A couple of weeks ago, I began discussing the idea of Anchors and Offsets in option trading. We’ll continue with that today.

While the simplest use of options is just as lower-cost substitutes for stock, this only scratches the surface of what they can do. We can certainly buy Call options in place of buying a stock, or buy Put options in place of selling a stock short. But to get the real power of options, we need to combine them.

For example, on June 10-12 the SPY, a main bellwether for the global equity market, reacted to geopolitical concerns and disappointing data by dropping by about three points, or 1.5%. The chart is shown below:

Let’s say we were still bullish on the equity market, and thought that this pullback was probably over. Moreover, we would be happy to own SPY if it dropped a little further into our demand zone from roughly $192-193.

One possible move would be to sell the July $193 puts. These could be sold at the time for $2.70 per share ($270 per 100-share contract). We would receive the $270 right away. If SPY remained above $193, the options would expire and that $270 would be clear profit.

If SPY dropped below $193, and remained there at the expiration of the July options on July 18, then we would be obligated to buy the SPY stock at $193 per share ($19,300 for the 100 shares covered by the single put contract). Our net cost would be the $193 strike price, less the $2.70 we had received for selling the puts, or $190.30 per share. Let’s say we thought it very unlikely that SPY would be below $190.30, so we considered this a risk worth taking.

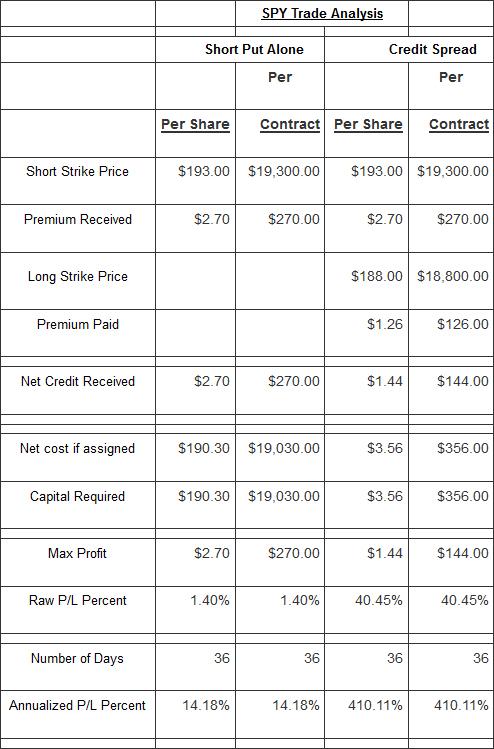

Let’s look at the stats on this trade:

If we were right about SPY rallying from here, this trade would pay off at the rate of 14% (annualized). If SPY did not rally, at worst we would own the ETF at $190.30, a price we were happy with.

Fine. But could we improve on this? What were the undesirable characteristics of this position?

Here are three:

Unlimited risk. If SPY did drop below $190.30, we would have a loss, and that loss would be unlimited. Well, it would not exactly be unlimited. At most, if the value of SPY dropped to zero (an impossibility), we would lose $19,030. But this is close enough to infinity compared to our $270 maximum profit, that for practical purposes, our loss was unlimited. By convention, naked short put trades are referred to as having unlimited risk. We could mitigate this by planning to exit the trade (buy back the short puts) if SPY dropped below a certain level. But this would expose us to:

Extreme exposure to changes in Implied Volatility (IV). IV is the measure of how much people are willing to pay for time value. The Implied Volatility of SPY at the time was smack in the middle of its most recent 52-week range. IV could just as easily go up or down. If the price of SPY went down, the price of time value in its options (IV) would probably go up. If that happened, then our puts would become even more expensive, increasing our loss.

High capital requirement. In order to insure that we would have the money to buy the SPY if the puts were assigned, our broker would require that we earmark funds for that purpose. We would need to have $19,300 in cash in our account in order to sell that put for $270. (This would be a cash-secured put. Some people are able to sell puts naked, by putting up about 20% of this amount. If so, then they will get margin calls to put up more cash if the stock falls. We assume here that we are doing this trade on a fully cash-secured basis, No margin calls are possible, and the cash-secured short put can be done inside an IRA account.)

How could we reduce or eliminate these undesirable effects?

By turning the short put position into a credit spread position. We could do this by simultaneously purchasing another put at the $188 strike. These could be bought for $1.26 per share ($126 per contract). With the short $193 put as the anchor of our position, the long $188 put would be our offset unit. Here is how that would change things:

Unlimited risk. Not any more. Now our $188 put would protect us in the event of a very large drop. At worst, we might have to pay $5 per share (the difference between the $188 and $193 strikes) to get out of the position, no matter how far SPY dropped.

Extreme exposure to changes in Implied Volatility (IV). Much improved. Since we now owned the $188 put, if SPY’s IV went up, our long put would go up in value too. This would offset most of the damage from an IV increase.

High capital requirement. Hugely reduced. Since our maximum exposure was now $5 instead of $190, we would only be required to put up $5 per share. And that would be reduced by the $144 net credit generated (the $2.70 premium received for the short put, less the $1.26 paid for the long put). The net out of pocket would be just $3.56 per share, compared to $190.30. This would increase our cash-on-cash profit percentage immensely.

Here’s the comparison of the original short put position and the credit spread:

In this trade, adding an offset to the anchor unit, transformed the trade from one with unlimited risk into a limited risk trade. At the same time, the profit percentage was improved a very great deal.

I hope this piques your interest in options, especially the power available by combining them. This is only one small example. There are many ways to construct very exciting positions. We’ll look at more in the future.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD stays depressed near 1.1850 ahead of German ZEW

EUR/USD remains in the red near 1.1850 in the European session on Tuesday. A broad US Dollar bullish consolidation combined with a softer risk tone keep the pair undermined ahead of the German ZEW sentiment survey.

GBP/USD holds losees near 1.3600 after weak UK jobs report

GBP/USD is holding moderate losses near the 1.3600 level in Tuesday's European trading. The United Kingdom employment data suggested worsening labor market conditions, bolstering bets for a BoE interest rate cut next month. This narrative keeps the Pound Sterling under bearish pressure.

Gold pares intraday losses; keeps the red above $4,900 amid receding safe-haven demand

Gold (XAU/USD) attracts some follow-through selling for the second straight day and dives to over a one-week low, around the $4,858 area, heading into the European session on Tuesday.

Canada CPI expected to show sticky inflation in January, still above BoC’s target

Economists see the headline CPI rising by 2.4% in a year to January, still above the BoC’s target and matching December’s increase. On a monthly basis, prices are expected to rise by 0.1%.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.