A longview on precious metals

The precious metals complex and especially gold is fascinating many investors. Not surprisingly, some myths formed around the asset class. There is a widespread belief that precious metals are a safe haven and protect against inflation. That’s true over the long run but can be costly on short- and medium-term timeframes.

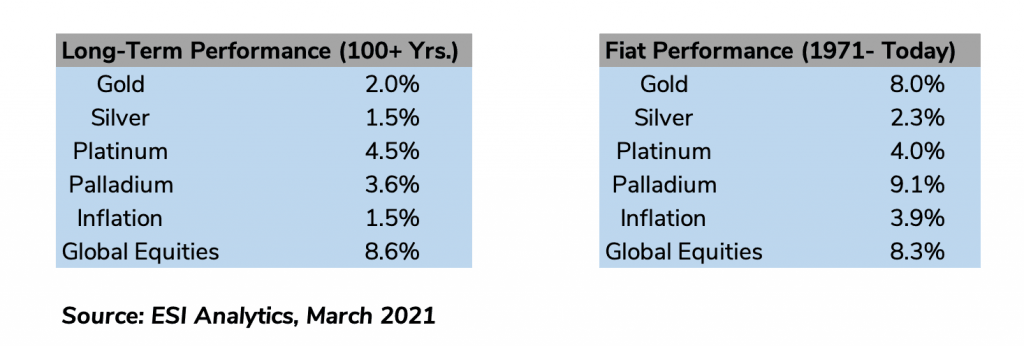

The crucial question is first and foremost, how did precious metals perform in the long-run? Our dataset spans to more than a century of data and reveals a modest but steady long-run result. Silver takes the last spot with an annual yield below 1.5% since 1790. Gold was the second-worst performer and yielded roughly 1.9% per annum over the same timeframe. Palladium and platinum yielded 3.6% and 4.5% respectively since the beginning of the 20th century. All in all, not spectacular gains but an equally-weighted precious metals basket outperformed long-term inflation, as measured by the official U.S. CPI, by roughly 1.4% annually.

It makes sense to split precious metals performance into two distinct periods, pre-fiat and post-fiat, as decoupling major currencies from gold could lead to a different yield regime. Evidence shows that precious metal yields slightly improved since the fiat system was introduced globally at the beginning of the 70s. Palladium was the top performer with 9.1% since then. Gold came up second and yielded 8.0% p.a. Platinum and silver disappointed and the latter did not even maintain purchasing power during the fiat era. Both yielded 4.0% and 2.3% p.a. respectively. An equally-weighted precious metals basket yielded 5.9% annually and outperformed fiat-age inflation by roughly 2% p.a.

A few interesting facts can be gathered from the long-term data. The entire complex moved along a volatile path steadily to the upside. However, it is essential to realize that we are looking at more than a century of data, which means that the visible corrections within the charts were severe. Two corrections were exceptionally painful and lasted five and two decades, respectively. A precious metals basket lost more than 40% of its value from a peak in the 1920s and took roughly five decades to recover in nominal terms. It was not a unique event and the 1980s kicked off a devastating 75% nominal (inflation-unadjusted) loss that took more than two decades to recover. It occurred during the fiat system era, which is contrary to the intuition of many investors. The last significant draw-down unfolded during the Global Financial Crisis in 2008. An equally-weighted precious metals basket lost more than half of its value as the global crisis unfolded.

Evidence debunks several myths around gold and its siblings. Precious metals are a robust store of value over the long term. However, the medium-term character comes as close as it gets to that of a risky asset. Precious metals are not just in terms of their draw-downs short- and medium-term risky assets but also during periods of crises such as the Great Depression and the Global Financial Crisis. Neither the asset class nor its individual components are reliable crisis mitigators and should not be perceived as a safe haven. The long-term analysis shows that precious metals are not as easy to handle as equities. The complex performed positively over the long run but showed disproportionate drawdowns in terms of time and asset value in comparison to a diversified global equities basket.

There is no doubt that precious metals have an economic rationale as a store of value over the long run. However, the key takeaway is that the asset class behaves like a risky asset over short- and medium-term timeframes. The bottom line is that precious metals are not a buy-and-hold substitute to global equities from an evidence-based investment perspective. An efficient long-term equity and bond portfolio can be structured semi-passively. Including a larger passive precious metals component does not add value to that portfolio. Instead, market timing matters significantly for the asset class. Therefore, precious metals are more appropriate for trading secular trends with a bullish bias.

Interested in more of our ideas? Check out Scienceinvesting for more details!

Author

Science Investing Team

Science Investing