A sustained correction in Silver could initially take it back to the $28 level

You won't be surprised to hear that I'm a long-term precious metals bull.

Still, that doesn't mean I think these metals go up in a straight line. Almost nothing does.

I've been saying for some time that silver and gold were due for a correction. We may be getting one now.

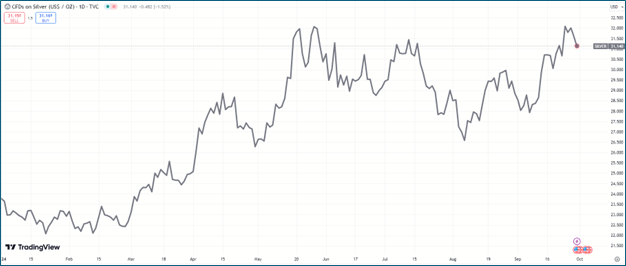

Here's a chart of the silver price year-to-date:

Back in mid-July, I was telling subscribers that the move from $22 in February to $32 in May was unlikely to be sustained. My targets were $28 and then $26. Notice how it corrected to the $26.50 level back in early August.

I think we are in for another correction, as gold, too, has potentially gotten a little ahead of itself. A sustained correction in silver could initially take it back to the $28 level, which I think would make for another great opportunity to buy.

Additionally, silver speculators are extremely bullish, which makes for a strong contrarian signal as they are often on the wrong side at futures position extremes. At the same time, the smart money silver commercial hedgers are near a multi-year high in their bearish positioning. This suggests a higher risk of a silver price correction in the near term.

While all of this is happening, the US dollar may be at the start of a rally, which could help cement a precious metals selloff.

Still, the outlook for silver in the medium to long term is bright.

Global precious metals trader refiner and recycler Heraeus points out that in the previous quarter, silver ETF inflows reached 829 tonnes, the most in a quarter since early 2021 when holdings peaked. Heraeus figures that China's recent fiscal and monetary stimuli will help boost industrial and investment demand.

They also highlight that Chinese solar installations have so far exceeded 2024 forecasts and that energy analysts at Ember think installations could reach 334 GW, well above the 190 GW forecast by the China Photovoltaic Industry Association. What's more, Ember expects global growth of 29% year-on-year.

And lately, more mainstream analysts are agreeing silver is primed to rise.

A recent Citibank research note was titled Commodities Flows, thanks to a dovish FED and their Q4 commodities outlook. They are clearly bullish on silver, with a year-end target of $35, while expecting silver to reach $38-$40 by mid-2025. They cite the Chinese energy transition demand for solar and EVs, in addition to a more recent jump in retail demand, as a store of value in response to weak property markets, consumer sentiment, and record-high gold prices.

When mainstream analysts get this bullish, I see that as another near-term contrarian signal, as they are often late to the party.

Still, with this increasingly fundamentally bullish backdrop, the silver outlook is compelling.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Peter Krauth

Money Metals Exchange

Peter Krauth is the author of the bestselling book The Great Silver Bull, publisher of the silver-focused investment newsletter Silver Stock Investor, and is affiliated with TheGoldAdvisor.com.