Gold Price is finding solace in a risk-on setting, key events eyed

- Gold Price finds support as equities rise and US dollar sulks below 20-year highs.

- The bulls are correcting the gold price which could equate to a significant retracement.

- The key events coming up are the ECB, US PMIs before the Fed next week.

Gold price is flat in Asia in a quiet session consolidating the overnight volatility. With that being said, equities are following the lead that was made on Wall Street with the Nikkei up a stunning 2% in the first hour of trade. As such, the US dollar is on the backfoot as risk-on sentiment persists. Overall, XAUUSD leans bullish with time frame continuity within the bullish correction of the recent leg of supply from $1,750 that took out the $1,700 level last week. The pullback in the US dollar continues to support the gold price as investors move to the sidelines ahead of key central bank meetings.

US and Asian stocks on the front foot

US stocks were firm with better-than-expected earnings which comforted investors that have otherwise been fretting over the risks of elevated inflation and a stronger US dollar presumed to eat into corporate profits. This is supportive of the gold price as risk-on weighs on the US dollar.

Read: Forex Today: Dollar’s sell-off continues

The Dow Jones Industrial Average climbed 2.4% to 31,827.05, the S&P 500 added 2.8% to 3,936.69 and the Nasdaq Composite gained 3.1% to 11,713.15. In Asia, the upbeat mood has shined through and stocks are recovering from the prior day's slump after media reports that tech-giant Apple plans a hiring slowdown. After a three-day weekend, the benchmark Nikkei 225 rose 173.21 to 26,961.68, as gaining issues outnumbered losers 169 to 55.

US dollar slumping further below a 20-year peak

The US dollar is falling further below the 20-year highs in Asia, as per the DXY index, as it corrects towards a potential area of support in the longer-term time frames, an area that XAUUSD traders will be watching. The index, which measures the greenback vs. a basket of currencies has moved in on the 50% mean reversion level of the last weekly bullish impulse. At the time of writing, DXY is trading down 0.1% to 106.58 and around 106.53 as the low of the day so far.

From a daily perspective, the price is hovering over a void of offers that leaves 105.27 vulnerable should DXY bears continue to hit the bids. Gold traders will be keeping a close eye on price action at this juncture. Meanwhile, for the week and further out, central banks and key US PMI data will be eyed. Before the Federal Reserve meets next week, the European Central Bank, ECB, will meet on Thursday and then US PMI Surveys for July will be keenly watched on Friday.

ECB, the Fed and US PMIs coming up

The Federal Reserve

The ECB and US PMI Surveys have the potential to throw up some volatility in the gold price before the Fed meets on July 26-27. The ECB has firmly telegraphed a 25bps rate hike and while it is unlikely to surprise, the meeting will coincide with news related to the Nord Stream pipe. After a shutdown, gas is supposed to resume flowing. However, Berlin is growing concerned that Moscow may not resume the flow of gas as scheduled. Russia's Gazprom declared force majeure on gas supplies to Europe to at least one major customer, in a letter dated July 14 and seen by Reuters at the start of this week.

Heated inflation risks had already seen money markets punting for a half-point hike. The uncertainty is indeed a cloud over the ECB event. However, if the central bank goes ahead with a rate hike, be it 25 or 50bps, regardless, it will be the first time in more than a decade and the outcome of the event could have a material impact on the euro, US dollar and gold price.

As for US PMIs, analysts at TD Securities explained, ''business surveys fell markedly in June, led by broad declines in the S&P Global PMIs. The manufacturing index, in particular, posted a large retreat to 52.7 from 57.0 in May.''

Manufacturing index PMI

''While we look for relief in the pace of declines in the mfg PMI, we still expect it to register a new drop in the flash estimate. Conversely, we expect a steady number for the services index after recent declines.''

The Federal Reserve is around the corner and for the time being, ''gold prices are being supported by the markets' repricing for odds of a 100bp hike after Fedspeak from notable hawks has pushed back against this narrative, which is raising the risk of a near-term short-squeeze,'' analysts at TD Securities argued. ''Notwithstanding, this scenario would create the ideal set-up for additional downside in the yellow metal.''

Gold price technical analysis

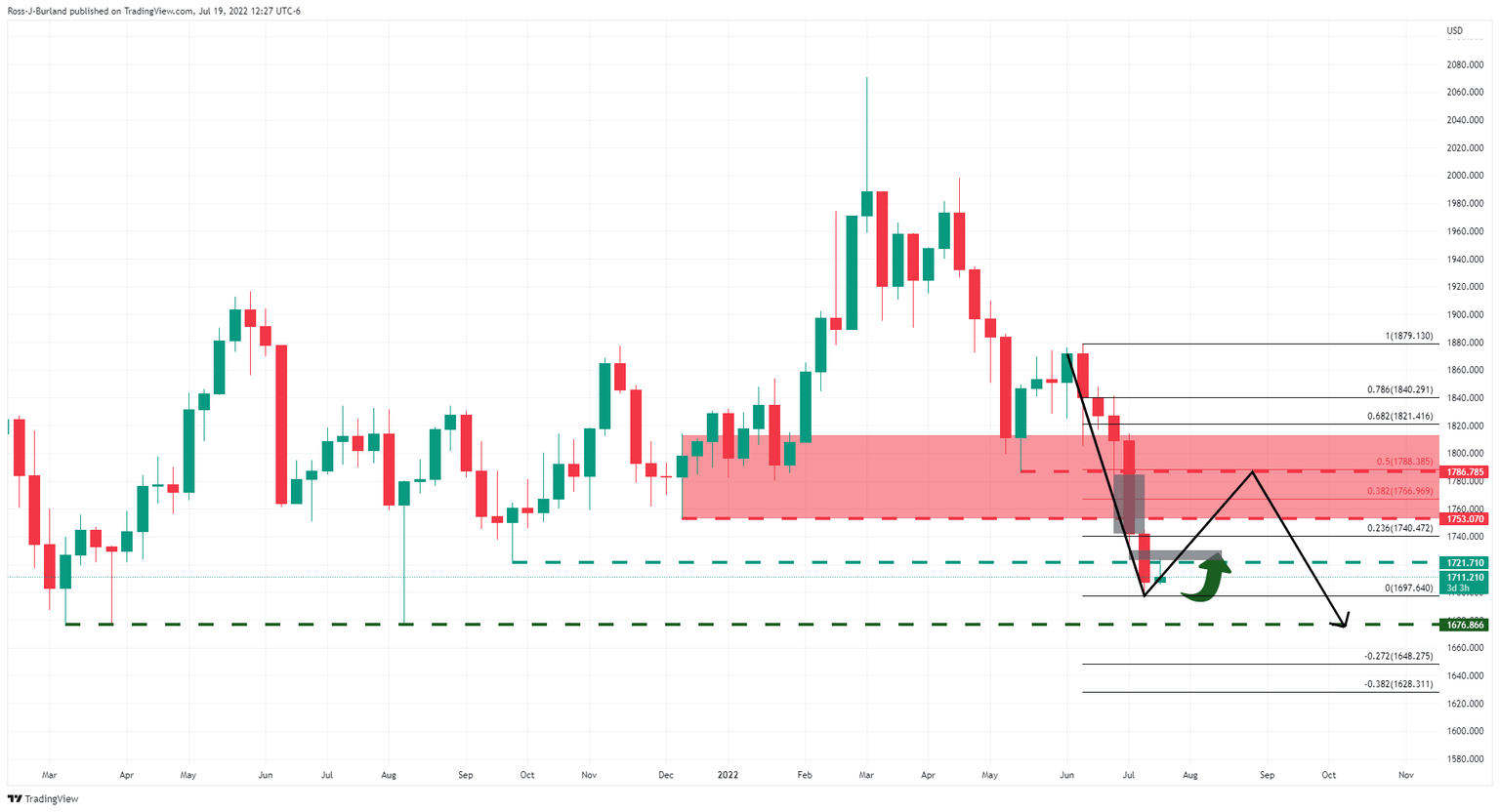

Gold price, from a weekly perspective, the bull correction is underway but the lows of $1,676.86, as illustrated on the chart below and up for grabs from a technical perspective longer term:

The greyed-out areas on the chart above are void of bids which could draw XAUUSD to test the commitments of bears in a 50% mean reversion. On the way there, however, we have a couple of major pivot points that could offer resistance at $1,721 and $1,753.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637938532289769428.png&w=1536&q=95)