- Dr. Stefan Friedrichowski is physicist and full-time trader and manages the scientific work and the development of trading strategies and Christian Stern is full-time trader and heads the treasury and the education department at Trading Stars.

Traders always search for volatility – there is even a dependency of it, because without market movements you will not earn profits. Around the time of the publication of important economic news the stock markets often show erratic movements in many underlyings. We show you how to use these movements successfully with an example of EUR/USD.

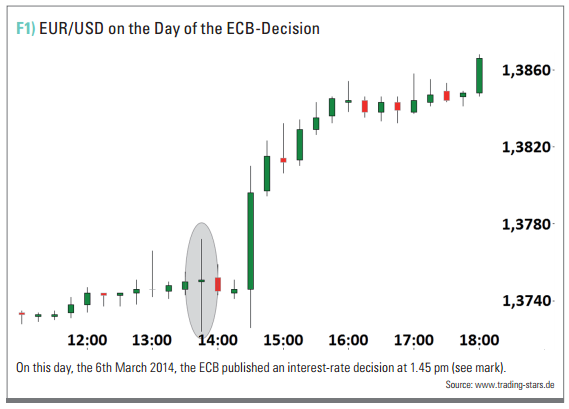

The Trading Idea There are days when prices only move in slow-motion – there are only sideways phases and many false breakouts. But then there are days where everything changes: dynamic breakouts up or down, sometimes even to both sides within minutes. These events can take place completely unplanned (for example because of attacks, riots, natural disasters) or predictably at big news-events like the publication of the gross domestic product (GDP) or the NFP-data (non-farm payrolls) or a press conference of the Fed. Dynamic price movements take place, but you know the date and time in advance. We want to introduce a trading idea based on the monthly ECB-interest rate decision and we want to show that we can recognise a mathematical probability advantage and use it for a real profit.

An old saying goes: “Close your trades prior to important news or at least protect them with a stop-loss.”

This is absolutely true. There may be some insiders who know in advance what will be published, but the reaction of the market is hard to predict. For example nonfarm payroll data is published and they are better than expected, which should mean a bullish move. But maybe because of this the market fears that the monetary measures will be reduced and therefore the DAX drops 100 points. In hindsight we can always explain the “Why”. But to be honest, this could be an explanation for the contrary as well. The consequence is clear: Stay still and close open positions – unless you want to trade the news systematically.

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.