2020 Elections: The case for a historic Trump defeat, in five quick charts

- Memories of 2016 put emphasis on Trump's chances to defy the polls.

- Different margins, surveys, turnout, enthusiasm and demographics all paint a different picture.

- Markets could react positively to a landslide Biden victory unless the Senate majority is overwhelming.

2016 all over again? Anxious Democrats, hopeful Republicans, and pundits all over seem to focus on President Donald Trump's chances of victory in 2020. Here is FXStreet Senior Analyst Joseph Trevisani's highly recommended point of view:

2020 US Election: A guide for the perplexed

However, all signs are pointing in a different direction. Here are five quick charts that build the case for a landslide victory for Joe Biden.

1) State polls are stable and point to a Biden win

FiveThirtyEight's final forecast is showing an 89% chance for Biden to become the 46th President, contrary to Hillary Clinton's 71% probability. The model is based on state polls on which have taken eduction into their weighting and have proved correct in the 2018 midterms. Moreover, the direction of travel has been in Biden's favor, increasing steadily.

Source: FiveThirtyEight

The Economist's forecasts stand at 95% for the former Vice-President.

2) Larger margin on the national level

For those who prefer staying away from Nate Silver's nerdy approach or from the Biden-endorsing – yet neo-liberal – Economist, the RealClearPolitics is also pointing to a larger deficit for the incumbent. RCP, which prominently includes partisan Republican polls such as Rasmussen and Trafalgar, is showing Biden outperforming Clinton by 3.4 points in the national average:

Source: RCP

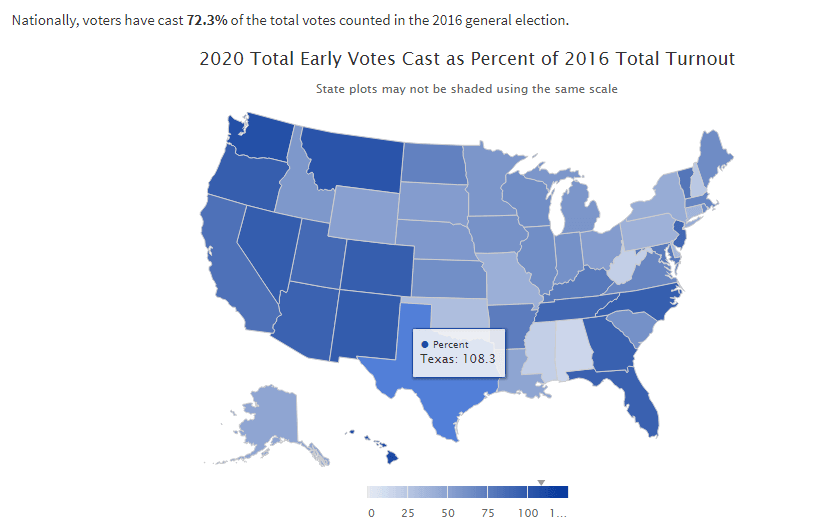

3) Early vote is massive, watch Texas

For those unimpressed by models and aggregators based on polls, early voting provides an indicator. Whether in-person or by mail, nearly 100 million Americans have cast their ballots, some 72.3% of the total 2016 turnout.

When people are willing to stand for hours in line to vote, they want to change.

Voting is especially robust in Florida, Georgia, North Carolina, and Texas – where 2020 voting has surpassed 2016. Trump is leading by only 1% in polls in the Lone Star state. Can Texas turn blue?

Source: US Elections Project

4) Trump's base is shrinking

State polls in the Upper Midwest underestimated support for Trump among white working-class voters. Their share in the population is in a long-term decline.

Source: New York Times

5) Democrats are more enthusiastic

The president's rallies – which have contributed to the spread of COVD-19 – are massive, supporters say, and that shows enthusiasm. Massive turnout and enthusiasm among Trump backers may outweigh the vote for "Sleepy Joe" – as the incumbent describes his challenger.

However, while Republican enthusiasm is high, that of Democrats is even higher – beating even levels seen ahead of Barack Obama's 2008 landslide victory. It probably reflects an urge to oust Trump than to vote in Biden, but the outcome is the same.

Source: FiveThirtyEight, using Gallup data

Conclusion

Even without taking the upcoming third covid US peak into account, a victory for Biden – perhaps a huge one with over 400 electors – is a reality. Trump has a path to victory, yet it is considerably narrow. The fear of a 2016-repat may even cause pollsters to hedge and overestimate Trump. A landslide victory for Biden cannot be ruled out.

See 2020 Elections: Three states traders should watch, plus places that could provide surprises

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.