2020 US Elections: Equities in three scenarios

- Stocks would fare best in a Republican sweep.

- Split result, Biden in White House with Republican Senate second best equity outcome.

- A Democratic Presidency and Congress would over time diminish growth and limit equities.

- Recent equity declines are COVID-19 related and not election driven.

In six days Americans will go to the polls in the most contested, ugly and violent election in 50 years. Not since the 1968 selection at the height of the Vietnam War has the electorate been so divided, have riots punctuated the news so frequently or has the political rhetoric from both parties been so apocalyptical.

Markets operate in the same environment but by their nature take a less emotional, long term and practical view of political developments. Whichever side wins on November 3rd and whatever changes in law and regulation transpire, markets and businesses will accommodate the legal and regulatory dictates coming from Washington.

We will compare the possible election verdicts to the long-term and traditional interest of stocks for economic growth, light regulation and access to power and consider the positions of the candidates and the parties.

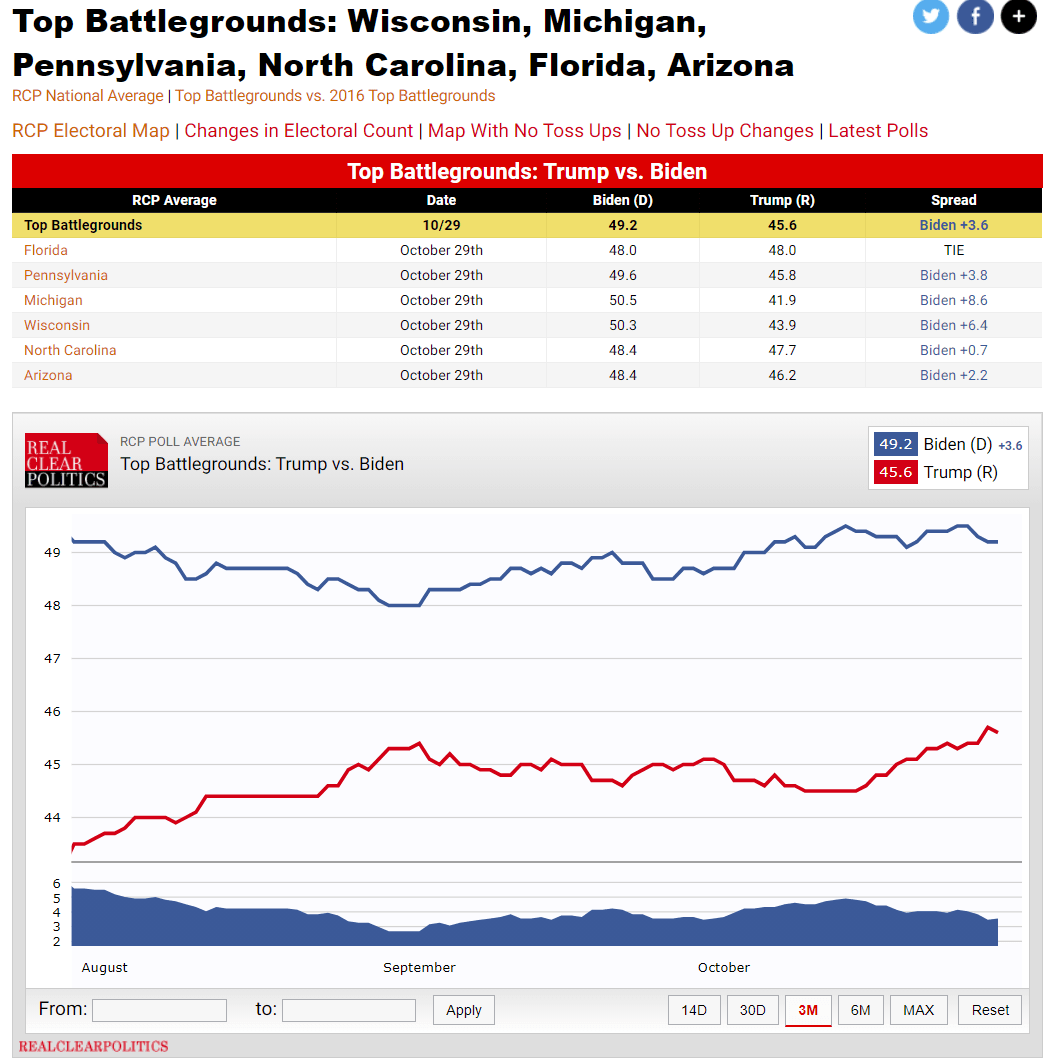

The three scenarios are, in descending odds and judging solely from the RealClearPolitics polling averages, a Democratic victory in the Presidency by Joe Biden and a take-over of the Senate, a split decision with Biden taking the White House and Republicans retaining the Senate and finally a Republican sweep with President Donald Trump re-elected and his party keeping control of the Senate.

Two other possibilities, a Trump White House and a Democratic Senate and a Republican capture of the House for the entire government, will not be considered.

In the first case if the President is reelected his coattails should enable the Republicans to keep the Senate. In the second the national Republican party has devoted most of its energies to the White House and Senate, recapturing the House would require a huge and so far totally undetected Republican wave in the electorate.

In this volatile and hard to assess election year poll averages are not the last word in prediction. The huge miscalculation of 2016, when the Democrat Hillary Clinton was universally expected to win, is a blunt warning not to put too much faith in polls. They are, however the only real statistical comparisons so, with humble wariness let us proceed.

Democrats win Presidency and Senate

A double victory would give the party unified control of the government for two years until the next Congressional election in 2022.

It would not only make it far easier for Biden to enact his programs but it would embolden the ascendant leftists and socialists in the party to push harder for their regulatory, political and policy goals. The more influence the leftists exercise the greater the detriment to markets and equities. With control won there would be little reason or electoral logic for the Democratic leadership to fight hard to prevent the wilder initiatives of its party from becoming law.

Pro

- The first order of business for a Biden administration will be a second COVID stimulus bill. It will be massive and should cheer equity markets concerned about the economic damage from the current COVID-19 infection spread.

- The stimulus should promote immediate economic growth and boost all stock averages

- A unitary administration, whatever its political bent, will be a known commodity and markets generally prefer the obvious to the questionable.

- Financial executives and the sector have backed the Biden campaign five to one in donations. That should help Wall Street keep its interests in front of the Democratic leadership.

Con

- The new Congress is not in office until January. It is unclear whether the Republican Senate would cooperate with the Democratic House in the interim.

- President Trump is in office until January 20th and no law could be passed without his signature.

- Markets may be willing to price a stimulus even though the actual legislation will be delayed for more than two months.

- COVID-19 prevention will emphasize lockdowns and view economic damage as necessary

- Biden has promised to raise taxes and rescind the Trump reforms which lowered levies for 85% of US households.

- Biden and Harris are both big government and regulatory patrons.

- Legislation will be be overtly anti-business and confiscatory.

- Business and markets can expect a raft of new regulations and taxes on trading, capital, profits and investment.

- Biden has promised to end the oil industry, will curtail or heavily regulate fracking and the party supports the economic inanities of the Green New Deal.

- Energy costs will rise taxing businesses and consumers.

- Business will likely become subject to numerous diversity and cultural mandates restricting decisions in hiring, advancement and compensation

- Over time the taxes, regulation and distrust of business and markets by the Democrats will subtract substantially from economic growth.

- Biden's longevity in office is in doubt.

- Kamala Harris, the Vice-President had the most liberal voting record in the Senate.

- If she becomes President due to Biden's incapacity or retirement the political pendulum will swing even further to the anti-business and anti-markets left wing of the party.

- Overall, business and markets can expect an antagonistic and predatory administration, unchecked by Congress

Biden wins the White House, Republicans retain the Senate

Split power in Washington historically has produced good equity markets as the division blocks new legislative initiatives and gives business input to both sides of the aisle. Democrats will still try to enact their energy, tax, social and other policies and the ability of Republicans to resist or modify will depend on the size of their majority which will probably be narrow, one or two seats.

Pro

- A new stimulus will pass as the Biden administration will need it immediately and the Senate will cooperate

- Economic growth will be supported until the economy can fully recover

- The Trump tax cuts will remain and there will be no new impositions

- Democratic anti-business policy initiatives will be stymied in the Senate

- A Republican Senate will be able to block or water down the more market and economically damaging attempts at social and business legislation by the House

- Markets like government paralysis because it preserves the status quo

Con

- COVID-19 prevention efforts will discount or ignore economic damage

- With only one house of Congress the Republican position will be considerably weaker

- Regulatory reform will end with Biden the official head of the executive branch

- Democrats will use the regulatory system to enact many of their blocked legislative goals

- Businesses can expects many new rules, regulations and mandates from which they will have little recourse

- The stimulus bill will be smaller and possibly delayed well into the New Year

- A third stimulus bill, if needed, may be difficult to pass

- As above Biden may not serve a full term.

- Kamala Harris will push the legislative agenda further to the left of the political spectrum

- with two of three power centers the Democrats will be able to lobby hard for their policy initiatives

Trump is reelected and Republicans retain the Senate, Democrats keep the House

A second Trump administration would be able to continue and expand its tax and regulatory programs benefiting economic growth and equity markets. The pandemic remains the potential spanner in the works. The economy cannot fully recover until people are willing to resume a large portion of their normal economic activities.

Pro

- A new stimulus will pass focused on encouraging return to work and business initiatives to restore the economy

- Equities will benefit from the continuing government support and liquidity

- COVID-19 suppression will balance economic growth and infection mitigation

- Economic growth will be supported as long as necessary, by executive order if needed

- Trump's first term tax cuts will remain in place, though additional reductions will be difficult

- Regulatory reform will accelerate and spread, assisting economic recovery

- Democratic control of the House will be insufficient to enact policy goals

- The general pro-business outlook of the administration will support economic growth and optimism in markets

Con

- Democrats will not accept a Trump victory

- Political and social unrest will, at least initially, spike, potentially frightening equity markets and inhibiting economic growth

- COVID-19 mitigation efforts may not prove successful and a second lockdown would severely damage the economy

- It is unknown whether the acceleration in cases will overwhelm the health system as was feared in the first wave in March and April

- Equities and markets are taking their cue from the pandemic and may not respond until is it under control

Conclusion

Business and equity markets historically prefer the economic and regulatory policies of Republican administrations.

On a strict policy basis that remains true of the Trump tenure. The overwhelming tilt to Biden in financial sector campaign contributions is a function of two factors. The first is practical. Biden has led in the the polls throughout the fall and Wall Street, true to its analytic basis, is just playing the odds.

The second reason is as much cultural as it is emotional. Trump is anti-establishment. He ran and won against the opposition of the Democratic and Republican party establishments. The leaders and executives on Wall Street are just as much a part of that ruling class as the party figures in and out of Congress in Washington. Mr. Trump's style, language and attitude are a deliberate break with that class. His antipathy is returned in spades.

If the Democrats gain control of both houses of Congress the center of political gravity in the party will move further and further left. A Biden White House will be unable to resist the traction. A Harris administration would actively participate.

Individuals on Wall Street may prefer an alternative to Mr. Trump but markets can only hope that President is returned to office to continue his checkered but successful political career.

Please see our other election coverage:

2020 US Elections: Polling, history and the sumberged Trump vote

Gold Price Analysis: XAU/USD has three ways to go in response to the 2020 Presidential Election

2020 US Elections: Trump scores but is it enough?

2020 US Elections: Trump is showing signes of a comeback, will the dollar follow?

2020 US Elections: Handicapping the race--polls, registration and the shy Trump voter

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.