As we start 2016, I thought it might be good to look back on some of the trends from 2015. Looking back can give us a glimpse of the future.

Foreign buyers: The news media says things like, “Foreigners are buying up the U.S.!!!” Well, there is no doubt that there is a great deal of money coming in from many places around the world buying U.S. properties. Most of the foreign investing in the U.S. is concentrated on commercial and luxury markets. In my opinion, this is a positive thing for the real estate market at this time and it’s not affecting the middle class home buyer. I saw this happen in the 80’s when the Japanese where purchasing up all kinds of real estate.

Cash was still being used a great deal in 2015. In California it was reported that 23 percent of buyers paid all-cash. That fact is a strong indicator that the cash buyer market is still going strong.

Credit is easing up but not back to the early 2000 “standards”. According to Laurie Goodman Ph.D., Director of Housing policy at the Urban Institute, “Credit is expanding very, very slightly from absurdly tight levels. Lenders needed clarity before they were going to be willing to underwrite more risky loans, and they have not had that clarity. The good news is that everyone is aware they need it and it is beginning to happen very slowly.” There is evidence that the default rate is half of what it was in the years heading up to the mortgage crisis. This is evidence, Goodman maintains, that lenders have less to fear by taking on more risk.

Rents hit all-time highs with no stop in sight. USC Professor Raphael Bostic states that, “Our forecast continues to report that we will see rents increase pretty aggressively and I don’t see any signs that it is going to slow.” There are two main reasons: 1) many renters can’t get loans and 2) more individuals that are of age and means to buy are choosing to rent.

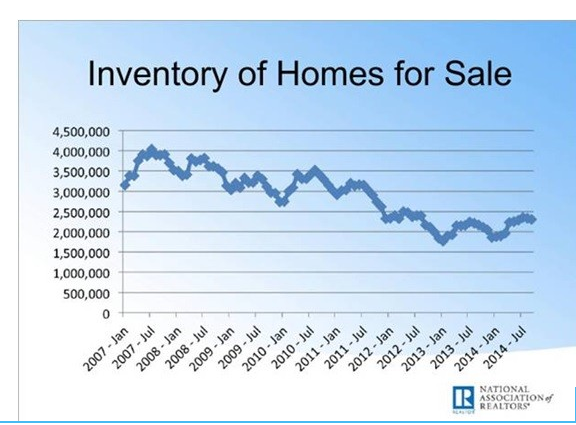

Lack of Supply/Inventory: We know that six to seven months of inventory is considered “the norm”. In 2015 we saw typically only three months’ worth of inventory. We know that with limited supply, prices increase.

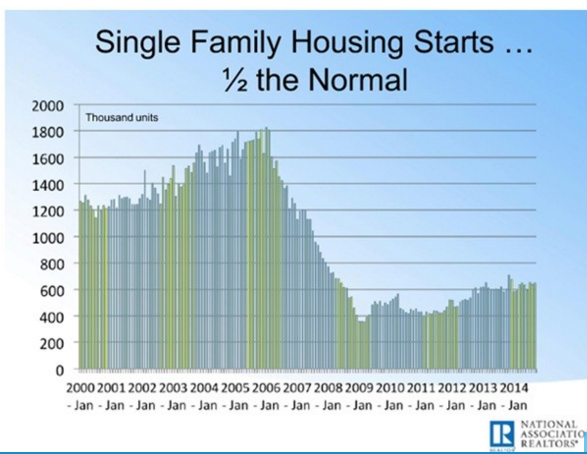

There are a number of things that are leading to the historically low inventory numbers. These are just a few:

- Lack of new building: Since 2008 there have been unparalleled low levels of new housing starts. Builders are building but it’s more commercial product such as apartments, not SFR’s.

- Values are not back to 2007 levels. In many parts of the country values are back to 2007 levels but there are many more that haven’t reached those levels yet. Often sellers in these areas are waiting to sell until the prices come back to the 2007 levels.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

AUD/USD: Buyers retake 0.6350 after Chinese GDP data

AUD/USD picks up fresh bids and retakes 0.6350 in Asian trading on Wednesday. The pair finds fresh demand after Chinese Q1 GDP beat estimaes with 5.4% YoY while Retail Sales and Industrial Production data also exceeded expectations. However, the further upside could be capped by US-China trade woes ahead of Powell.

Gold price hangs close to all-time highs at $3,275

Gold price holds the advannce to record another all-time high at $3,275 per troy ounce in the Asian session on Wednesday. Safe-haven demand amid US President Donald Trump's uncertain tariff plans, softer US Dollar and prospects of further easing by the Federal Reserve provide some support to the yellow metal.

USD/JPY stays pressured toward 142.50 amid renewed US Dollar selling

USD/JPY turns south toward 142.50 and remains close to a multi-month low touched last week. Tariff-driven uncertainty continued to weigh on the US Dollar. Adding to this hope for a US-Japan trade deal, the divergent BoJ-Fed policy expectations and a softer risk tone underpin the safe-haven Japanese Yen.

Binance and KuCoin traders panic as Amazon Web Service outage halts Crypto withdrawals

On Monday, a technical outage from Amazon Web Services temporarily halted operations at top cryptocurrency exchanges, including Binance and KuCoin. The outage disrupted withdrawals and trading services, sparking major concerns among cryptocurrency traders.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.