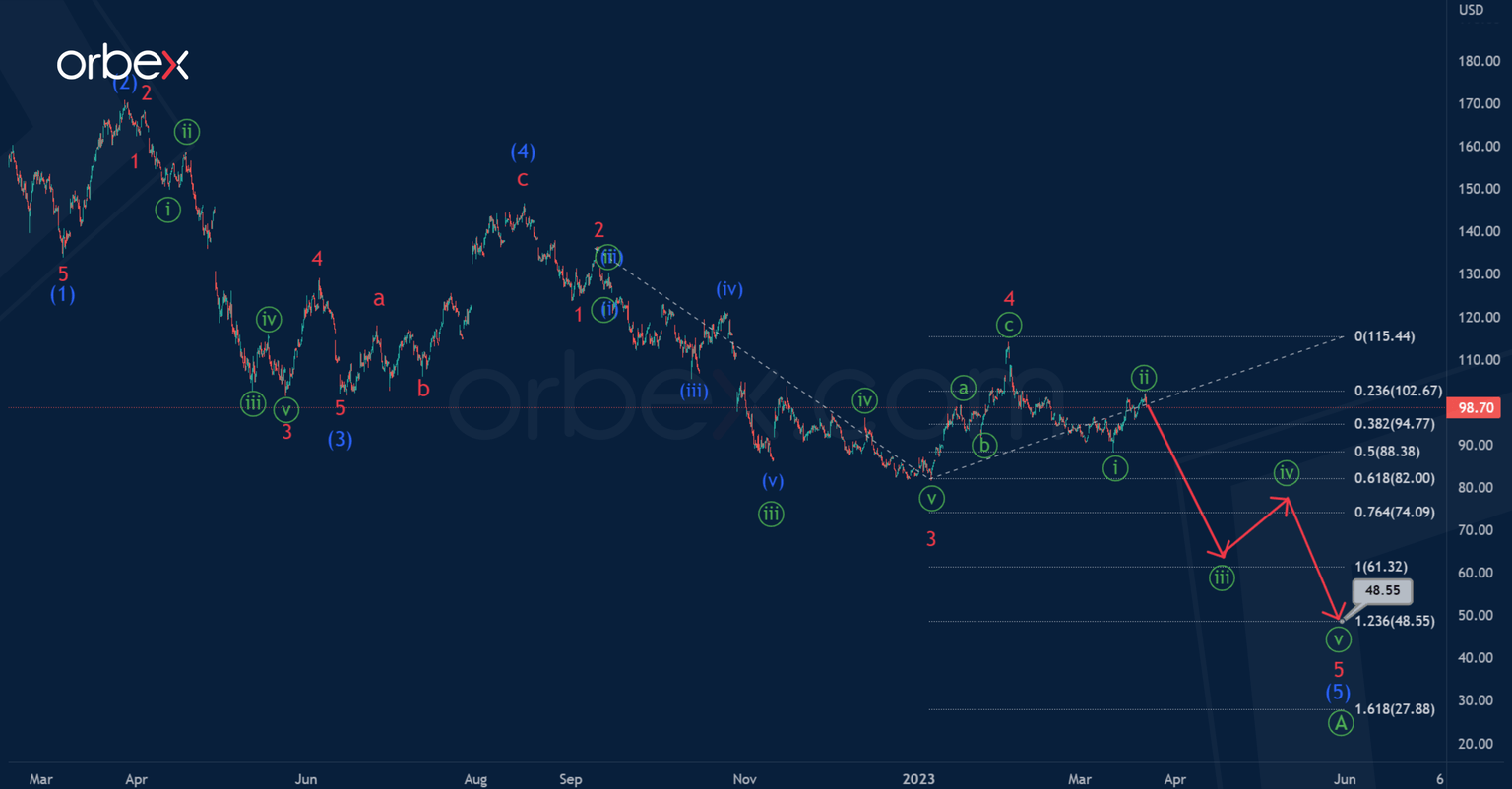

AMZN: A drop In the minute impulse is expected

On the 1H timeframe for AMZN shares, we can notice the formation of a bearish correction b, which takes the form of a zigzag of the primary degree Ⓐ-Ⓑ-Ⓒ.

The depreciation of the shares is expected to continue in the final intermediate wave 5 of (5) of the leading diagonal Ⓐ to the level of 48.55. At that level, minor wave 5 will be at 123.6% of impulse wave 3.

Wave 5 can take the form of a minute impulse, as shown in the chart.

However, the leading diagonal Ⓐ can be fully completed, and the price is already moving within the sideways correction Ⓑ.

There is a high probability that the correction wave Ⓑ will take the form of an intermediate double three (W)-(X)-(Y), where the second intervening wave (X) has come to an end.

In the next coming trading days, an upward movement is expected in the final wave (Y) in the form of a zigzag A-B-C to a maximum of 146.85, where the wave (W) was completed.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.

-638151579716630045.png&w=1536&q=95)