A new all time high for Gold

XAU/USD

-

A few days ago I wrote that Gold was beginning to look like we had a new bull trend. Since then Gold has continued higher with significant gains.

-

The break above 2427 was the next buy signal targeting 2433 & we retested the all time high at 2446/49 yesterday.

The break above 2450 was an obvious buy signal for this week & we immediately shot higher to 2475 as I write. -

Next targets are 2487/90, 2495/99 & 2507/09. Eventually 2516/19 & 2526/29 are achievable.

-

A buying opportunity at 2450/45 & longs need stops below 2440.

-

However further losses risk a slide to support at 2426/23 & longs need stops below 2419.

XAG/USD

-

Silver longs at first support at 3060/50 worked perfectly yet again but this time we beat minor resistance at 3095/3105 for a buy signal targeting 3125 & 3145, even 3170/75 is likely.

-

A break above 3180 is a buy signal targeting 3205/10 & 3225/30, perhaps as far as 3245/50.

-

First support at 3105/3095 & longs need stops below 3085. A buying opportunity again at 3060/50 & longs need stops below 3030.

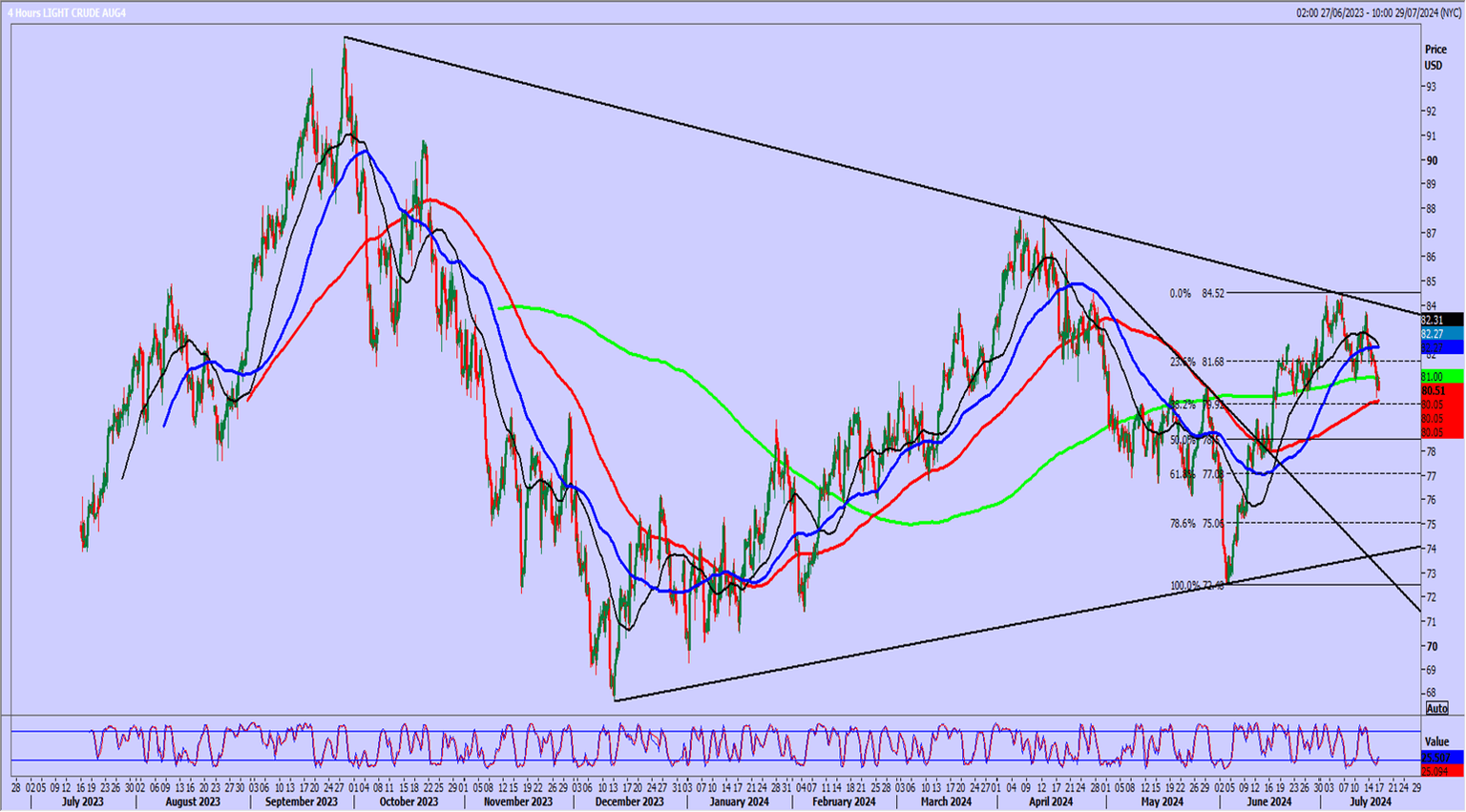

WTI Crude August future

Last session low & high for the AUGUST contract: 8022 - 8193.\

-

WTI Crude August broke support at 8150/8100 & meets support at 8010/7980 today. With the sideways nature of recent price action we could see a low for the day here but longs need stops below 7940.

Targets: 8100, 8150, 8190, perhaps as far as 8220. -

A break below 7940 is a sell signal targeting the 8-month range around 7850 this week. Further losses are possible as far as 7730/00.

Author

Jason Sen

DayTradeIdeas.co.uk