- The US presidential and congressional elections are set to rock markets.

- Campaigning begins early and will have a growing effect on trading.

- This practical guide lays out the timetable and other useful details for the event of the year.

America is not only a country, but also an idea – fashions begin in New York and spread to the world, US values are exported, and as an issuer of the world's reserve currency – the dollar – any change in the US has an outsized impact on all markets.

The basics

November 3 is the date to circle on the calendar – the first Tuesday of November, as per tradition. Voting and the results are happening while markets are open– contrary to many other countries that go to the ballots during the weekend.

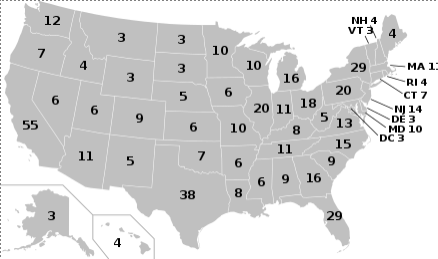

The president is elected via the Electoral College system. The candidate that wins most votes in each of America's 50 states and the Capital District of Colombia wins all the electors for that state, with two minuscule exceptions. The total number of elections is 538, and 270 are needed to clinch the victory. The minimum is three electors, and California has the maximum number of electors, 55.

Source: Wikipedia

The president is the Commander-in-Chief and has significant sway over foreign policy. Incumbent Republican President Trump is facing Joe Biden, the presumptive Democratic nominee. Several minor third-party candidates are unlikely to influence the outcome.

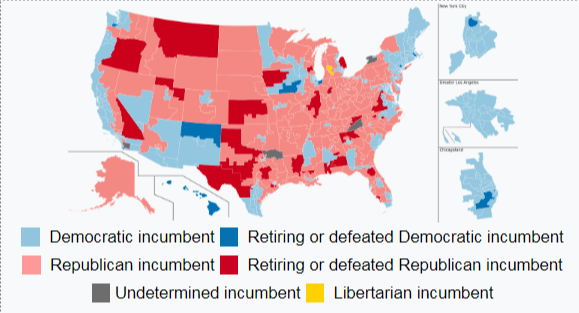

Americans also elect all 435 members of the House of Representatives, the lower chamber of Congress, and 35 out of 100 Senators, the upper house. Broadly, the House approves budgets, and the Senate is responsible for nominations. Major legislation requires agreement between both chambers and the president.

Source: Wikipedia

Democrats, led by Speaker Nancy Pelosi, currently control the House, with 233 seats. Representatives are voted for a two-year term.

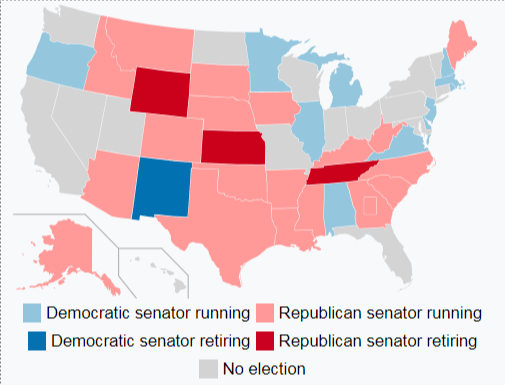

Republicans led by Majority leader Mitch McConnell, currently command control of the Senate with 53 seats. They are defending 23 and Democrats 12 in the upcoming vote. Senators are elected for six-year terms.

Source: Wikipedia

A clean sweep enables the ruling party to do more and may have a more significant impact on markets than split powers.

Tips about reading the polls

The best resources for following the race are FiveThirtyEight and also RealClearPolitics. Both aggregate polls, with the former in a more sophisticated weighting while the latter uses simple averages.

National vs. state: Support for candidates at the national level show where the wind is blowing, but the presidential elections are decided according to the electoral college count.

Who is polled? Polls of likely voters are more significant than those of registered ones, which in turn, carry more weight than surveys of adults. It is also essential to note the survey dates.

The margin of error: If candidate A leads B by two points and the margin of error is three points, it means that at the time of the survey, the pollster projects any result between a victory for A by up to 5 points, to B, winning by one point.

Who is polling?: Even if some pollsters are somewhat biased, the quality of their methodology and the comparison with the same firm's previous poll is significant.

Make the trend your friend: Following up on the previous point, if the same firm shows candidate A rising from a one-point lead to three and then six, it is significant. States that are polled infrequently do not provide clear trends, raising the level of uncertainty.

Undecideds: A poll showing candidate A is leading over candidate B by 52 to 46 points is more significant than one showing a 46 to 40 lead. A high level of people who have yet to make up their minds means uncertainty is elevated. This is of greater importance closer to election day.

The run-up to the vote

Electoral campaigns in the US are long, and some say never-ending. The end of the primary season and the focus on the COVID-19 pandemic have shifted the focus away from politics, but President Trump's mid-June election rally may refocus attention on the vote.

The big events looking forward:

August 17-20, Democratic National Convention in Milwaukee, Wisconsin, but could be held virtually. The party will officially nominate former Vice President Biden and a yet-to-be-announced VP candidate. Investors will be on the lookout to see if the party moves toward the center or more radical-left policies.

August 24-27: Republican National Convention in Charlotte, North Carolina, and Jacksonville Florida will formally nominate Trump and Vice President Mike Pence. It will also sharpen the party's messages ahead of the elections. Delegates and politicians will even agree on a platform, that may shift between free-market capitalism and populism.

September 8: The day after the long Labor Day weekend is when many Americans tune in to the elections and when opinion polls will likely have a more considerable influence on markets.

September 29: First Presidental debate in Notre Dame, Indiana. The first encounter between the candidates tends to gain the most media attention and could shape opinion polls and market reactions.

October 7: Debate between VP candidates in Salt Lake City, Utah. An outlandish victory for one side would be needed to move markets in this case.

October 15: Second presidential debate in Ann Arbor, Michigan. The follow-up encounter may provide an opportunity for the nominee that is perceived as the loser to hit back at his opponent.

October 22: Third President debate in Nashville, Tennessee. While the last clash could convince those on the fence to vote for one candidate or another, many voters will have suffered from "debate fatigue."

October Surprise? The term coined back in the 1960s refers to a last-minute move – more likely from the incumbent that has more power – to convince the undecideds to shift one way or another.

Mail voting intensifies ahead of election day, and reports about turnout may also move markets, yet they usually prove noisy. 2020 could be different due to coronavirus, but a tendency toward one party in remote voting does not imply a lead – just early voting.

November 3: Election Day.

November 4: Reaction day.

Election night timetable

Similar to reports about mail voting, turnout figures during the American session on election day may cause movements in markets, but they will likely be minor.

Exit polls and real results emerge during the Asian session, which tends to experience lower volume. However, banks and brokers reinforce their trading desks around the big night, and while volatility is high, it is backed by elevated rather than reduced volume.

This is a rough timetable for election night results:

- 22:00 GMT / 18:00 Eastern on November 3: Polls close in some parts of Indiana and Kentucky.

- 23:00 /19:00 Polls close in six additional states, including Florida, New Hampshire, and Virginia.

- 23:30 / 19:30 Polls close in three more states: North Carolina, Ohio, and West Virginia.

- 00:00 / 20:00 Flooding time: polls close in 16 states, including Pennsylvania and Michigan (gave Trump the victory together with Wisconsin) + Texas.

- 1:00: / 21:00 Polls close in 13 more states, including Wisconsin, Arizona, and New York. Real results counted in the states where voting already ended.

- 2:00 / 22:00 Polls close in more states such as Iowa, Nevada, and North Dakota. Still peak time for real results.

- 3:00 / 23:00 Polls close in the West Coast. By this point, we should have a clear picture, at least for the House.

- 4:00 / 00:00 Polls close in Alaska. Everything should be clear by now, with the losing candidate making his call to the winner, and later both candidates addressing their supporters.

- 6:00 on November 4: European morning reaction.

In case the race is extremely tight, there will be no concession call, and uncertainty can last between an additional few hours to several weeks, as it happened in 2000. These cases are rare in US history. The usual procedure is for television networks to call the winner before the beginning of the European session.

Poll closing times. Source: dailykos.com

Conclusion

The US 2020 elections are critical to markets. The identity of the White House's occupant and the composition of Congress will be decided on November 3. Still, investors will react to polls, party conferences, and other events throughout the summer and fall.

This practical guide marks the beginning of FXStreet's coverage of the elections, which are focused on actionable news and analysis for traders. Stay tuned for pieces on potential market reactions to the outcome of the all-important event.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.