- President Trump is trailing Biden by a wide margin but skeptics point to 2016.

- There are seven reasons why this time is different.

- The Senate race is much closer and could be more consequential for markets.

Polls dismissed then-candidate Donald Trump in 2016, and are off the mark also in 2020 – that is the common response to the president's trailing in the polls. One such example is here Handicapping the Presidential Race.

History may rhyme, but not this time. Here is why.

What happened in 2016?

Back in 2016, final national opinion polls showed Democratic candidate Hillary Clinton leading Trump by around 5% nationally in the final days before the vote. The actual result was a 2% gap in favor of the former First Lady – within the margin of error.

Around 20% of the electorate disliked both candidates, with 45% of them opting from Trump and only 30% for Clinton. James Comey, the Director of the FBI, announced he is reopening an investigation into the former Secretary of State's emails ten days before the vote – potentially making the difference.

Polls in battleground states failed to capture the break toward Trump in the last days of the race and also the enthusiasm toward him among non-college-educated whites. That was enough to win Pennsylvania, Michigan, and Wisconsin by less than 1%, and Florida by 1.2% – clinching an electoral college victory despite losing the popular votes.

Seven reasons why 2020 is different

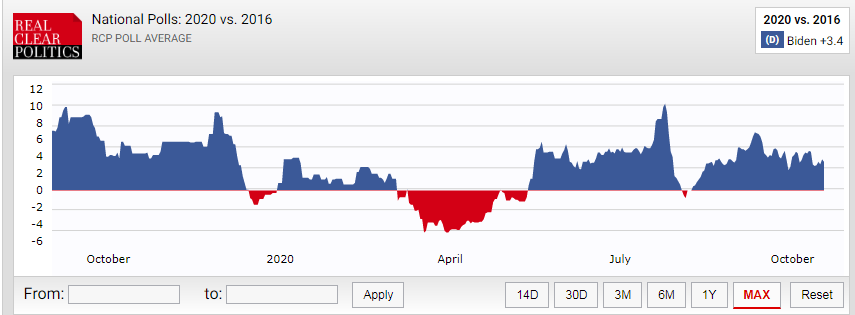

1) Bigger gap: According to the RealClearPolitics, former Vice-President Joe Biden leads the president by 9% nationally and has consistently had a larger lead than Clinton's. The gap stands at 3.4% as of mid-October.

Source: RCP

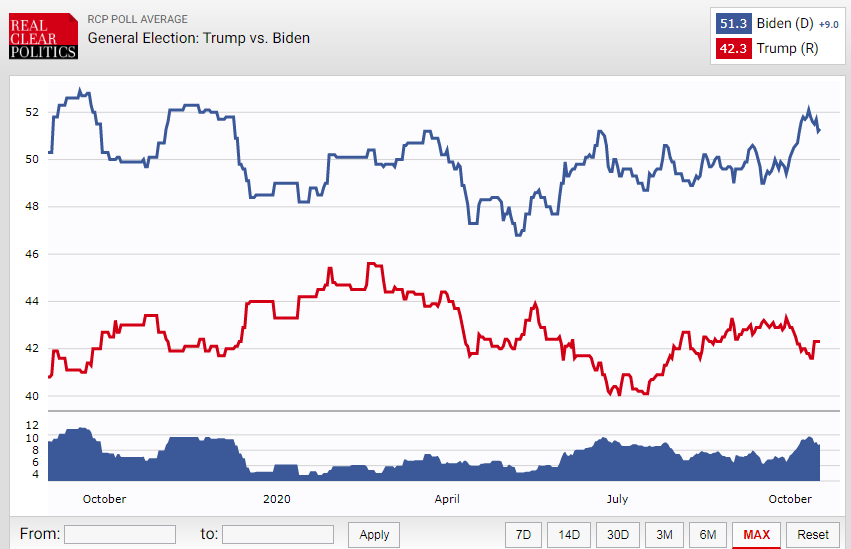

2) Fewer undecideds: Back in 2016, support for Clinton peaked below 47%. This time, backing for Biden has been above 50% with fewer undecideds. There are fewer people that could break toward Trump. Biden – which has positive favorability ratings – enjoys 51.3% support at the time of writing.

Source: RCP

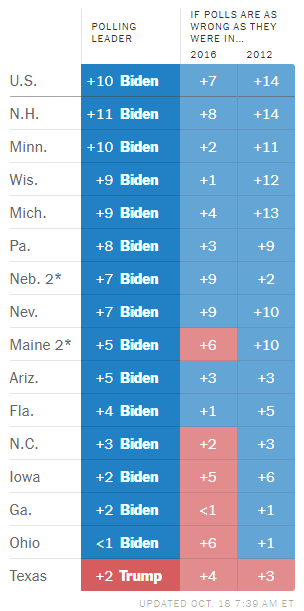

3) Poll mistakes go both ways: It is easier to compare to 2016, when the president shocked the world with a victory but looking back into history shows that surveys can miss in both directions. Back in 2012, surveys underestimated President Barack Obama by around 4% on the national levels, and state polls missed Democratic support as well. Accounting for a 2012-style miss, Biden has an even larger advantage.

Source: NYT Upshot

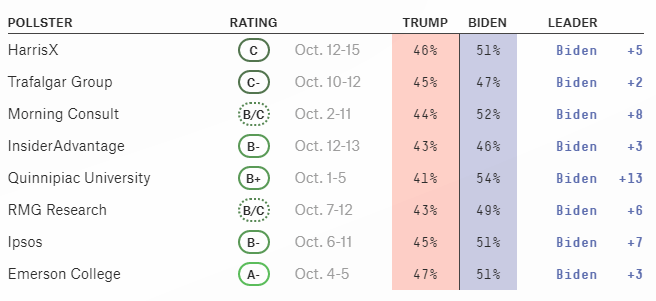

4) Pollsters have learned: Firms that survey public opinion need to defend their reputation toward the next elections and to rake in income from commercial firms. They would not want to repeat the exact same mistakes – and may even overcompensate and underestimate a potential Biden landslide.

Education is better factored in surveys, which try to correctly account for the share of people that do not hold a college degree in the vote. Similarly, in 2020, there are more frequent high-quality polls in battleground states.

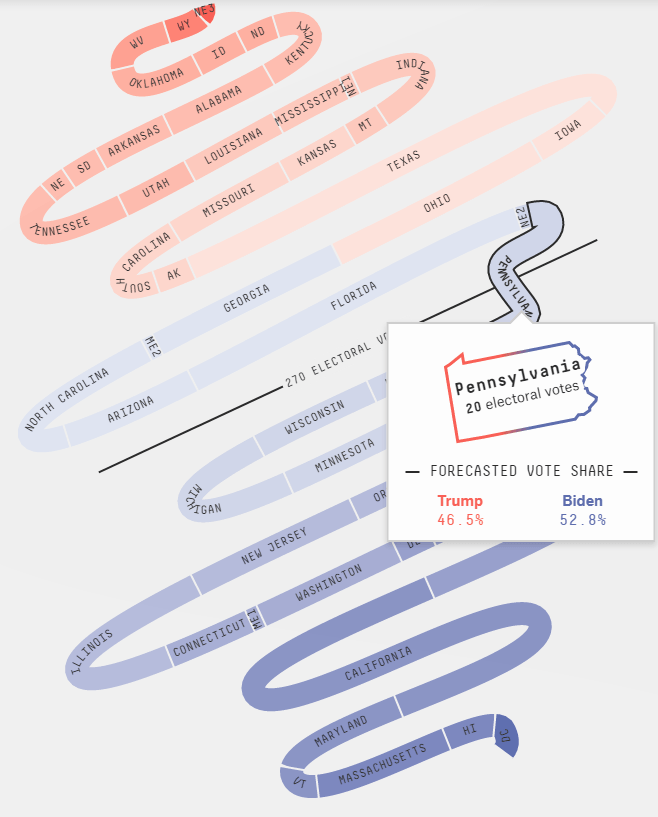

Both FiveThirtyEight and The Economist view of Pennsylvania as the tipping point state. The table below shows intense surveys of the Keystone State. The same goes for other swing states.

Source: FiveThirtyEight

5) Gap between states and national vote smaller this time: Not even the most ardent Trump backers believe he can win the popular vote, but build their hopes on an electoral college victory. And while the aforementioned Keystone State shows a smaller projected gap against Trump – 6.3% according to FiveThirtyEight – it is beyond the margin of error.

Biden's lead is even more solid in Nevada, Wisconsin, Michigan, and Minnesota. Moreover, the challenger is ahead of the incumbent in several additional states such as Florida, Arizona, and North Carolina. If he wins them, it would be a landslide.

Source: FiveThirtyEight

6) No shy Trump voters: With a substantial robust – and growing – advantage in the polls, some assume that those that are surveyed are lying to pollsters or are ashamed to say they support Trump. First, that is incompatible with reports about yard signs supporting the president, nor with enthusiasm in his rallies.

Trump backers are not shy, there are just small quantities of them. The base is too small and Trump has failed to pivot to the center and enlarge his support.

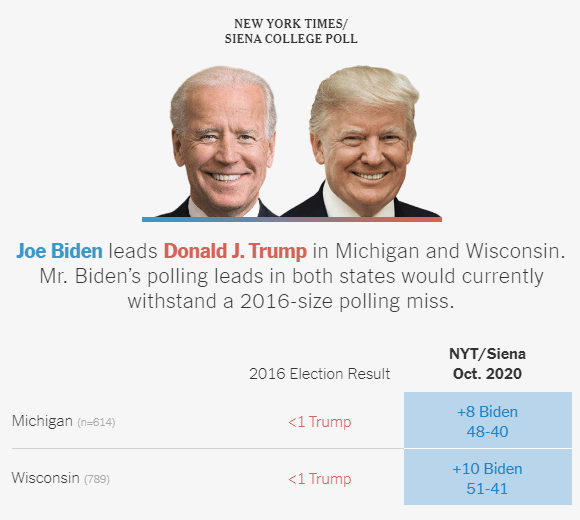

Moreover, The Sienna College/New York Times polls of Michigan and Wisconsin – which together with Pennsylvania tipped the 2016 race in favor of Trump – showed Biden benefits from defectors from the president's camp. Surveyees in these two critical battlegrounds said they voted for Trump and now for Biden. If they are willing to admit backing the president, they are not shy.

Source: NYT

7( October surprise? Trump and Biden are set to meet in the second and final debate on October 22, and that is probably the president's best chance to win back support. He faces an uphill battle due to time that is running out, the wide gap – and the fact that millions have already voted.

Can something like the Comey letter happen again? Anything is possible, but so far, nothing has stuck to Biden. The Trump campaign tried doubting the former VP's mental capacity, being weak on China, false accusations of his son's wrongdoing, and nothing worked.

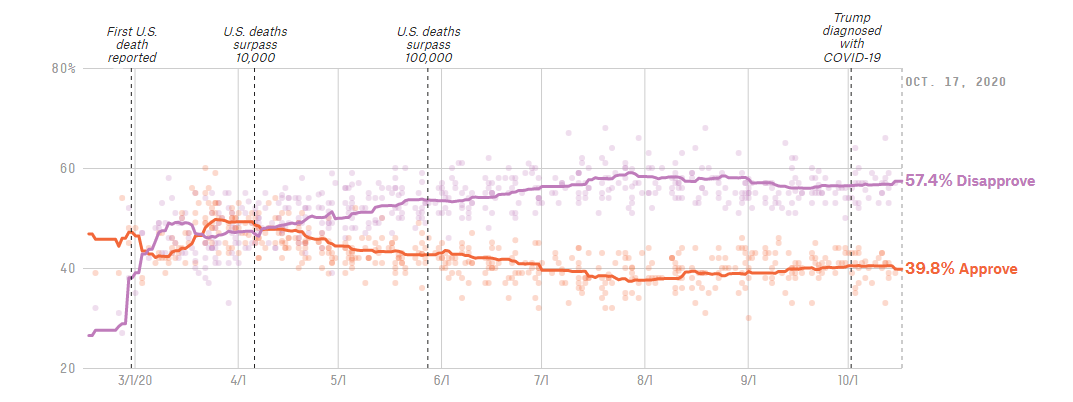

In the meantime, the No. 1 topic worrying Americans is COVID-19, where approval of the president is trailing behind his general one – -17% vs. -11%.

Source: FiveThirtyEight

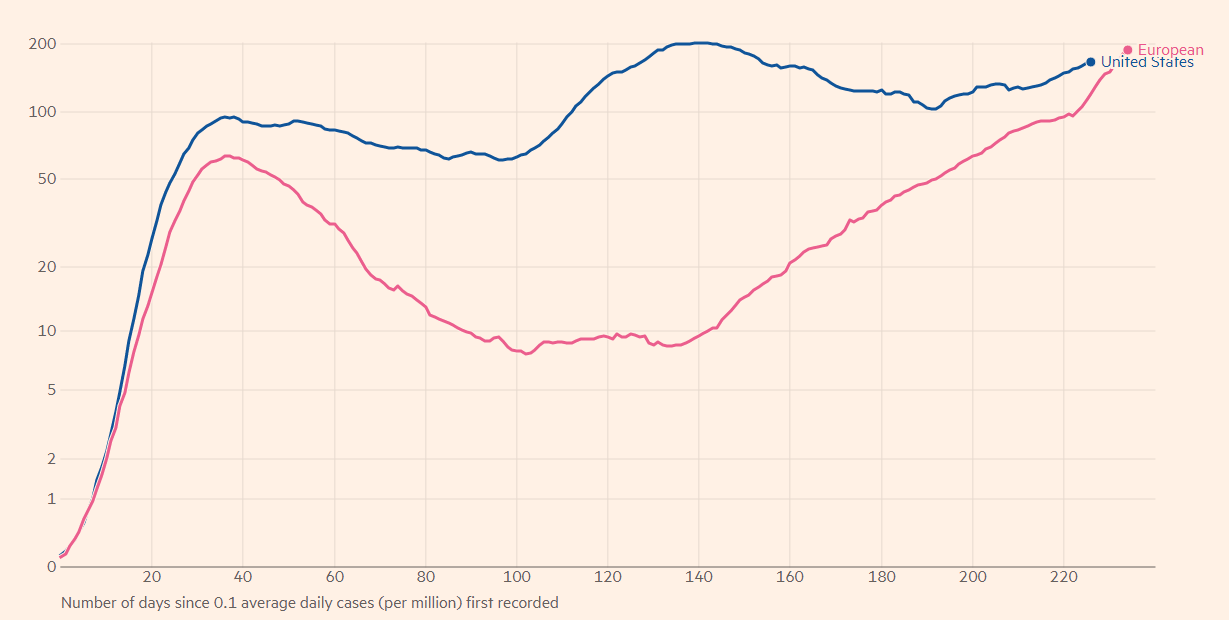

With the recent upsurge in European COVID-19 cases and the focus on US politics, it is easy to forget that infections are on the rise in the US as well. After a peak in the summer in hot southern states, the disease is spreading in cold states. This is no "October surprise" as closed spaces are known to be a better breeding ground for the virus, whether they are airconditioned or heated.

Source: Financial Times

Contagion in the north could further tip the few undecided voters in the former blue wall against Trump.

Conclusion and what to focus on

Overall, the polls are pointing to a high probability of Biden beating Trump, reflected in FiveThirtyEight's 88% and The Economist's 91%.

And as explained above, there is little reason to doubt the polls.

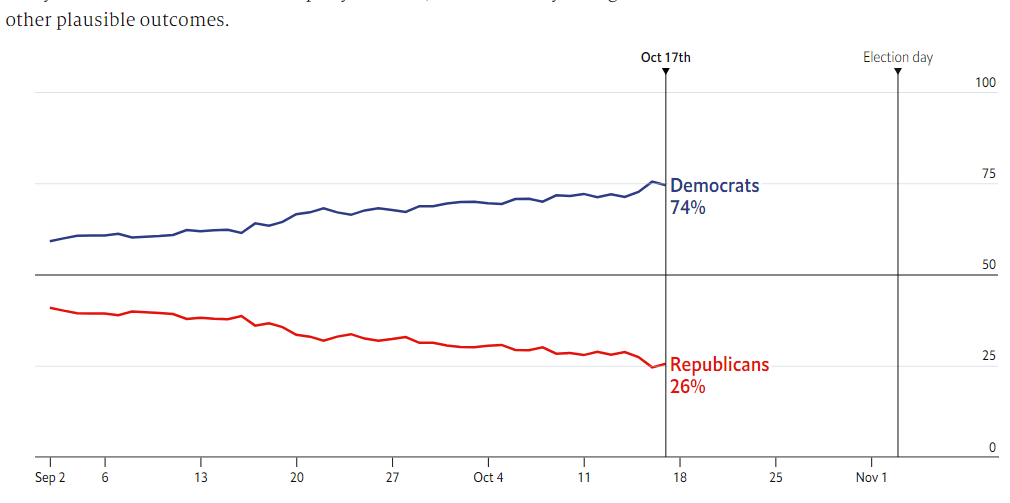

The battle for Senate is much closer, with FiveThirtyEight giving Democrats a 73% chance, and The Economist a 74% probability of flipping the upper chamber. There is little doubt that Dems will hold onto the House of Representatives.

Source: The Economist

With the coronavirus crisis still looming large over the economy, markets are focused on the next stimulus package.

Talks about new relief are unlikely to yield results with the clock ticking down to the vote. Trump cut off talks with the opposition only to see stocks fall and quickly return to the negotiating table. However, he left House Democrats with more leverage and he also discovered that Senate Republicans rediscovered their fiscally conservative roots, desiring only a "skinny bill."

If Dems win the Senate, they are set to approve a large package, yet if Republicans hold onto the chamber, there are prospects only for minor support, making a difference for investors.

Therefore, unless there is an earth-shattering swing towards Trump, Senate polls may become more significant.

More Big move coming in EUR/USD? Fiscal stimulus and coronavirus are the keys

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.