A moment of truth has arrived

S2N spotlight

Over the decades I have seen setups like this a million times, and every time the situation feels unique and complicated. Everything in life is complicated, but we tend to make it far more complex than we need to.

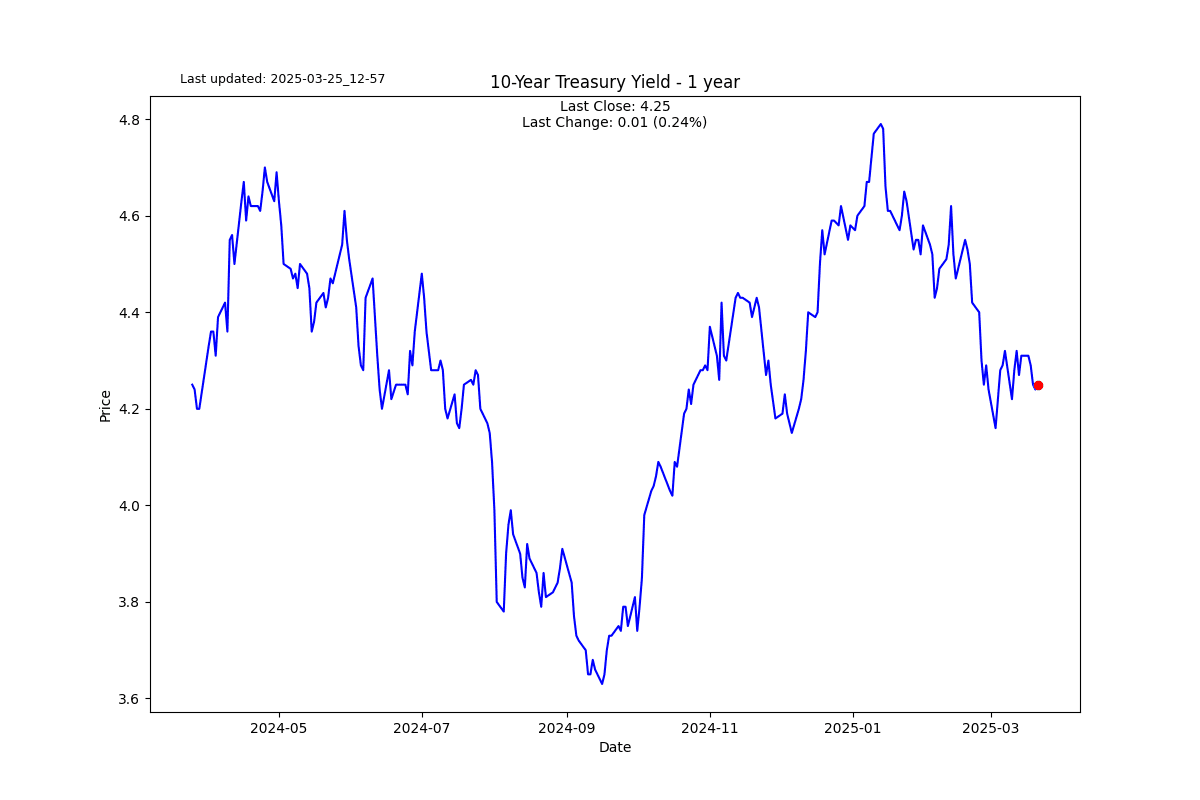

The S&P 500 has bounced over the last few days and has now just climbed above its 200-day moving average. So the natural question is, should I go long now?

The chart below shows the S&P 500 and its 200-day moving average, and in the bottom pane the % of index constituents above their respective 200-day moving averages (46%).

If you are a systematic trader, you shouldn’t have any doubt. You simply follow what the system you built tells you to do.

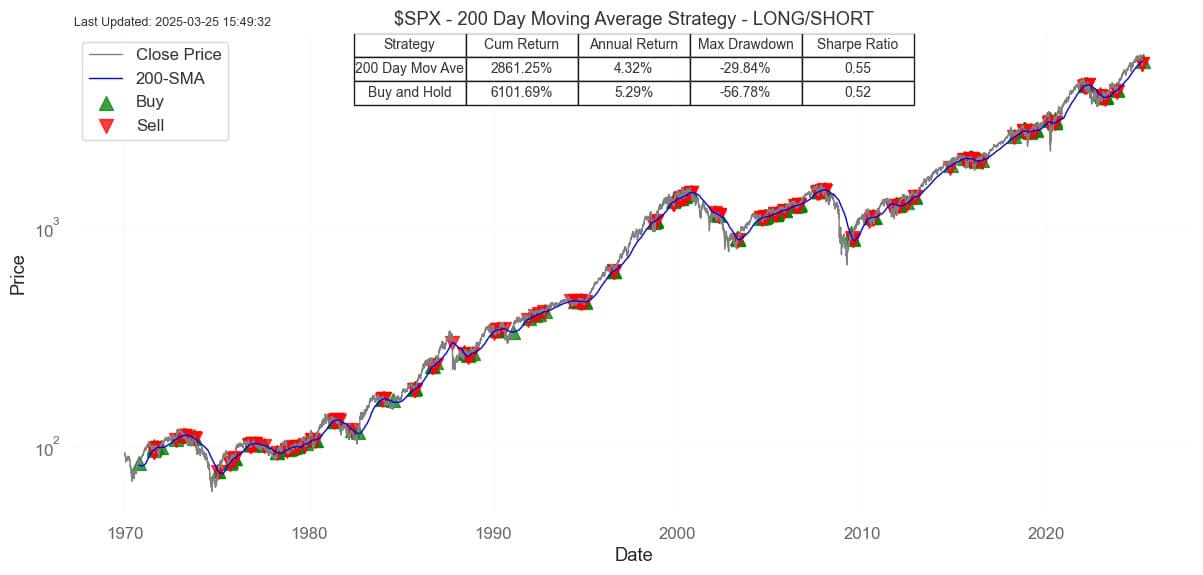

Here is a vanilla 200-day moving average long-short system. The system has just initiated a close of the short and gone long. This system has a better Sharpe Ratio than a buy and hold but makes a lot less money. We are not judging this system today. We simply have to go long if we are following it.

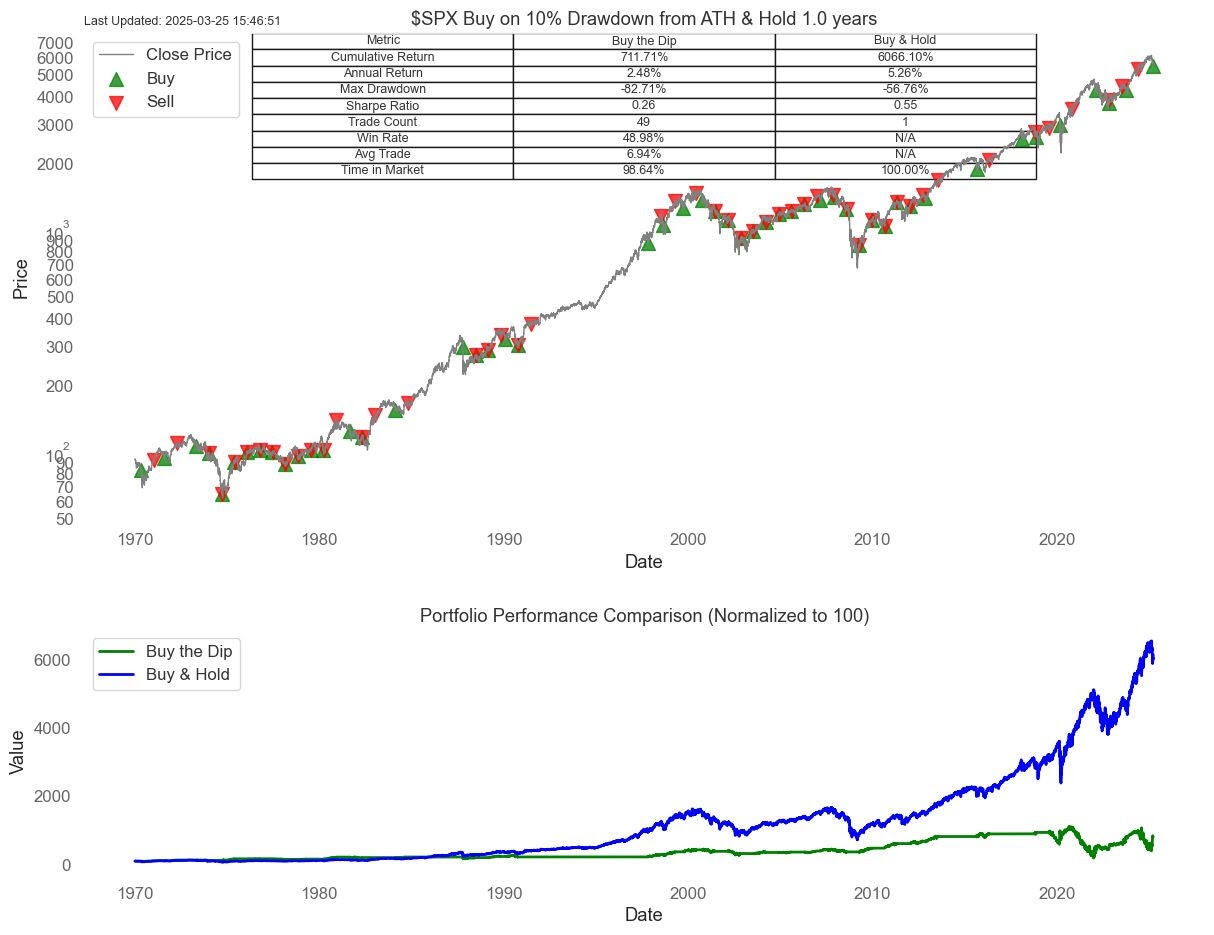

Let us consider if we are a buy-the-dip investor. Assume we are a buy-the-10% dip investor; this is what your performance looks like compared to a buy-and-hold investor. What is very clear is that this is not the best strategy in the world despite all the market cheerleaders encouraging one to buy the dip. The weakness you could argue is that the holding period is only a year from buying the dip. While not perfect, it is capturing 98.64% of the time in the market, so it’s a good enough approximation.

So where do I sit on all of this from a discretionary macro point of view?

The current market behaviour is being driven purely by news headlines. Not by fundamentals, which makes it a very skittish, unreliable market. The headlines driving all these bounces relate to Trump easing his stance on tariff policy. The market short interest is high, so bounces are squeezing bears, making them wish they were wearing bigger underpants.

Another bounce, and the shorts will be singing like pre-puberty choristers. Hold the line!

S2N observations

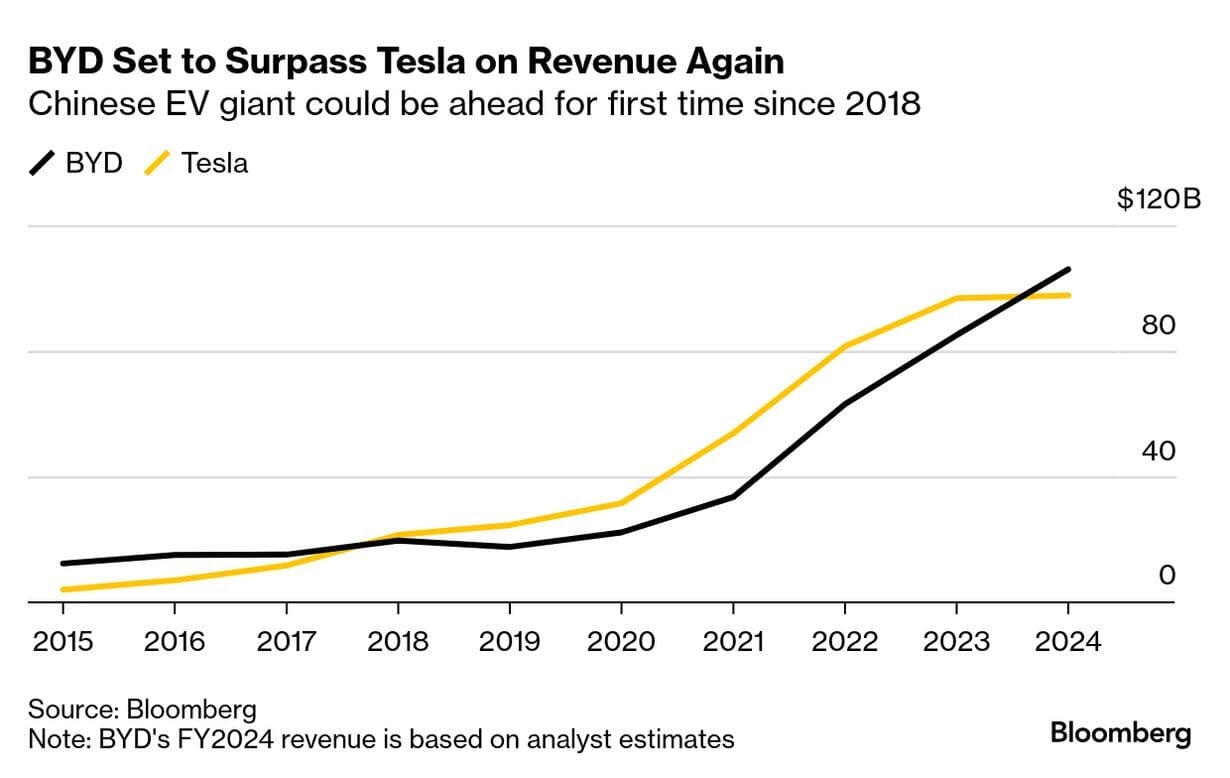

A few hours ago, BYD reported its full-year 2024 financial results.

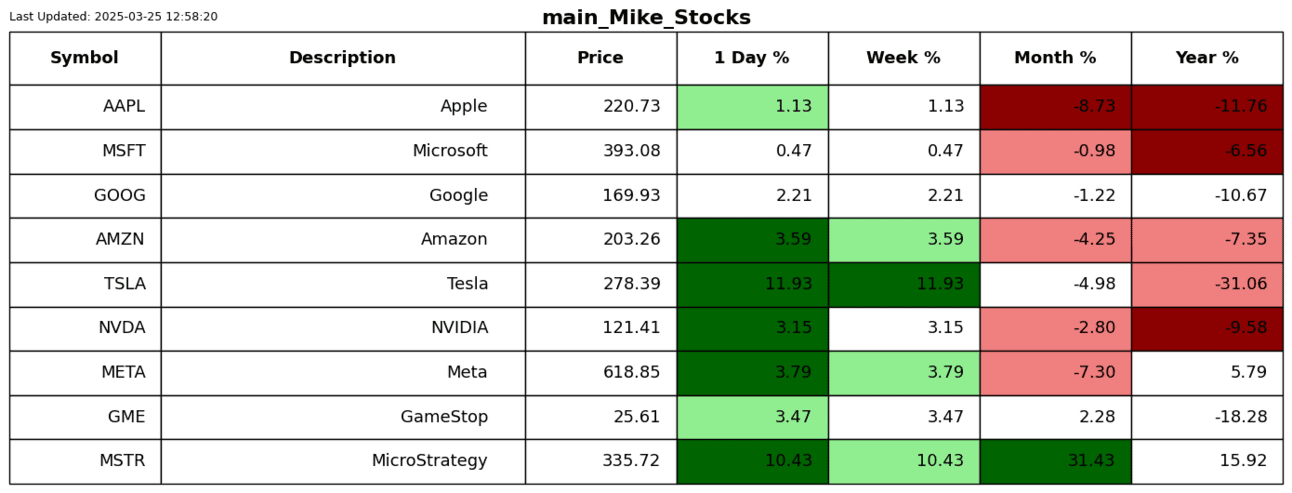

Shenzhen-based BYD reported revenue of 777 billion yuan ($107 billion) for the 12 months ended Dec. 31, up 29%, according to a filing late Monday, beating estimates for 766 billion yuan. Tesla’s 2024 revenue was $97.7 billion. The Chinese EV maker’s net income rose 34% to 40.3 billion yuan, beating analyst estimates for 39.5 billion.

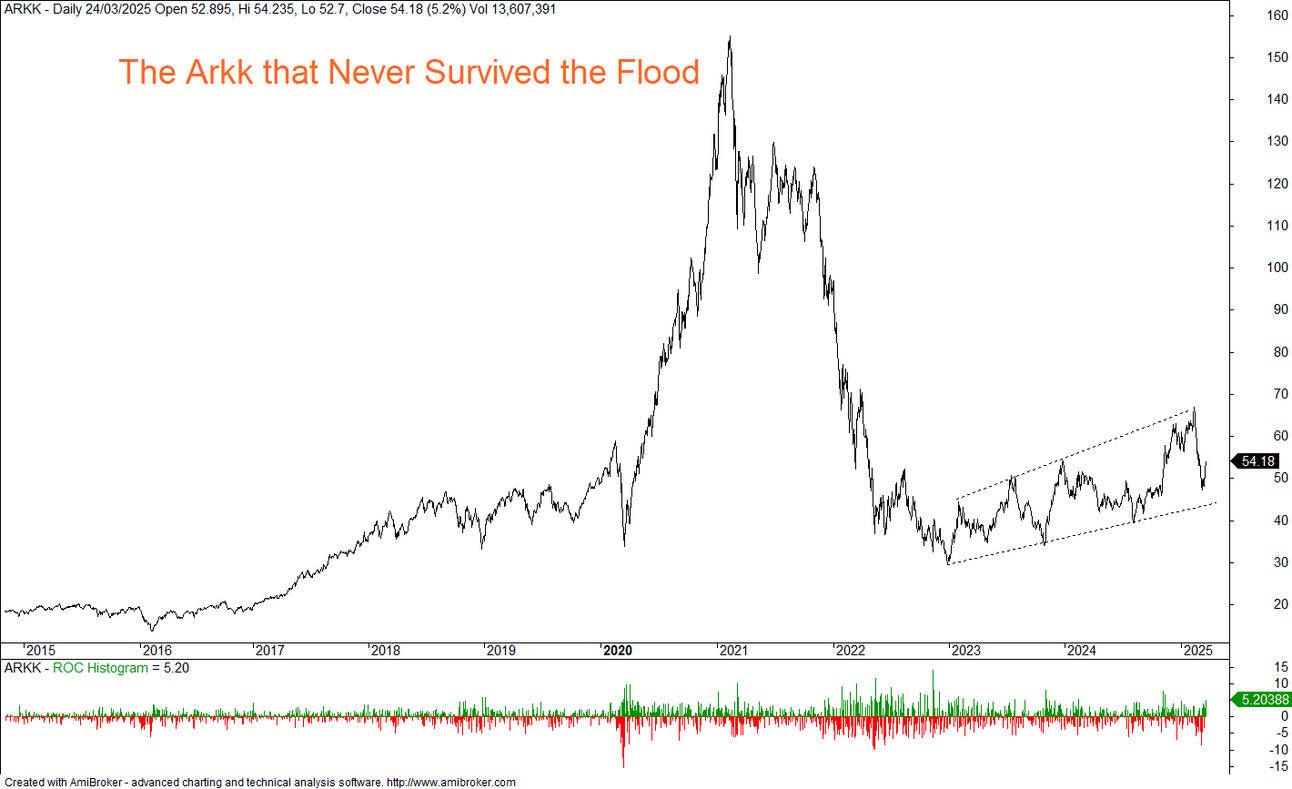

I have no idea why people still give Cathie Woods a soapbox to make her fantastical projections. Before I share her latest projection, let us first look at the value she has destroyed.

Cathie Wood’s Ark Investment Management LLC remains bullish on Tesla Inc. and expects the stock will hit $2,600 in five years, or almost 10 times its current price. Wood said in an interview with Bloomberg TV that Tesla’s robo taxis will account for 90% of its value over that time. Tesla has initiatives in humanoid robots that Ark hasn’t even factored into the price prediction, she added on the sidelines of the HSBC Global Investment Summit in Hong Kong on Tuesday.

Tesla rallied nearly 12% yesterday despite being surpassed in turnover by a Chinese EV manufacturer.

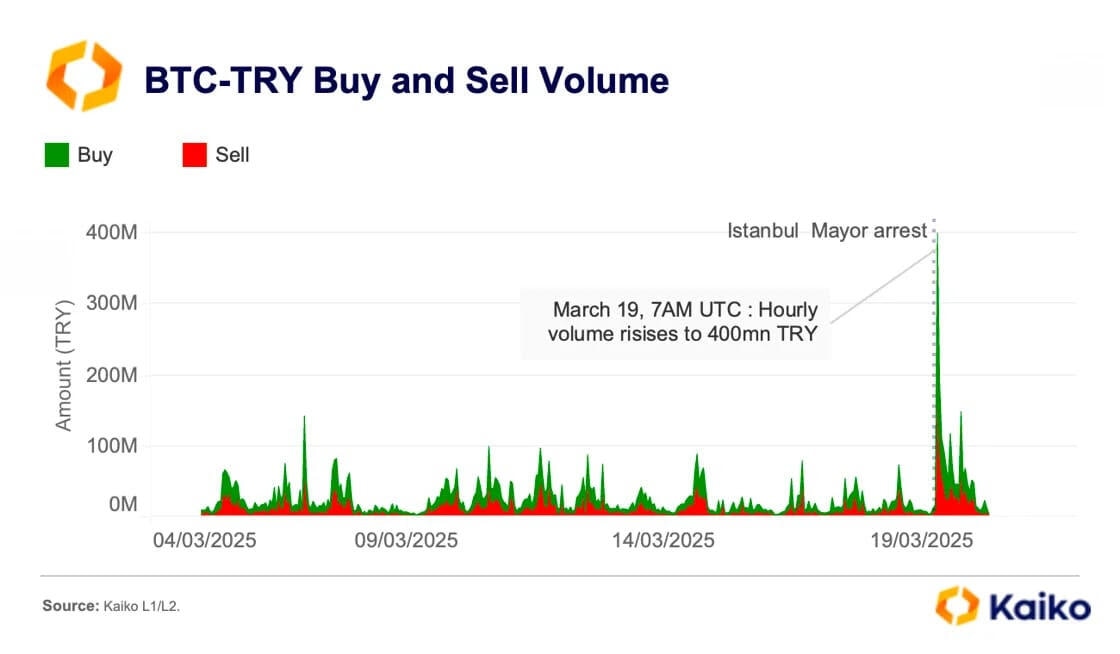

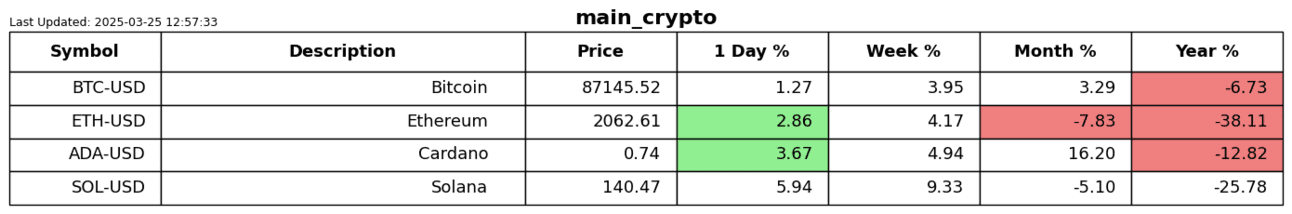

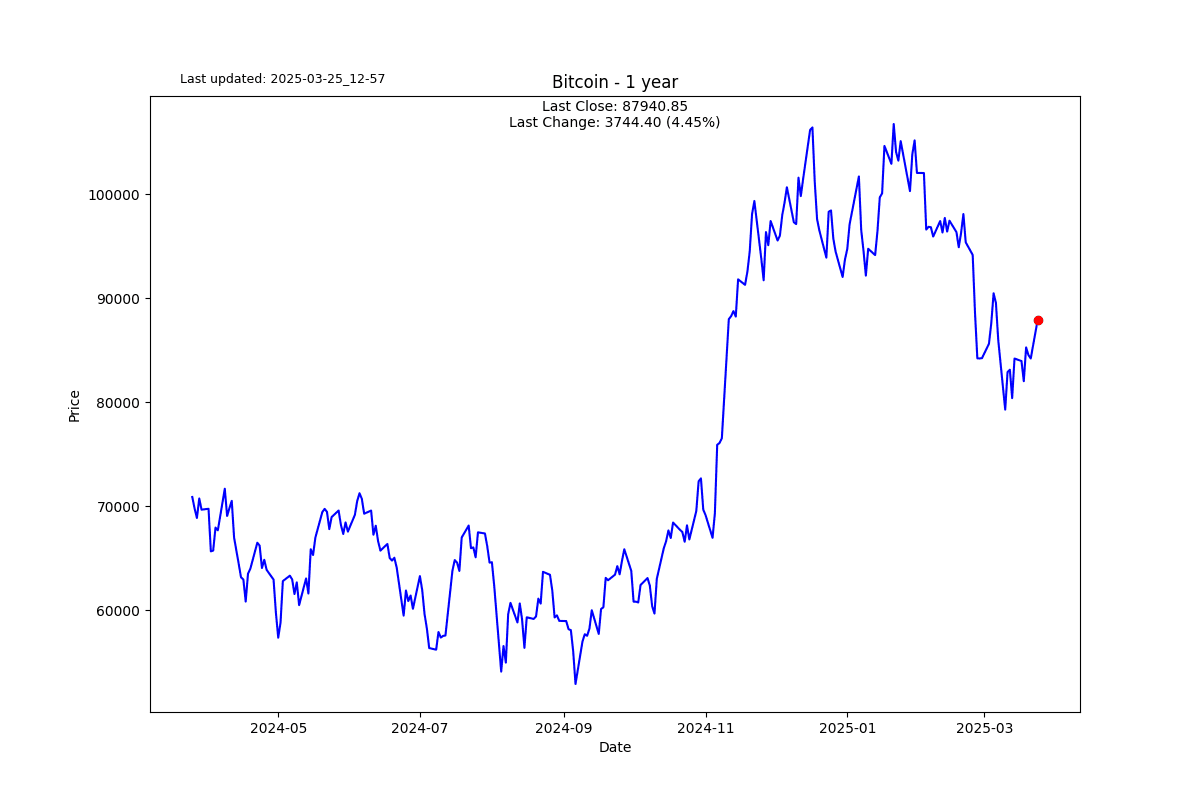

Expect more destabilising economic and military news from Turkey. Their currency is on its knees, inflation is at 40% per annum, and short-term interest rates are at 42.5%. No surprise that people are sticking their money into Bitcoin. This is probably a great use case for crypto.

S2N screener alert

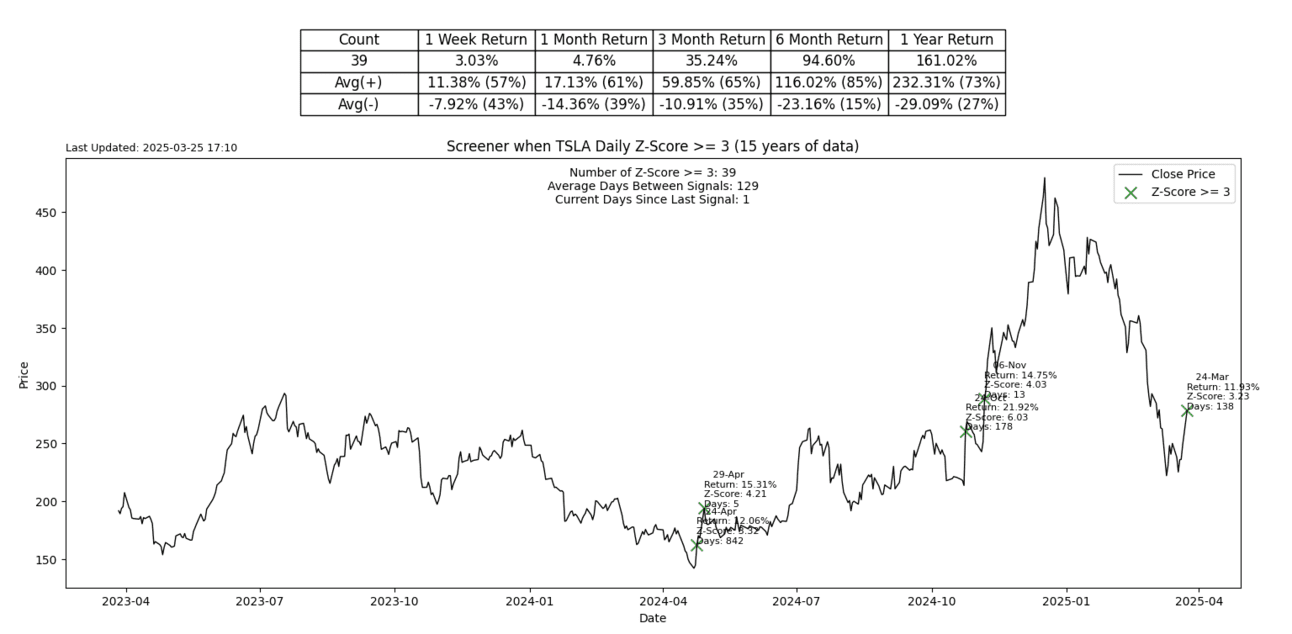

Tesla had a massive up 3 sigma day.

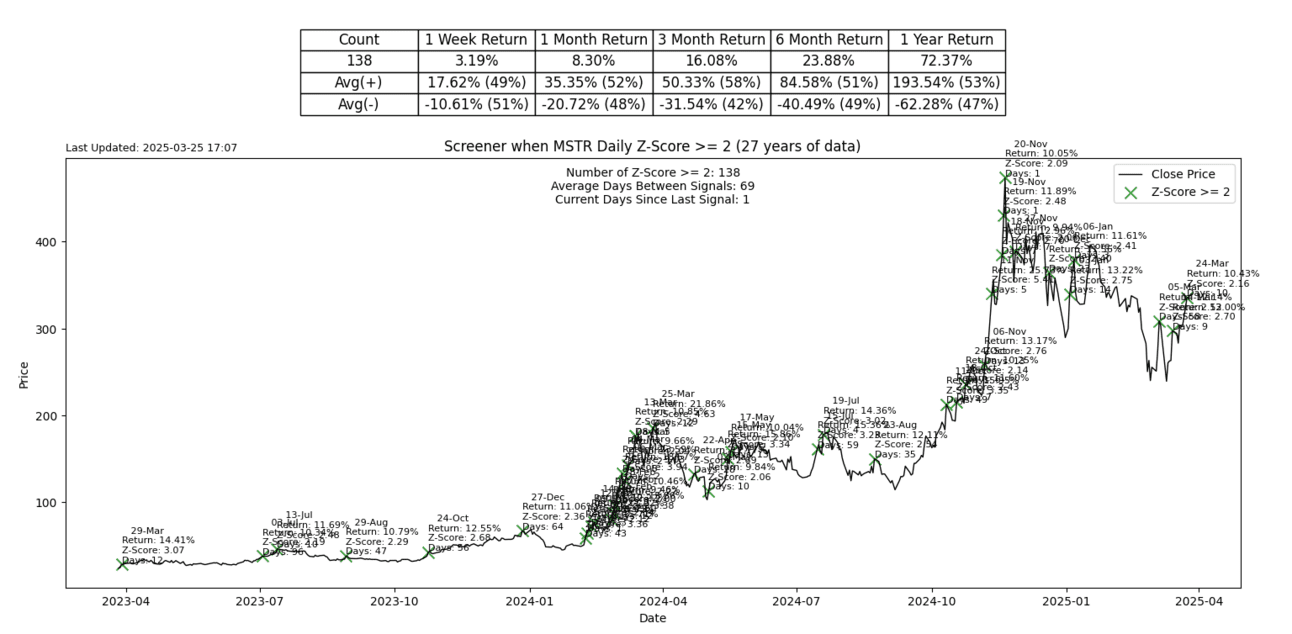

MicroStrategy enjoyed a 2-sigma up day as well.

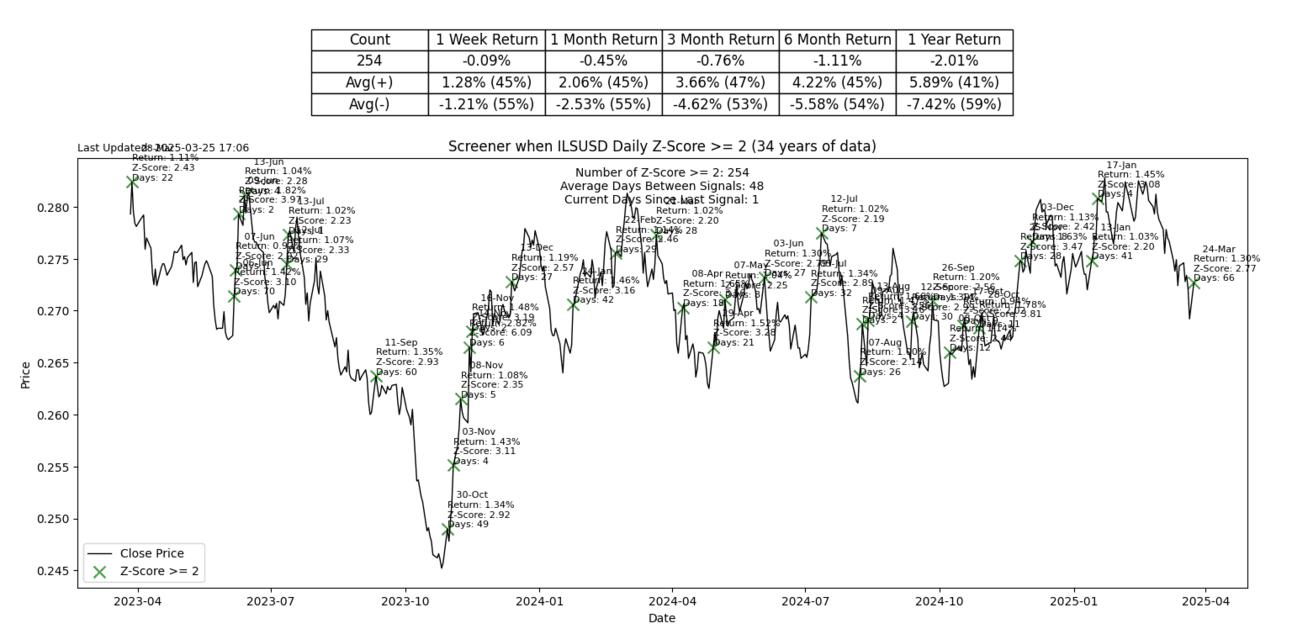

The Israeli shekel reverses its 2-sigma down day with a 2-sigma up day.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.