AAPL, tariffs and China

S&P 500 was drifting higher yesterday (habitual retail trap after the open) in runup to AAPL earnings – China sales issue shouldn‘t had been a surprise to anyone, and apart from tech, luxury goods sales there are also what we better keep an eye on.

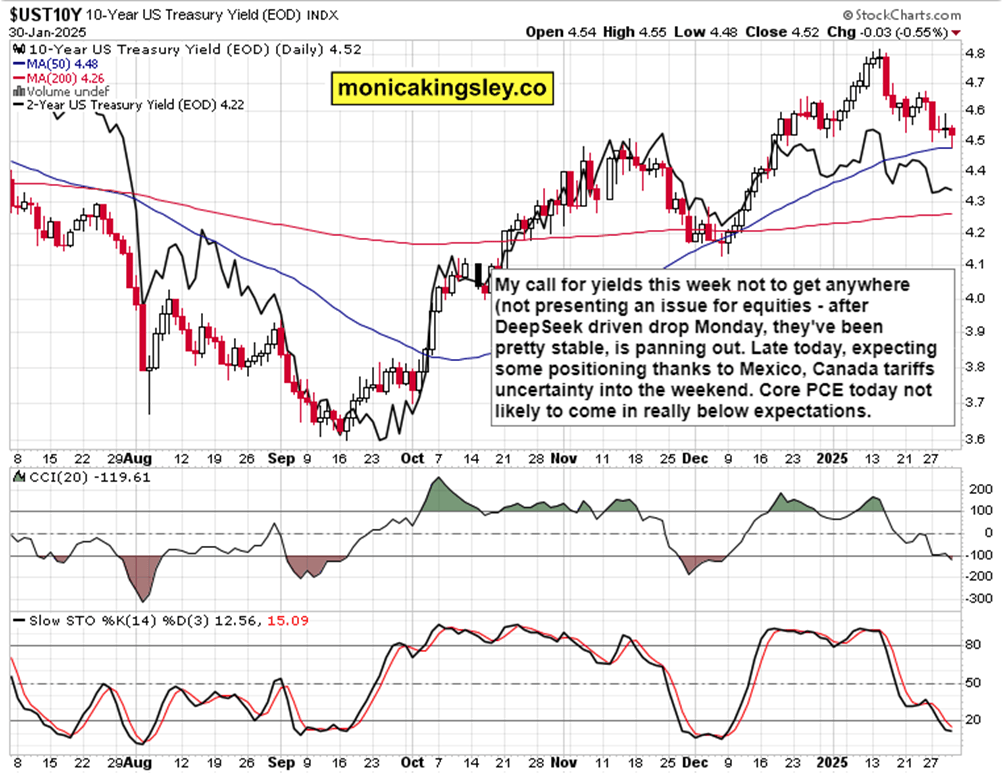

Why that drop before the close? Well, tariff threat against Canada and Mexico, let‘s see what this weekend brings (won‘t be easy, expect a gap Sunday). Yesterday‘s video about what‘s to squeeze and bring clients best profits, panned out great in both gold and oil, and today‘s rich video has it all too, bringing you many tech tickers (NVDA, AAPL to defend $142 , then META and MSFT), financials, utlities – here, I‘ll present the yields and USD perspectives in greater detail (thanks for liking today‘s video and all great reception of the daily presentations for you).

Today‘s data had erred a little on the hot side, and we still have a hot tariffs weekend ahead, don‘t underestimate Trump ever – this is what it means for S&P 500 (a bit retail games at the open, and risk aversion towards the close are ahead)… Monday‘s tone will be set by the Sunday gap, which is what I had been adamant about since 1 AM Sunday to Monday night my local timefive days ago, calling out the DeepSeek with implications, just review the rich videos of this week to pick the winners.

What a smashing ride for Trading Signals clients in both gold and oil! Neat profits served on breakout to ATHs, and on continued downswing – hour by hour, it‘s theirs and I‘m happy for them!

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.