2020 US Elections: Three reasons why Biden's lead over Trump is far greater than Clinton's in 2016

- There are fewer undecideds in 2020, making Biden's lead more solid.

- Biden is leading by around 9% while Clinton maxed out at 7%, only after the convention.

- The electoral college – which Trump won while losing the popular vote – is more aligned with the national map.

Fox News' polls point to a landslide loss for President Donald Trump – if the elections were held in late June. They are held only in November, and that calls for caution – especially when looking to the recent past when Hillary Clinton led Trump around this time in 2016.

However, presumptive Democratic nominee Joe Biden has several advantages over Clinton. While everything can happen until November – especially with events unfolding at a rapid pace. Biden has yet to make any substantial speech nor meet the press in two months and Trump may deal a blow to "Sleepy Joe" in September's debates.

The president may also tack to the center – something that he has failed to do in recent weeks – by allowing advisers to manage his Twitter feed or encourage wearing masks. He may also appeal to Republicans by touting his achievements on nominating conservative judges.

Nevertheless, with all these caveats and the time remaining in America's endless political campaigning – looking at opinion polls shows Trump is the clear underdog. It is Biden's election to lose.

1) Fewer undecideds

Americans were unhappy with their choices in 2016, with both candidates "competing" for higher disapproval ratings. Many remained on the fence until the last days of the campaign and then broke toward the Republican candidate. It may have been due to the announcement of reopening an investigation against Clinton by James Comey, the then director of the FBI, or any other reason.

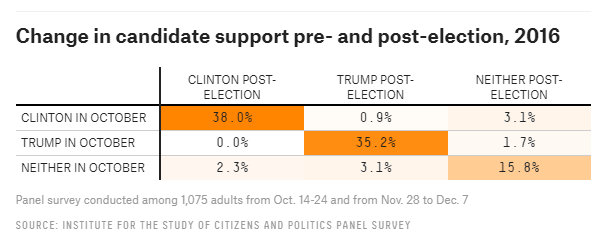

Some Clinton supporters switched to trump while the opposite move did not materialize. The current president won over most undecideds:

Source: FiveThirtyEight

There is a smaller pool of undecideds to choose from now. On election day, support for Clinton in opinion polls hit 45.7% in national polls, around the previous peaks. Ita barely scratched 43% in late June. Both leading candidates received only 79% in late June before both managed to add up some of the undecideds, reaching a total of around 86% on election day.

Source: FiveThirtyEight

As of late June 2020, Biden receives 50.6% – an outright majority – while Trump stands at 41.4%. Together they already have 92%, above November 2016 levels.

Biden backers could switch to Trump or just stay at home, while undecideds could break significantly toward the president. However, the occupant of the White House faces an uphill battle according to current polling.

2) Biden's lead is bigger

Back in June 2016, Clinton led Trump by around 5.5%. After the successful Democratic convention in Philadelphia and amid several Trump scandals, Clinton led by around 7.5% – the high watermark for the nominee.

In June 2020, Biden is stabilizing above nine points. Is this the former Vice President's high watermark? Perhaps, yet his low point was a minuscule lead of 3.4% in April, while Clinton temporarily nearly trailed Trump.

The final read on FiveThirtyEight's aggregate stood at Clinton leading 45.7% to 41.8% – up 3.9% and the actual popular vote came out at 48.2% for the former first lady and 46.1% for the current president. The 1.7% was within the margin of error and Clinton's 2.1% lead was insufficient to win the elections due to the Electoral college advantage.

3) Swing states look more aligned with the national mood

Trump's surprising win came after clinching the trio of Pennsylvania, Michigan, and Wisconsin. That was attributed to the president's appeal to white working-class men disappointed with the hollowing out of manufacturing in these states, yet there are endless essays about the closely fought campaign.

Back then, te won Michigan by a margin of 0.23%, Pennsylvania by 0.72%, and Wisconsin by 0.77%. According to Sienna College for the New York Times, Trump trails Biden by 10-11 points in these states.

According to polls by Fox News – Trump is set to lose the large state of Florida by 9%. These surveys also show Biden ahead – albeit by minor margins – in North Carolina, Georgia, and Texas.

Source: FiveThirtyEight

Contrary to 2016, Trump does not seem to enjoy a lead in battleground states that can compensate for his trailing on the national stage.

Repeating the caveats and disclaimers, there is plenty of time and polls can be wrong, especially at the state level. Biden can lose Minnesota and New Hampshire, and perhaps other states. Yet Trump has an uphill battle in Arizona.

Overall, the 2016 map has a smaller likelihood of repeating itself in 2016.

For markets, a Biden win with the current split in Congress would be acceptable, yet a clean Democratic sweep – allowing prominent left-leaning politicians to change American capitalism – would already be a nightmare. Bernie Sanders, Elisabeth Warren, and Alexandria Ocasio Cortez would benefit from a landslide defeat by Trump.

See 2020 US Elections: Trump loss, split Congress is what markets want, most likely scenario out of four

Other reasons why Trump is faring worse than in 2016

"Drain the swamp" was one of the Trump's rallying cries toward the end of the campaign. He was the outsider – stating "only I can fix it" – and touting his business pedigree. The New York tycoon is the president in the past 3.5 years and his record – especially in dealing with coronavirus – is under scrutiny. His shine is somewhat lost.

Another potential factor – yet to be quantified – is the impact of the black vote. African-Americans tend to vote for the Democrats but their turnout dropped when Barrack Obama was not on the ticket. Can the first black president's VP increase voting? That is still an open question. It may depend on the Biden's choice for Vice President – more important than usual given the candidate's old age.

That is a story for another day. Here are different opinions well worth reading

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.