Three essential indicators for gold trading

Gold is a highly liquid instrument with an average daily trading volume of more than US $140 billion. As gold is very liquid, traders can enjoy very tight spreads, especially during the height of the US and London trading sessions. Our gold spreads are among the best I the industry and we welcome you to compare our gold spreads to our competitors.

But to make the most of the favorable trading conditions that can be offered by gold, traders may like to utilise technical indicators to help determine the right trading strategy.

In this spirit, we have compiled a description of three technical indicators and why they are helpful for gold traders.

Relative Strength Indicator (RSI)

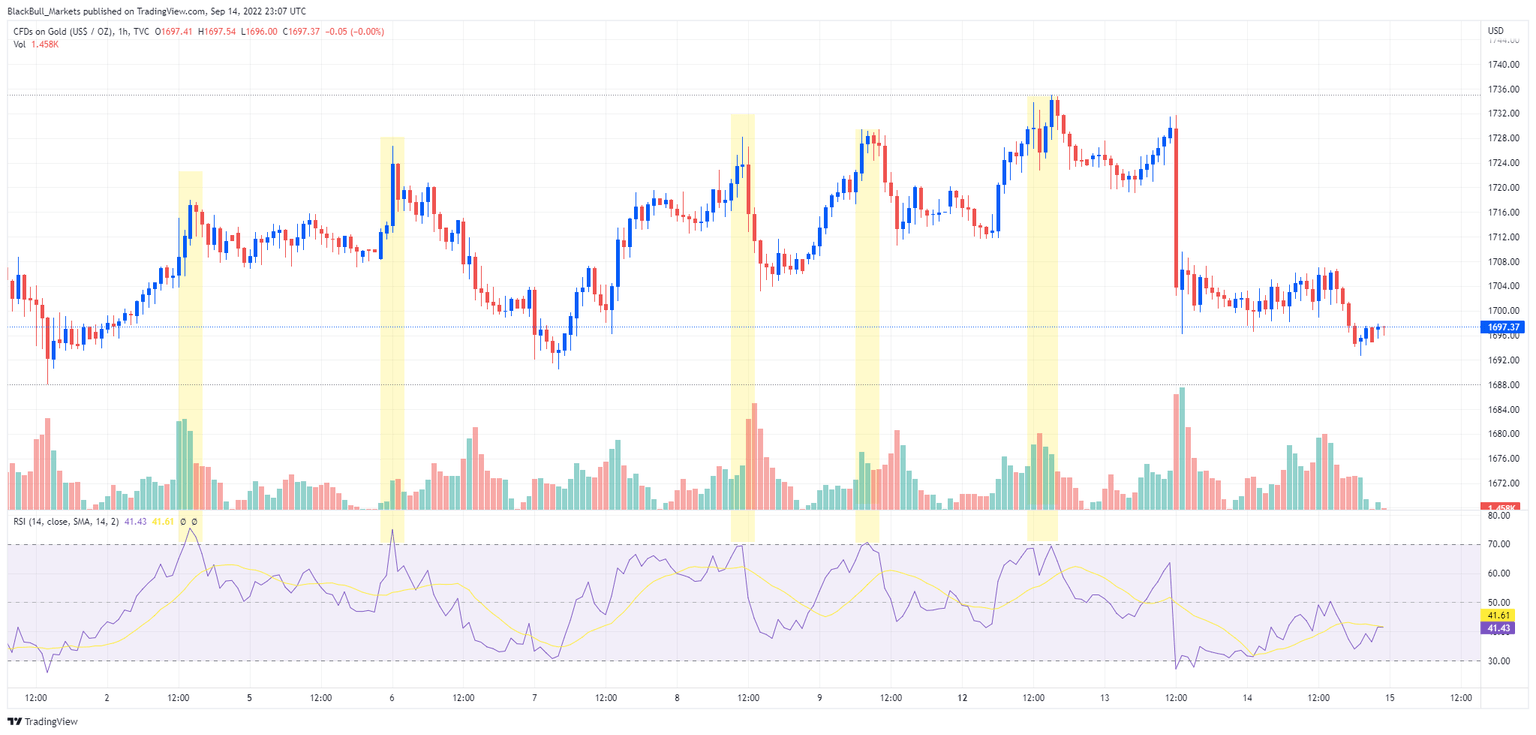

The RSI is a useful indicator for identifying when gold enters an overbought (above the 70 level) or an oversold (below the 30 level) condition.

Examining the RSI as it is applied to an hourly gold chart, we can see the correlation between the peaks in the RSI and the local peaks in the price of gold. After the RSI climbed above the 70 level (or got very close to doing so), the price of gold empathically fell in price.

RSI is great for confirming a trade decision with gold. If you find an entry for buy position, you can check the RSI value for confirmation. If the RSI is above the 70 level, you may want to reconsider this buy trade, as gold is in overbought territory. A value below 70 would be preferable.

XAU/USD 1H, with RSI

Moving Averages (MA)

Moving averages are effective indicators that can help gold traders by helping them gauge the direction of the market.

You have two main choices when it comes to moving averages: Exponential (EMA) and Simple (SMA). It is good to note that the EMA gives greater weight to the most recent prices, while the SMA weighs all inputs equally.

The best moving average to use with gold trading depends on your strategy and preferences, and particularly the time frame on which you are viewing the charts.

On the one-hour chart below there are 3 SMAs based on a small-time frame so that the direction of the market can be accurately depicted. The moving averages below are based on the previous 5, 8 and 13 candles. As we are on a very small time frame, the difference between the EMA and SMA lines are reduced.

XAU/USD 1H, with 5,8, and 13-candle SMA

Bollinger Bands

The Bollinger Bands indicator is useful for visualizing volatility and the range that gold has recently traded.

The most helpful quality of the Bollinger Bands is that the two outer lines show where price movement should be expected to trade 90% of the time (the trading band). As such, when trading gold, the outer lines can help you determine levels for placing your stop loss and take profit. Traders will typically open or close gold trades when gold price hits one of the outer Bollinger Bands.

XAU/USD 1H, with Bollinger Bands Indicator

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.