Once per month, financial markets regularly take on the big spotlight. Every first Friday of the month, at 12.30 pm GMT, the US Bureau of Labor Statistics publishes the employment data, which gives a good glance on the state of the american economy. The US Non-Farm Payrolls release is the biggest fundamental piece of data the market gets regularly.

Besides our monthly report on the event, in this series of articles several of our dedicate contributors help us explaining its importance and impact on the FX trading. We also get from them valuable insights and tips to trade before and after the event.

Trade the Nonfarm Payrolls

Why is the NFP so relevant?

Wayne McDonell, Chief Currency Coach at FxBootcamp, gives a precise answer to the question in the first paragraphs of his article How To Prepare For and Trade the Employment Situation Report:

“This report is important because the US is the largest economy in the world and its currency (USD) is the global reserve currency. The many economies peg (tie) their currency's value to the reserve currency, many commodities such as gold and oil are priced in terms of the reserve currency and the local economy's debt is priced in terms of its own currency.

The Non-Farm Payroll report, because of its importance to the reserve currency, tends to move all markets: currencies, equities, treasuries, interest rates, and commodities. It does so immediately after the release of the economic data and sometimes dramatically.

A lot more skeptical on the benefits of trading the event, as you can read in its article Step aside the Non-Farm Payrolls release, Adrián Aquaro, President at Trader College, says its importance has decreased a little bit lately:

“Even if the impact has diminished gradually over time, the US Non-Farm Payroll still generates huge attention on the markets and it normally drives important monthly trends. Lately another event (the Fed Monetary Policy Meetings) has been driving similar attention, thanks mainly to the Interest Rates being at 0%.

Still, there is no denying to the impact of the data on the markets.

How does the NFP impact the USD?

The answer to this question can begin with a simple analogy. Better employment numbers (more payrolls added), good for the USD; worse numbers, bad for the buck. Kenny Fisher, Analyst at Forex Crunch, expands on that in his Tips on How to trade the Non-Farm Payrolls:

“A NFP which is stronger than the estimate (also known as the forecast) indicates that the labor market is stronger than what the markets expected, and the dollar often rises as a result. Why? Let's use a stock market analogy to answer this question. Just like a company's stock often rises after the company releases a strong financial report, so to the US dollar can be thought of as the "stock of the US economy". Thus, when the US releases a strong economic report, the "stock" (US dollar) often rises against other currencies (such as the euro, pound or yen) as a result.

Conversely, a weak NFP report indicates that the labor market is weaker than what the markets anticipated, and a weak reading can push the dollar lower against other currencies.

But there's much more to this question.

TIP

Kenny Fisher: “Keep current on financial news, especially on the US labor market and employment conditions. This will help you trade the NFP.

Measuring the impact that macroeconomic data such as the number of payrolls or the rate of unemployed people has on the markets is difficult and complex. Several methods, strategies and tips can be used. Our contributors share some of them in their reports:

Before the NFP release

The hours that precede the release of the employment report may be decisive. Kenny Fisher bewares us of the “high uncertainty", which “can lead to volatility in the forex markets, as traders and investors anxiously await the release". But, nonetheless, Fisher thinks that “the volatility often seen prior to a major event does present trading opportunities".

Trying to profit on that, Wayne McDonell sets up a technical range strategy (read it in his full article) before the release of the NFP data. In his words: “The goal is to overlap the average daily range with solid levels of support or resistance".

McDonell also does some modeling on related macroeconomical data to elaborate its fundamental analysis. Those include averages of past headline NFP numbers or Weekly Jobless Claims, ISM Industry Data reports or other employment reports as the ADP or the Challenger. That is key on the preparation of the trades to set up just after the release.

In contrast, Adrián Aquaro doesn't believe in trading before or after the event. He argues that “banks and press already known the information when released and therefore any trader has a disadvantage". Aquaro also defines the market moves in the minutes that follow the release as “completely unpredictable to individual traders".

Beware the spreads!

Viktor Eperjesy, Head of Business Development at Trade Proofer, is an expert in gathering information on the brokers' spreads, something every retail trader must take very carefully into account.

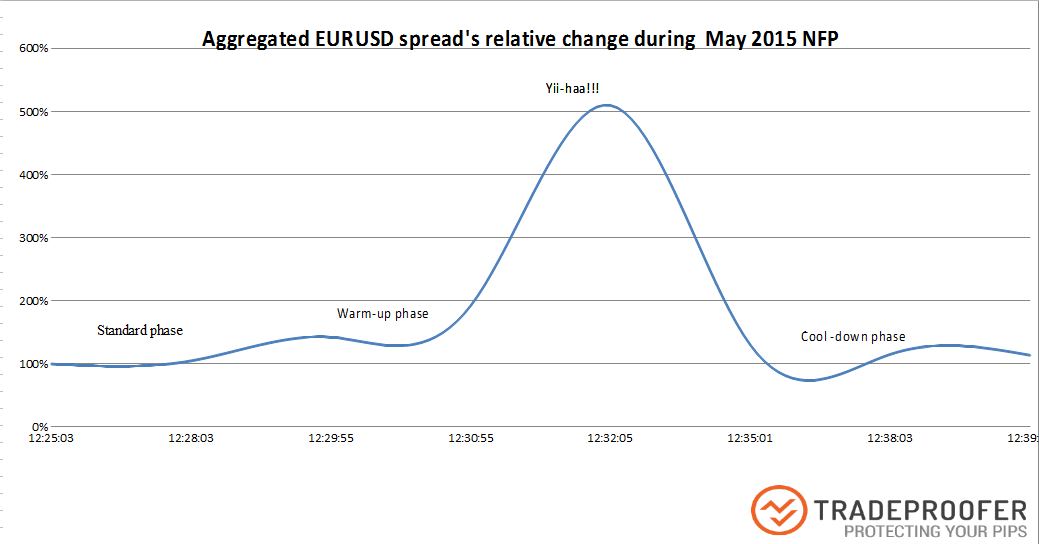

In his article, Eperjesy warns us about the divergence between “target spreads listed by brokers" and the actual spreads applied during a high volatility event as the Non-Farm Payroll. In his words:

“As we all know, forex brokers' information sheets listing "target spreads" are not something traders can rely on when they trade around important economic events, like non-farm payrolls. During these minutes spreads first fall apart and recover slowly afterwards as market calms down."

This evolution is way more explained with this very explicit graphic:

After the NFP release

The minutes just after the release tend to show big moves in the prices of the majors, but the volatility usually continues for several hours. Kenny Fisher believes in trading not only the actual release against the expectations, but also against the previous figure. Fisher sticks to the basics: “If NFP is higher than the estimate and/or the previous the dollar will likely move higher, but if lower, it will go down".

TIP

Wayne McDonell: “Trade the revision number. It is common to see 30% revisions. Especially on months when the headline number is “as expected", pay close attention the revised number. The market often trades that new information instead".

In a more advanced analysis, Wayne McDonell proposes another strategy for scalpers, those traders willing take quick trades and profit from short-term swings. This “continuation strategy", fully explained here, tries to trade “in the direction of the initial reaction to the news by the market".

Besides, McDonell also argues against “straddling the market" with “options style" strategies. FX Bootscamp's trading coach believes there are several problems with this, such as potential whipsaws, wide spreads and slippage.

Final tip

As you may note, our experts have different point of views, techniques and feelings towards the Non-Farm Payrolls release. There isn't one only way to approach it. The strategy to trade (or not) the release every trader should take is finally something to their choice. We hope these different views shared here can help you to take your own one and succesfully manage your accounts when trading this very highly volatile macroeconomic event.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

When are the China Retail Sales, Industrial Production and how could they affect AUD/USD?

The National Bureau of Statistics of China will publish its data for November at 02.00 GMT. AUD/USD trades on a positive note on the day in the lead up to the China Retail Sales, Industrial Production data. The pair gains ground as US Dollar softens amid the prospect of interest rate cuts by the US Federal Reserve next year.

USD/JPY weakens below 156.00 amid Fed rate cut outlook, BoJ rate hike anticipation

The USD/JPY pair trades on a negative note near 155.75 during the early Asian session on Monday. The US Dollar softens against the Japanese Yen amid the prospect of interest rate cuts by the US Federal Reserve next year.

Gold poised to challenge record highs

Gold prices added roughly 3% in the week, flirting with the $4,350 mark on Friday, to finally settle at around $4,330. Despite its safe-haven condition, the bright metal rallied in a risk-on scenario, amid broad US Dollar weakness.

Week ahead: US NFP and CPI, BoE, ECB and BoJ mark a busy week

After Fed decision, dollar traders lock gaze on NFP and CPI data. Will the BoE deliver a dovish interest rate cut? ECB expected to reiterate “good place” mantra. Will a BoJ rate hike help the yen recover some of its massive losses?

Big week ends with big doubts

The S&P 500 continued to push higher yesterday as the US 2-year yield wavered around the 3.50% mark following a Federal Reserve (Fed) rate cut earlier this week that was ultimately perceived as not that hawkish after all. The cut is especially boosting the non-tech pockets of the market.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.