When are the UK data releases and how could they affect GBP/USD?

The UK Economic Data Overview

The UK docket has the monthly and the second quarter GDP releases today, alongside the releases of the Kingdom’s Trade Balance and Industrial Production, all of which will drop in at once later in Europe at 0930 GMT.

The United Kingdom GDP is expected to arrive at -0.2% MoM in September while the first readout of the Q2 GDP is seen at +0.3% QoQ and +1.1% YoY.

Meanwhile, the manufacturing production, which makes up around 80% of total industrial production, is expected to show MoM decrease of 0.2% in September, improving slightly from a drop of 0.7% recorded in August. The total industrial production is expected to come in at -0.1% MoM in Sept as compared to the previous reading of -0.6%.

On an annualized basis, the industrial production for Sept is expected to have dropped 1.2% versus -1.8% previous, while the manufacturing output is also anticipated to have declined 1.3% in the reported month versus 1.7% last.

Separately, the UK goods trade balance will be reported at the same time and is expected to show a deficit of £10.00 billion in Sept vs. £9.806 billion deficit reported in August.

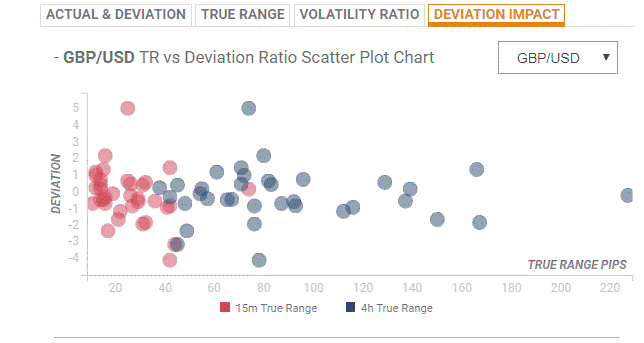

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements in excess of 60-70 pips.

How could affect GBP/USD?

A downbeat UK GDP report could offer fresh impetus to the GBP bears, as the Moody’s UK outlook downgrade continues to overshadow the Conservative Party’s lead in the opinion polls released over the weekend.

Haresh Menghani, FXStreet’s Analyst notes: “From a technical perspective, the pair finally seems to have found acceptance below the 23.6% Fibonacci retracement level of the 1.2198-1.3013 recent positive move. However, oscillators on the daily chart have still managed to maintain their bullish bias and warrant some caution before placing aggressive bets for a further near-term depreciating move. Hence, any follow-through weakness might continue to attract some dip-buying interest and help limit the downside near the 38.2% Fibo. level – just ahead of 1.2700 round-figure mark.”

“On the flip side, 23.6% Fibo. support breakpoint, around the 1.2835-40 region, now seems to act as immediate resistance. The mentioned hurdle coincides with a short-term descending trend-line, which if cleared might be seen as a fresh trigger for bullish traders and set the stage for a move back towards reclaiming the 1.2900 round-figure mark,” Haresh adds.

Key Notes

Moody’s: UK outlook cut to negative on policy 'paralysis – Cable slips below 1.2800

Forex Today: Trump's trade pessimism pressures markets, Spain stuck again, UK GDP set to rise

UK Election Math: What are the Odds of a Hung Parliament?

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.