Accumulate exactly these assets

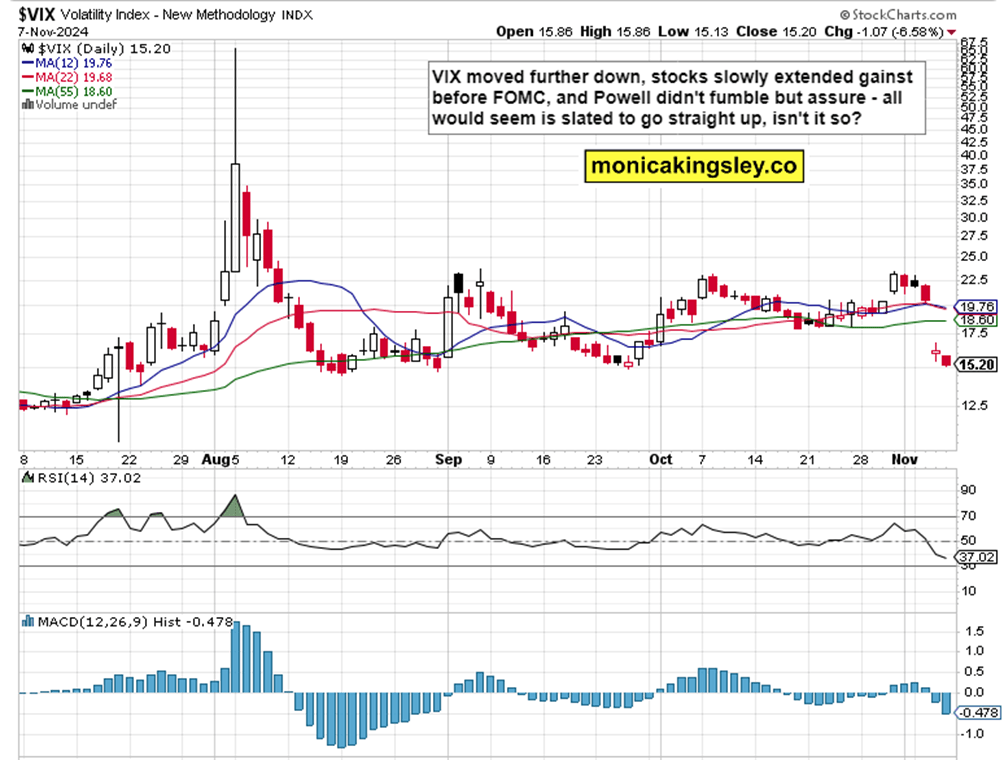

Not too much of a premarket S&P 500 ascent yesterday, but buying after the open, then a little stumble into Powell – I was convinced he would deliver 25bp, and the same applies to correctly forecasted reactions across the three indices (Powell pleasantly surprised, so no dip in ES or NDX offered) – and clearly rose on the reassuring conference.

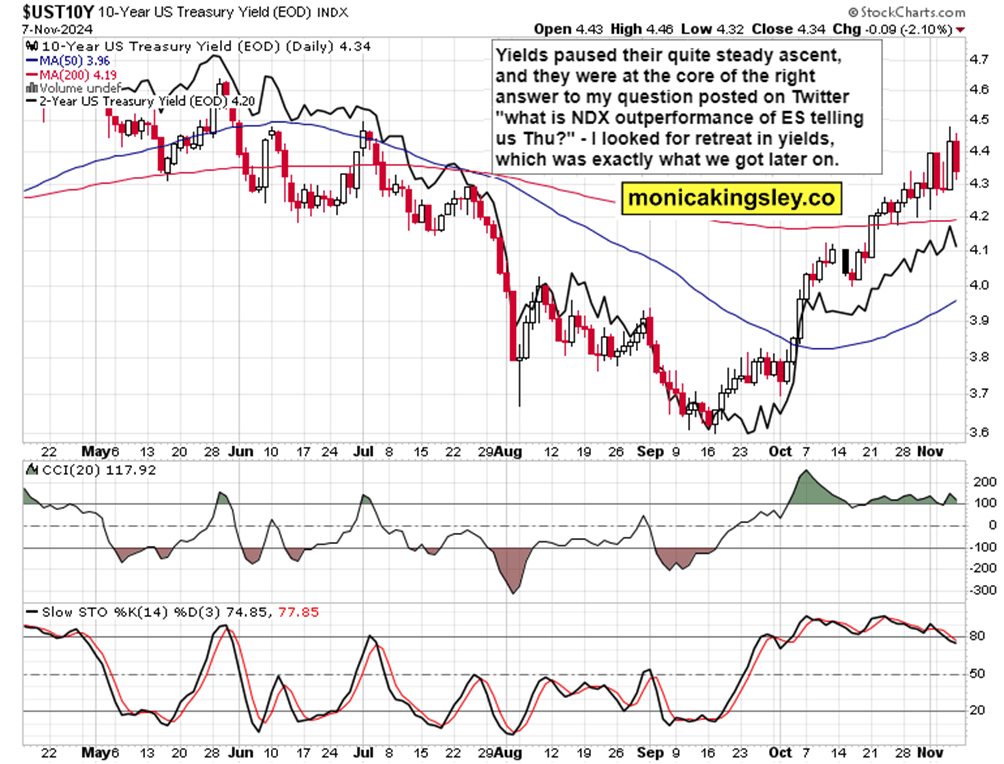

I just wonder what‘s the rationale for a cut when yields signal rising future inflation and no recession ahead (it‘s been only the job market and manufacturing that were delivering negative economic surprises, otherwise the overall balance is positive) when productivity is slowly rising, but that‘s what I‘ll discuss more in one of the upcoming analyses.

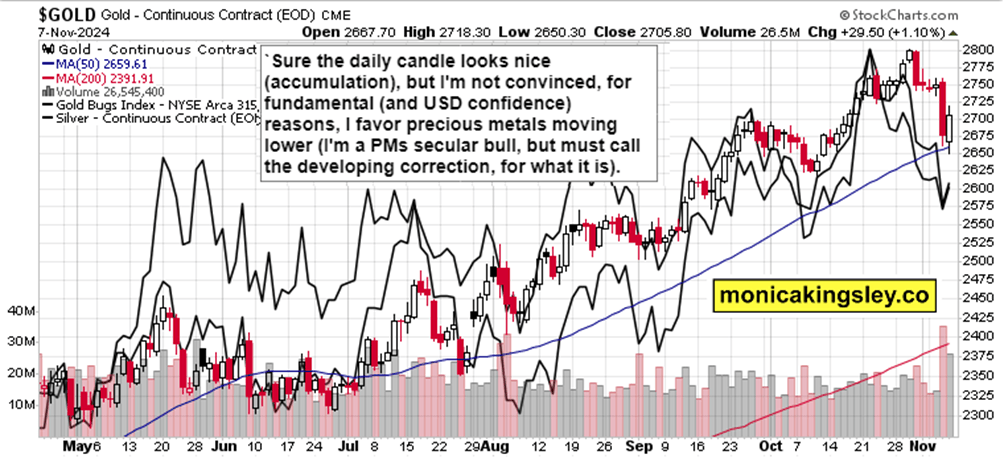

For now suffice to say that the three bullish picks described – select growth and cyclicals, crypto and USD – are best to be understood as themes. Note also that while I had been calling so often in the year for precious metals upswing and timing these too, now I‘m in favor of a correction actually having started,

Yields duly paused their rise yesterday, and I say that Treasuries going sideways or at least not plunging fast, is precisely what the doctor ordered for S&P 500 bulls. USD has already paused, well below my high 105.xx resistance, confirming the at least daily retreat in yields dead ahead.

We did great in TSLA, PLTR to the upside, and avoiding LLY hit as well in our channel.

Let‘s mve right into the charts – today‘s full scale article contains 4 more of them, with commentaries.

S&P 500 and Nasdaq

Don‘t expect much from the sellers – the consolidation will happen rather in time than in price, there is just no good enough fundamental reason to force closing of any important gaps, so take it as an island reversal. Short-term indicators (stocks trading above various moving averages on different time frames) aren‘t wildly overbought either – there is still a bit more room to go to the upside, and we‘re to see shallow corrections in the environment of generally low volatility, that‘s the outlook for today and Monday. Dips are a gift.

Gold, Silver and Miners

In hindsight, today will be considered as a shorting opportunity, in gold, silver and miners. See the underperformance in rebounding compared to the move the dollar made – it‘s time to listen more to the USD message following elections.

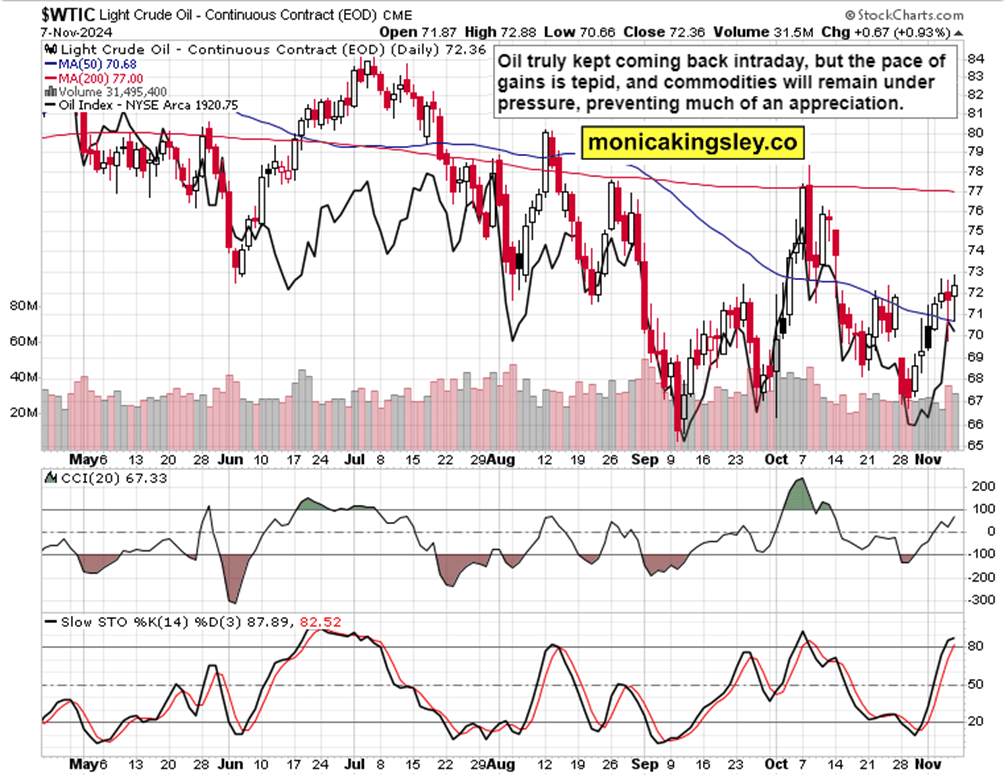

Crude Oil

Neither oil nor copper have recovered much when the balance of yesterday and today premarket is combined – greater gains and way easier ride to the upside is to be seen in crypto, beyond Bitcoin, MSTR , then COIN, RIOT, and then MARA.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.