KENNY FISHER

KENNY FISHER

PROFILE:

- Current Job: Analyst at Forex Crunch

- Career: Graduated from law school in Toronto. Former account manager at Bendix. Senior writer at Forex Crunch.

Introduction

This article discusses trading FX based on the Non-Farm Payrolls. It is a given that there is an element of risk in trading FX. However, an understanding of some basic concepts about major economic indicators, such as the Non-Farm Payrolls report, can minimize some of that risk.

Background

Financial markets in the US, Europe and around the world react, often sharply, to global economic events. These events can also have a significant impact on the currency markets, so it is important for currency traders to monitor the release of major economic indicators, such as US Non-Farm Payrolls (NFP). This indicator is also referred to as US Non-Farm Employment Change.

NonFarm Payroll

Definition: measures the number of jobs added or lost in the US economy over the last month.

Publication: released usually on the first Friday of each month, at 8:30 EST. It is published by the US Department of Labor.

Significance: considered the most important employment indicator. It provides a look at the health of the US economy in general, and the labor market in particular.

How NFP affects the US Dollar

As one of the most important economic indicators, the NFP release can have a major impact on the forex markets and can affect the direction of the US dollar. This means that traders should always treat the NFP report as market-moving data.

A NFP which is stronger than the estimate (also known as the forecast) indicates that the labor market is stronger than what the markets expected, and the dollar often rises as a result. Why? Let's use a stock market analogy to answer this question. Just like a company's stock often rises after the company releases a strong financial report, so to the US dollar can be thought of as the "stock of the US economy". Thus, when the US releases a strong economic report, the "stock" (US dollar) often rises against other currencies (such as the euro, pound or yen) as a result.

Conversely, a weak NFP report indicates that the labor market is weaker than what the markets anticipated, and a weak reading can push the dollar lower against other currencies.

TIP: Mark your economic calendar so that you can monitor the release time of NFP.

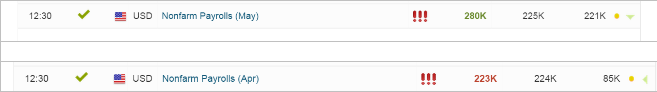

The chart above, taken from the FXStreet Economic Calendar, provides the estimates and actual readings for the June 2015 and May 2015 NFP reports.

Each report covers the employment change measured in the previous month. The June report, released on June 5, covers the employment change measured in May. Similarly, the May report, released on May 8, covers the employment change measured in April.

The chart shows the following:

June reading: actual release: 280 thousand

estimate: 222 thousand

May reading: actual release: 223 thousand

estimate: 224 thousand

D. Effect of NFP release on the markets

When trading based on economic events, it's always a good idea to be well-versed with that particular sector of the economy. So, for trading based on the NFP, a trader should have a solid understanding of employment conditions in the US. The more knowledge you have, the more confident you will feel trading the NFP. Don't accept the market estimates as written in stone; they are often well off the mark. Ask yourself if you think the NFP will improve or lose ground in the next release. If, for example, you feel that the NFP may move higher, then there's a strong chance that the US dollar will move higher following the release (we'll explain why shortly).

TIP: Keep current on financial news, especially on the US labor market and employment conditions. This will help you trade the NFP.

Trading before release of NFP

The period immediately before the NFP release is when market uncertainty is at its highest “ will the reading move higher or lower compared to last month? This uncertainty can lead to volatility in the forex markets, as traders and investors anxiously await the release. Trading during this time carries additional risk, as the markets do not have any solid data to work with prior to the release. Nonetheless, the volatility often seen prior to a major event does present trading opportunities.

Trading after release of NFP

We noted earlier that the NFP is a major economic indicator, and that there is a strong likelihood that the currency markets will move after the NFP is released. Will the US dollar move up or down? That of course, is the million dollar question which nobody can predict, but we can use a general rule to help us make an educated guess:

NFP is higher than the estimate >> dollar will likely move higher

NFP is lower than the estimate >> dollar will likely move lower

However, this rule is not absolute, and another factor that we need to keep in mind is the previous release (one month earlier). If NFP showed a higher gain in the current reading compared to the previous reading, but fell short of the estimate, the dollar could still rise because the indicator improved in actual numbers, despite falling short of the estimate.

There is of course, the possibility that the markets will not show much movement at all following a major release like NFP. This could happen if the actual reading is close to the estimate. However, if the reading is significantly higher or lower than the estimate, there is a strong chance that the dollar will respond with some movement.

Duration of NFP release on markets

Economic indicators like NFP are considered short-term market movers. This means that the dollar often reacts immediately after the indicator is released, but in some cases, the NFP reading can affect the markets for up to 2 or 3 days. This means that market volatility is most likely right after the release of NFP, but the markets can experience volatility well after the actual release time.

TIP: If there is volatility after the NFP release, it is likely to be at its strongest in the first few hours after the release.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

When are the China Retail Sales, Industrial Production and how could they affect AUD/USD?

The National Bureau of Statistics of China will publish its data for November at 02.00 GMT. AUD/USD trades on a positive note on the day in the lead up to the China Retail Sales, Industrial Production data. The pair gains ground as US Dollar softens amid the prospect of interest rate cuts by the US Federal Reserve next year.

USD/JPY weakens below 156.00 amid Fed rate cut outlook, BoJ rate hike anticipation

The USD/JPY pair trades on a negative note near 155.75 during the early Asian session on Monday. The US Dollar softens against the Japanese Yen amid the prospect of interest rate cuts by the US Federal Reserve next year.

Gold poised to challenge record highs

Gold prices added roughly 3% in the week, flirting with the $4,350 mark on Friday, to finally settle at around $4,330. Despite its safe-haven condition, the bright metal rallied in a risk-on scenario, amid broad US Dollar weakness.

Week ahead: US NFP and CPI, BoE, ECB and BoJ mark a busy week

After Fed decision, dollar traders lock gaze on NFP and CPI data. Will the BoE deliver a dovish interest rate cut? ECB expected to reiterate “good place” mantra. Will a BoJ rate hike help the yen recover some of its massive losses?

Big week ends with big doubts

The S&P 500 continued to push higher yesterday as the US 2-year yield wavered around the 3.50% mark following a Federal Reserve (Fed) rate cut earlier this week that was ultimately perceived as not that hawkish after all. The cut is especially boosting the non-tech pockets of the market.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.