WAYNE MCDONELL PROFILE:

Current Job: Chief Currency Coach at FxBootcamp

Career: Member of National Futures Association. Licensed as Commodities Trading Advisor. Chief FX Market Strategist at TradersWay. Coached thousands of traders for 10 years.

View profile at FXStreet

WHAT IS NFP?

The Employment Situation Report, otherwise know as Non-Farm Payrolls or simply NFP, is released by the Bureau of Labor Statistics once each month, usually on the first Friday. It generally measures the health of the economy in the United States.

This report is important because the US is the largest economy in the world and its currency (USD) is the global reserve currency. The many economies peg (tie) their currency's value to the reserve currency, many commodities such as gold and oil are priced in terms of the reserve currency and the local economy's debt is priced in terms of its own currency.

The Non-Farm Payroll report, because of its importance to the reserve currency, tends to move all markets: currencies, equities, treasuries, interest rates, and commodities. It does so immediately after the release of the economic data and sometimes dramatically.

The Employment Situation report consists of two surveys; The Household Survey and the Establishment Survey. The first survey uses a sampling methodology of data provided by private citizens. It does NOT ask about how many jobs they have or the quality of their jobs. The second survey uses a sampling methodology of data provided by businesses. It looks at how many employees are on the company's payroll.

It would be impossible for the government to survey every citizen and every employer each month. Therefore, the NFP surveys are based on a small sample sizes and then statistical engineering produces a headline number for the entire employment market nationally.

FUNDAMENTAL ANALYSIS

The headline number for NFP tends to move all financial markets. Traders, investors, bankers, financial managers and economists use this information to formulate opinions, identify opportunities and develop strategies to mitigate risk in the market, not just in the US, but globally. Its important that these market participants are prepared for various scenarios and thus develop economic models to predict the likely headline number.

The following are likely included in many economic modeling techniques.

1. Average NFP Number

Create averages based on the headline numbers. For example, what is the 3, 6 12 and 24 simple averages for the headline number? This would give you a benchmark to base the actual result on. An above average headline release may indicate an increased velocity in the current uptrend or perhaps a potential change in trend in a down trend.

2. Average in weekly Jobless Claims

Create averages based on the weekly headline numbers. Typically 4, 12 and 24 week simple averages are enough. This can be important to measure not only changes in trend, but perhaps changes in the velocity of the trend.

3. ISM Industry Data

The Institute for Supply Chain Management releases reports each month that measures an industry that reflects the health of the local economy as well as global macroeconomics. The ISM reports cover the Manufacturing and Non-Manufacturing sectors in the US. Pay close attention to the employment sub-component of each. You will see the current trend for sector jobs and the velocity of the trend in each report.

4. ADP Employment Report

ADP is a payroll processing company. They typically provide paycheck, tax and benefits processing services to small and medium sized businesses. The ADP number is release the first Wednesday of the month. They simply report how many new employees were added to their system by their clients. It does not use a sampling methodology.

5. The Challenger Report

This report is created by an executive recruiting firm. It measures mass layoffs when corporation let go many employees at one time. Use this number to discount after you estimate your headline number. For example, if your model suggests 300K jobs at NFP, but the average Challenger Report is 50K job cuts, then reduce your estimation to 250K.

TECHNICAL ANALYSIS

Over the years I have developed two strategies to identify short term trading opportunities for the release of the Non-Farm Payrolls headline number.

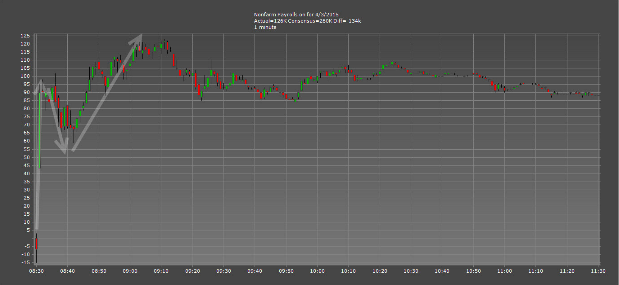

1. RANGE STRATEGY (swing)

This strategy is setup before the news is released. The goal is to overlap the average daily range with solid levels of support or resistance. For example, let's say the EUR/USD move 110 pips per day. About 30 mins before NFP, measure 110 pips above the current market price and 110 pips below the current market price. Mark each on your chart. Then look for key weekly or monthly reversal pivot points (R2 or S2) and round psychological numbers (like 1.0800000). Ideally there will be an overlap of two or more levels of support and resistance.

If price hits one of these levels, look for a reversion back inside the range. The logic is that if the market has moved too far too face and will normalize now that the emotion created by the initial release has dissipated.

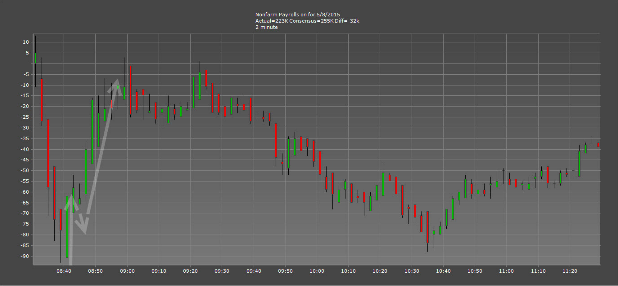

2. CONTINUATION STRATEGY (scalp)

This strategy is setup after the news is released. Its based on a continuation pattern. The goal of this strategy is to trade in the direction of the initial reaction to the news by the market.

If the headline release of NFP creates green candles on the 1 minute chart, you will be looking to buy the currency pair on a retracement. After a few minutes you will start see some red candles. Measure the distance from the the Pre NFP price to the to peak using a fibonacci study. Your aim is to buy in a zone between the 38.2% and 61.8% retracements.

Your trade should be near breakeven within 5 mins. If you are not profitable by then, you may consider exiting your trade early, regardless of the number of pips. However, your stop loss will be placed below the 100% line, which is generally less than 25 pips away. Your target would be the support/resistance entry point identified in the pre release trade setup.

The exact opposite tactics would be true of a down move.

TRADING ADVICE: Don't straddle the market

Some traders use an options style trading strategy which I don't think makes sense in a spot currency market like forex. This strategy places market orders above and below price just before the release of the new. It is generally done with a One-Cancels-Other (OCO) so that if one order is triggered, then your position is entered into the market and the other order is canceled. The goal of this strategy is to get into the trade immediately after the news and in the direction of the initial move of the market.

I see several potential problems with this strategy.

Whipsaws: This happens when the market jumps for a few second in one direction and then immediately reverses and continues the other opposite direction. This can happen for a variety of reasons, such as misreporting the headline number by the media, traders guessing before the release, but also the market learning of a large revision from the previous month and it often takes a few second longer to get that number since the headline number is released first.

Wide Spreads: Most forex brokers now use Non-Dealing Desk and ECN business models. They are not market makers. This means you recieve the retail market price for your trades. During high volatility situations like the release of NFP, the market is either very thin or has a glut of orders that needs to be processed. In either case, the BID/ASK spread can widen, sometimes as dramatically as 25 pips. Its not your broker's fault... that is the market price at that moment. If you had placed your stop 20 pips away, you would have been stopped out of an otherwise potentially profitable trade.

Slippage: The Non-Farm Payrolls report can create moving market with large trading volumes. Slippage can occur with such market conditions. Slippage is the delay of placing your order and then having it get filled in the market. Typically, this process takes just a second. However, after NFP, it may take 5 or 10 seconds and price may have moved as many pips during that period of time. Slippage isn't your broker's fault either... you are simply trading during unfavorable (risky) market conditions.

Tip: Trade the Revision Number

As mentioned, a few seconds after the release of the headline NFP number, a revision for the previous month is also released. Since the methodology for the Establishment Survey and Household Surveys are based on sampling and statistically modeling, the guess work by the government can prove extremely inaccurate. It is common it see 30% revisions. Therefore, especially on months when the headline number is as expected, pay close attention the revised number. The market often trades that new information instead.

Transactions in the CFD market offer ample opportunities and allow knowledgeable and sophisticated investors ready to take risks, to gain high profit. Customer should understand the risks associated with CFD trading, which may be high enough. This short statement does not contain descriptions of all risks and other material aspects of foreign currency trading. With this in mind, you should carefully analyze whether you should engage in such transactions, taking into account your experience, financial status, resources and objectives, the risk you are ready to take, and other circumstances.

Editors’ Picks

AUD/USD edges lower after mixed Chinese data, US Dollar remains stronger

The AUD/USD continues to decline for the second consecutive session, trading around 0.6660. This is largely influenced by recent mixed economic data from China released on Friday. The Aussie dollar had already been under pressure after Australia's employment figures were released on Thursday, which presented a mixed picture.

EUR/USD slipped on Thursday after Greenback pares some losses

EUR/USD eased slightly on Thursday, falling back below 1.0880 as the Greenback broadly recovers losses from earlier in the week. The pair remains up for the trading week, but a late break for the US Dollar is on the cards as investors second-guess the Fed's stance on rate cuts.

Gold price loses momentum, with Fed speakers in focus

Gold price trades with a bearish bias on Friday after retreating from the nearly $2,400 barrier. The bullish move of precious metals in the previous sessions was bolstered by the softer-than-expected US inflation data in April, which triggered hope for rate cuts from the US Federal Reserve.

LINK price jumps 10% as Chainlink races toward tokenization of funds

Chainlink price has remained range-bound for a while, stuck between the $16.00 roadblock to the upside and $13.08 to the downside. However, in light of recent revelations, the token may have further upside potential.

April CPI: Worst good news ever

The monthly rise in prices based on the Consumer Price Index (CPI) came in slightly lower than projected, sending a wave of euphoria across the financial landscape. The consensus is cooling inflation puts Federal Reserve interest rate cuts back on the table.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.