EUR/USD Price Analysis: An inverse head-and-shoulder targets 1.1750 before resuming the down trend

- EUR/USD extends its five-day rally, trades above 1.1600.

- A weaker dollar boosts the EUR/USD pair, despite surging US 10-year yields, above 1.641%.

- EUR/USD: The target of an inverse head-and-shoulders is 1.1750, but first, euro bulls need to reclaim 1.1700.

The EUR/USD climbs during the New York session, up some 0.22%, trading at 1.1636 at the time of writing. The market sentiment remains upbeat, as major US stock indices record gains between 0.46% and 68%, while the safe-haven status of the US dollar weakens across the board.

The euro extended its five-day rally, though weaker, reclaimed the 1.1600 figure. The US dollar sell-off witnessed the US Dollar Index drop below the 94.00 threshold despite higher US T-bond yields, with the 10-year coupon, rallying almost six basis points, sitting at 1.641%, at press time.

EUR/USD Price Forecast: Technical outlook

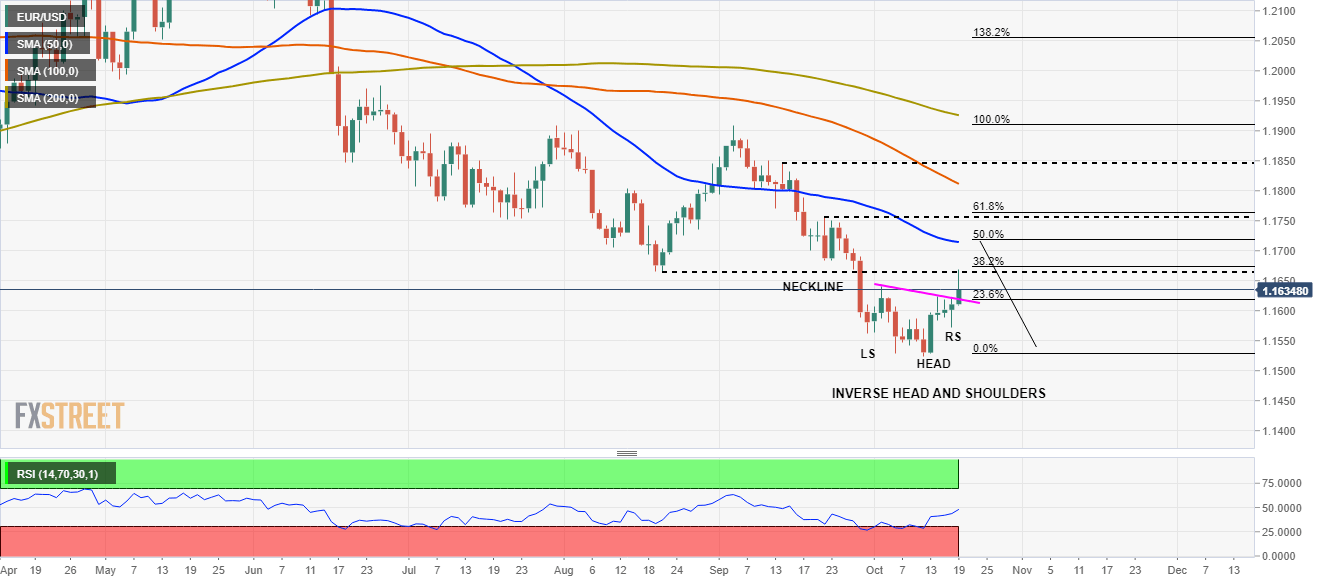

The daily chart of the EUR/USD shows that an inverse head-and-shoulders formed around the 2021 lows, indicating the EUR/USD is under some buying pressure. The inverse head-and-shoulders pattern measured target is 1.1750, near the 50% Fibonacci retracement, which could resume the long-term downward move towards a renewed test of 2021 lows.

To challenge US dollar bulls, euro buyers will need a daily close above 1.1800, near the 100-day moving average (DMA). In that outcome, the September 14 high at 1.1846 would be the first resistance level, followed by the 1.1900.

On the flip side, to resume the downward trend, US dollar bulls will need to push the EUR/USD below the 1.1600 threshold. If EUR/USD sellers exert enough pressure to spur a daily close below 1.1600, a challenge of the 2021 lows around 1.1524 is on the cards.

The Relative Strength Index (RSI), a momentum indicator, is at 48, trending slightly up, indicating that buying pressure is piling on the EUR. However, caution is warranted, as the RSI remains below the 50-midline.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.