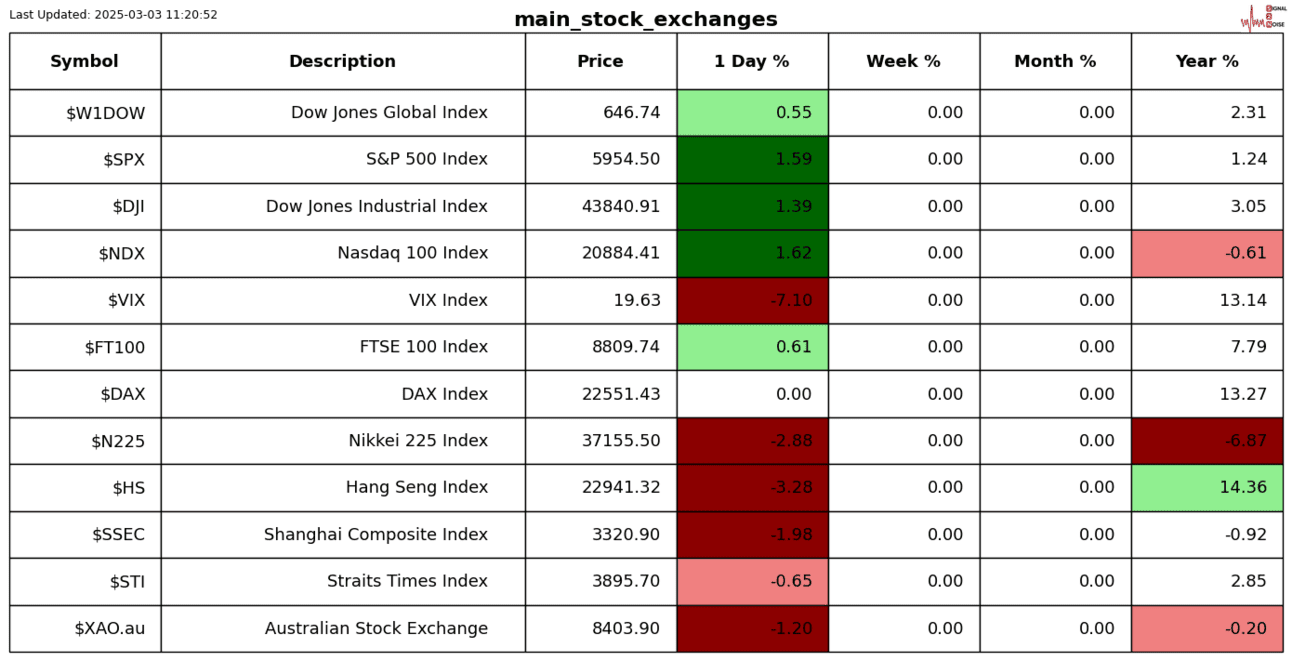

On the weekend, Trump announced that he will be proceeding with adding crypto to the government’s reserves, whatever that means. What I don’t believe most were expecting was that he named 5 crypto tokens that will form part of the reserves. If he was going to include Bitcoin, that would be one thing, as it is arguably electronic gold. But to include Ethereum, Solana, XRP, and Cardano makes very little sense to me. On that note, ADA (Cardano) spiked 60%. I will be interested to see what the liquidations across the exchanges were. I am pretty sure it was messy.

When I shut down for the week last Friday, Bitcoin was trading at around $79,000. I truly thought that the $67,000 average price MicroStrategy paid for its Bitcoin could come under threat. It will be very instructive to see if the crypto sector holds on to these weekend gains from thin market trading. I regard this sector as one of the canaries in the coal mine. Things are about to once again get super exciting.

S2N observations

I have been out most of the day so don’t have time to do some meaningful research for today’s letter. I just wanted to comment on the Zelensky Trump Oval Office meeting.

I personally think Zelensky showed poor judgment and restraint. He was “played” and behaved poorly. I spoke with a number of my Ukrainian friends who all thought he should have STFU.

I don’t want to go into the specifics or merits of the deal. What I do want to say is that we are in an incredibly perilous situation in world geopolitics. There are a number of circumstances that could easily trigger an escalation that could lead to World War 3. JD Vance made reference to this as he played attack dog on Zelensky.

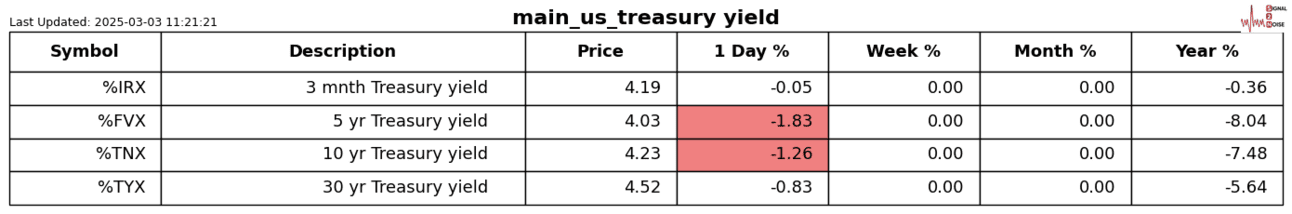

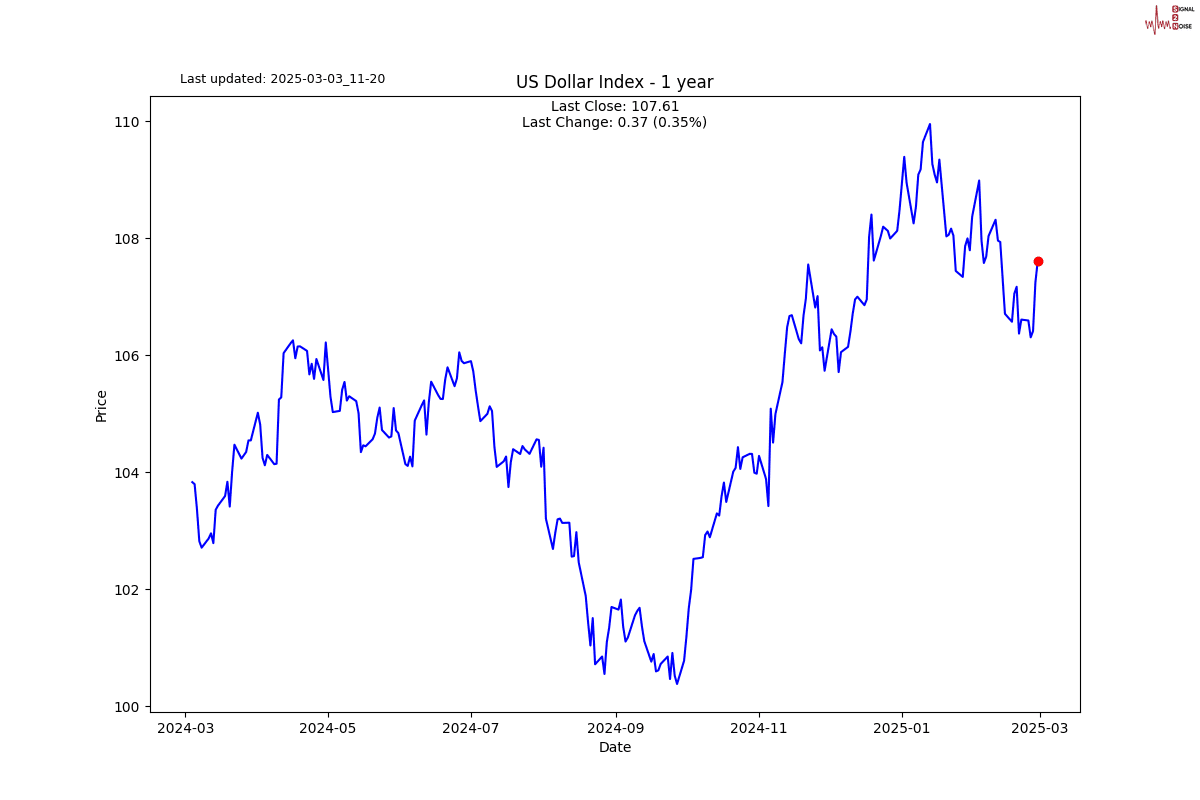

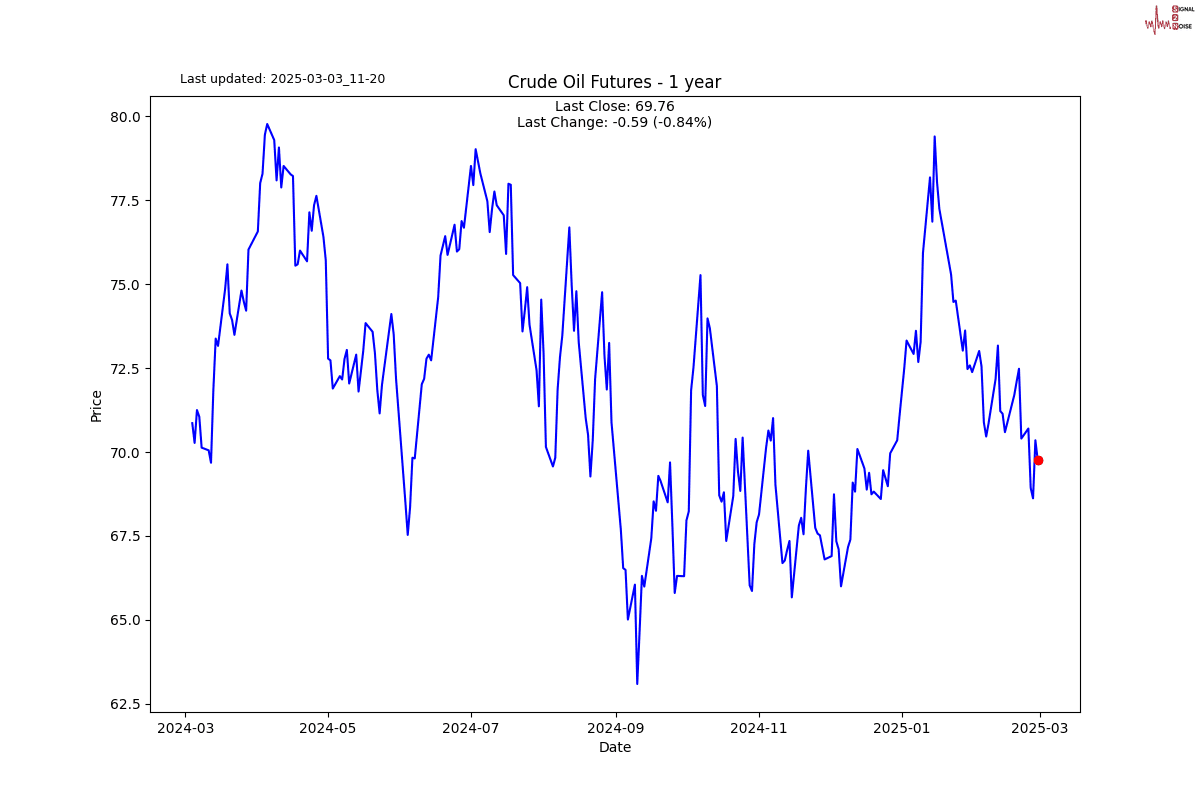

Financial markets have largely discounted risks in the markets, choosing to focus on blue skies. I urge a more cautious approach.

S2N screener alert

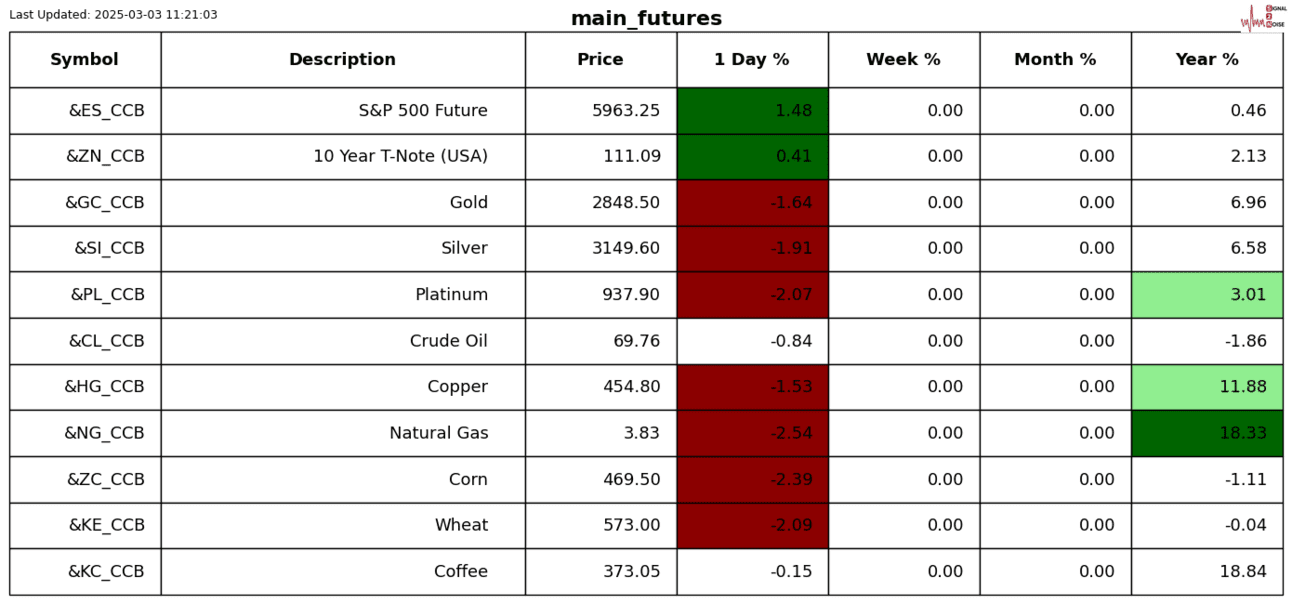

Gold had a sharp decline on Friday; it will be interesting to see how it reacts to the crypto news from the weekend.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.