Silver Price Analysis: XAG/USD hovers nearby 6-week highs above $23.00

- Silver price remains underpinned by a soft US Dollar and depressed US bond yields.

- XAG/USD Price Analysis: A daily close above $23.00 could exacerbate a rally toward YTD highs.

Silver price advances sharply to fresh six-week highs in the North American session, courtesy of a weak US Dollar (USD), which remains downward pressured by falling US Treasury bond yields. Hence, the XAG/USD is trading at $23.12 after hitting a daily low of $22.76.

XAG/USD Price action

During the Federal Reserve’s (Fed) monetary policy decision, the XAG/USD traded sideways around the $22.20s area before the US Treasury bond yields tumbled. After that, Silver rallied and tested the $23.00 figure before pulling back and closing at $22.97. However, Thursday’s price action resumed upwards, with buyers piling around the $22.70 area, and lifted XAG/USD price above the $23.00 mark.

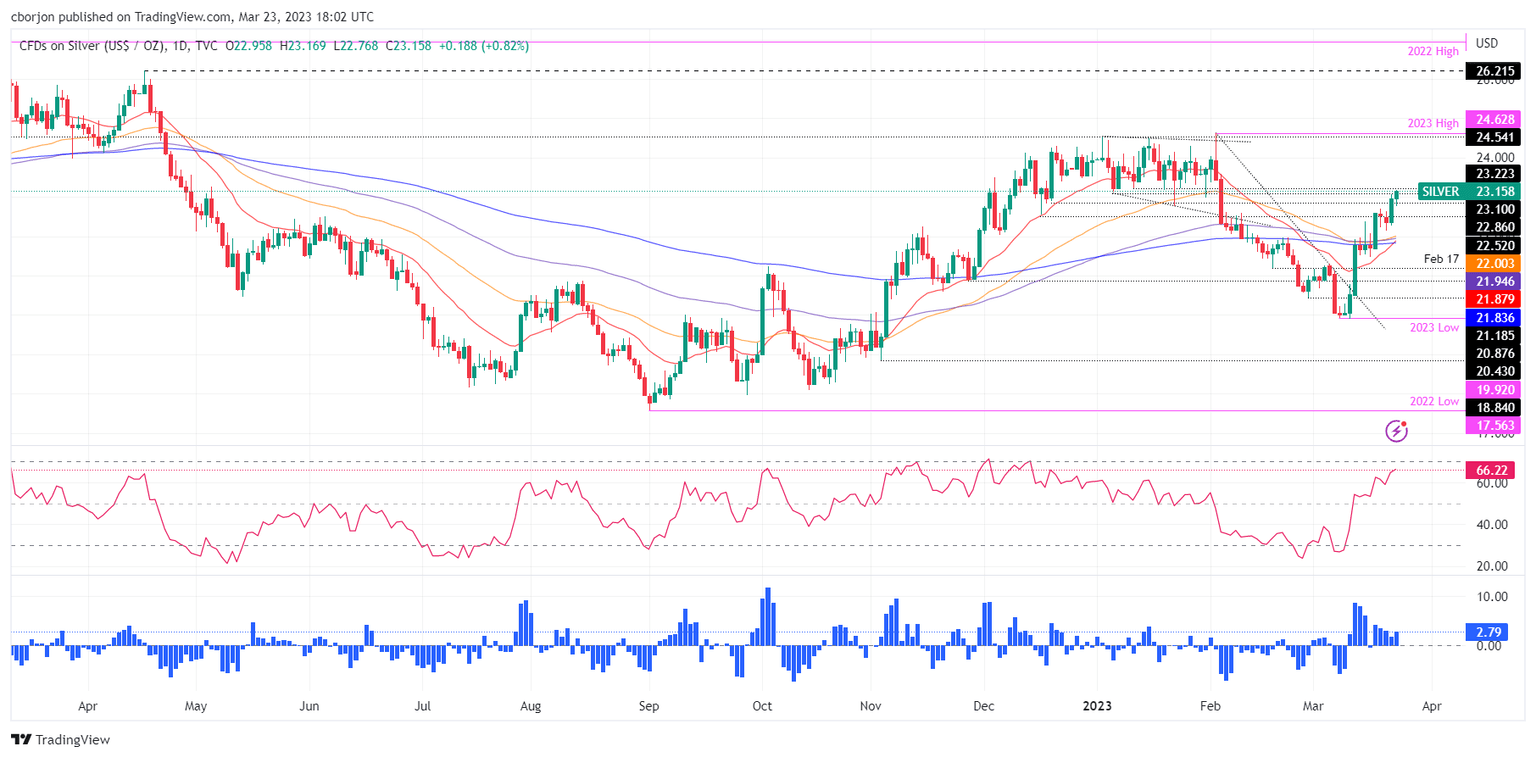

Although the XAG/USD bias is neutral, the 20-day Exponential Moving Average (EMA) at $21.87 exceeded the 200-day EMA at $21.83. That could exacerbate another leg-up in Silver prices, and the white metal could test the YTD high at $24.63.

The XAG/USD first resistance would be the February 3 daily high at $23.59. Once cleared, the XAG/USD will be headed toward the $24.00 mark. Once broken, Silver will be poised to test the YTD high at $24.63.

In an alternate scenario, the XAG/USD first support would be $23.00. A daily close below the latter will keep XAG/USD price downward pressured.

XAG/USD Daily chart

XAG/USD Technical levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.