A tantrum in Turkey – USD/TRY blow-ups and political headaches

This week, amidst the latest Fed meeting, partial U.S. equity market relief and lack of controversy from President Trump, you could have been forgiven for missing what has happened in Turkey.

Yet, in reality, it’s a story that warrants attention, partly out of interest for bystanders and partly to check in with any counterparties that may have been caught on the wrong side of USD/TRY.

Here’s the lowdown to end a crazy week.

Istanbul Mayor İmamoğlu detained

For those not up to speed, Ekrem İmamoğlu is Istanbul’s mayor and a leading opposition figure to President Erdogan. He was set on Sunday to be named the presidential candidate for the Republican People’s Party.

On Tuesday, Istanbul University annulled İmamoğlu’s degree, citing irregularities. This might not seem like a big deal, but this decision effectively barred him from running for president, as a university degree is a prerequisite for candidacy.

Critics viewed this move as a strategic effort to sideline a formidable political opponent ahead of the 2028 presidential election.

In the early hours of Wednesday, Turkish police surrounded İmamoğlu’s residence in Istanbul. On his way out, İmamoğlu addressed the public, saying, “We are facing great oppression, but I will not give up. I entrust myself to my nation.”

Shortly thereafter, he was detained alongside over 100 individuals, including his aide Murat Ongun, two Istanbul district mayors from the Republican People’s Party, journalists, and business figures.

The exact charges being thrown around are that of corruption, financial misconduct and terrorism. However, it doesn’t take a genius to see that these charges are politically motivated, aiming to eliminate İmamoğlu as a potential challenger to President Erdogan in future elections.

Needless to say, this didn’t go down well with the general public. The Turkish government imposed a four-day ban on public demonstrations in Istanbul, closed major roads, and restricted access to social media platforms such as Twitter, YouTube, and Instagram. These measures were reportedly taken to maintain public order amidst rising tensions, but again, they are seen by many as ways to restrict freedom of Istanbul Mayor İmamoğlu Detained speech.

Initial market reaction

In short, the market reaction was not good. As a barometer, we look at USD/TRY, overnight funding rates and the main domestic stock market index.

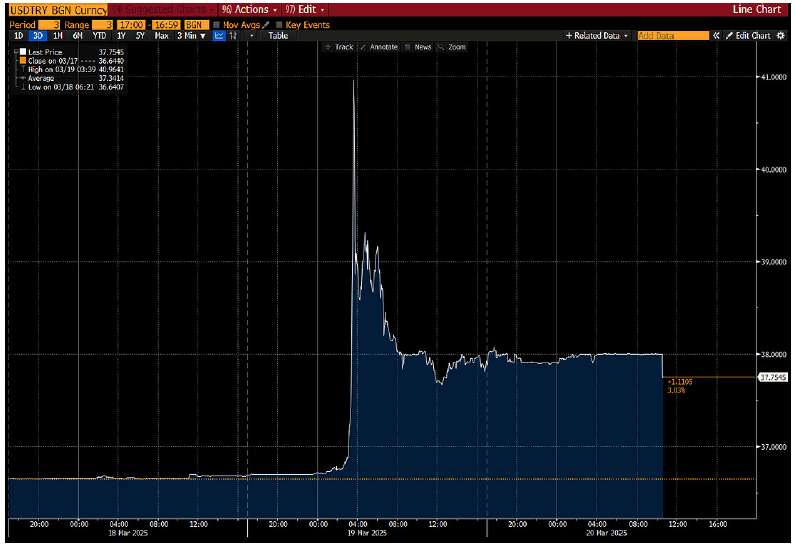

USD/TRY In the spot market, USD/TRY popped 11.5% higher on Wednesday, and even though it has retraced some of those losses, you can see a risk premium built in with it trading around the 38 handle:

Reports we’ve read detail that Turkish lenders sold around $8bn until midday on Wednesday to support the Lira, indicating that the spike we saw was somewhat of a cushioned move, which makes it even more incredible.

BIST 100

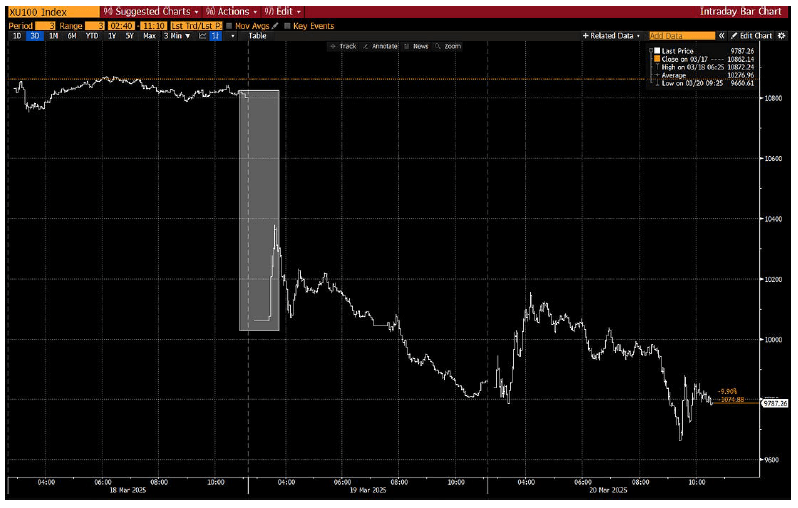

In the equity space, the main index triggered a trading halt after it dropped almost 7% on open:

ON/short-term funding

Funding rates, even at overnight tenor, massively spiked (and are still elevated). Even though this signals an unwinding of lira carry positions, it also shows the likely heavy losses that would have been incurred on these trades by funds, given the M2M of these positions and exit prices on the forwards.

In the bond space, the 2yr yield made fresh YTD highs, pushing beyond 41%:

Thoughts from here

Where do we begin… let’s start with things from an investors perspective regarding the pivot on the attractiveness of allocating funds to Turkey.

In recent months, sentiment has turned positive toward the nation. For those who had cycled out of the USD/JPY carry trade, being long TRY was seen as a potentially lucrative trade to own.

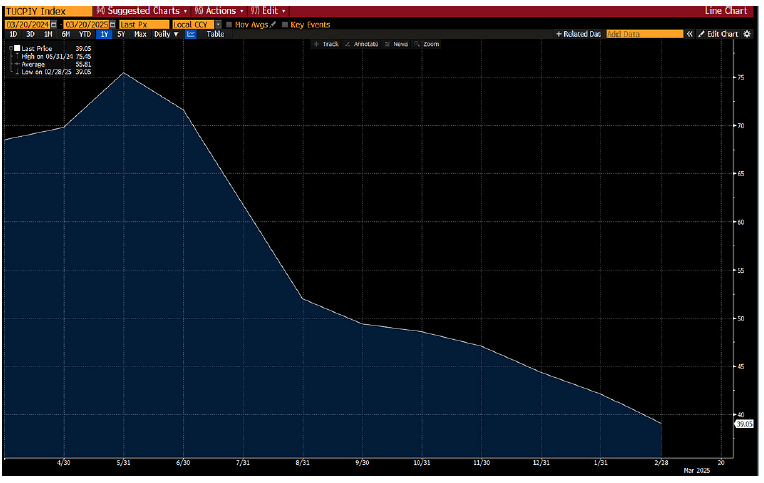

Inflation in the country has been falling over the past year, from crazy levels around 75% down to a February reading of 39%:

With confidence returning on the economic policies being enacted and a real possibility of further controlling inflation, we get why things were looking up.

Let’s also not forget that Turkey has been insulated from trade tensions with the U.S. Unlike countries like China, Turkey is not a major competitor to U.S. industries, making tariffs less of a policy priority.

Yet this week’s actions on the political front have blown up the carry trade, alongside equity longs. We expect to have some stories filtering through over the coming couple of weeks from Prime desks about some losses from clients on the FX front. It’ll have burnt a few for sure, at that likely means a lack of new conviction in putting on anything pro- Turkey in the coming months.

Now, let’s look at the implications from a political perspective. The detention suggests that Erdoğan is using judicial power to eliminate opposition, which could further undermine Turkey’s democratic institutions. Further crackdowns on the public could backfire, leading to greater opposition support, similar to what happened after the 2013 Gezi Park protests.

With the world starting to notice, it doesn’t bode well at all for it’s position in trying to get to the top table regarding EU peers, NATO peers, or as a serious peace broker for the conflicts nearby.

This then impacts sovereign yields, with political instability being one factor affecting pricing.

The question we’re left with is whether or not Turkey is uninvestible right now. In short, we think it is. Yet, if we’re being honest, hasn’t it always been? We remember from 2017 to 2019 when people got burned on USD/TRY, and again in 2021, with the pandemic. Quite honestly, we’ll never look to get involved in TRY or local equities. When you lack liquidity, a government happy to try unconventional economic policies and a president overseeing actions against rivals like we’ve seen this week don’t make for a compelling risk/reward.

If anything, Turkey should serve as a reminder that trades can blow up in your face very quickly,

Author

APFX Research

AlphaPicks

Multi-asset investment research.