Why Zilliqa price is mooning and where ZIL will go next

- Zilliqa price has rallied 280% in the last two weeks

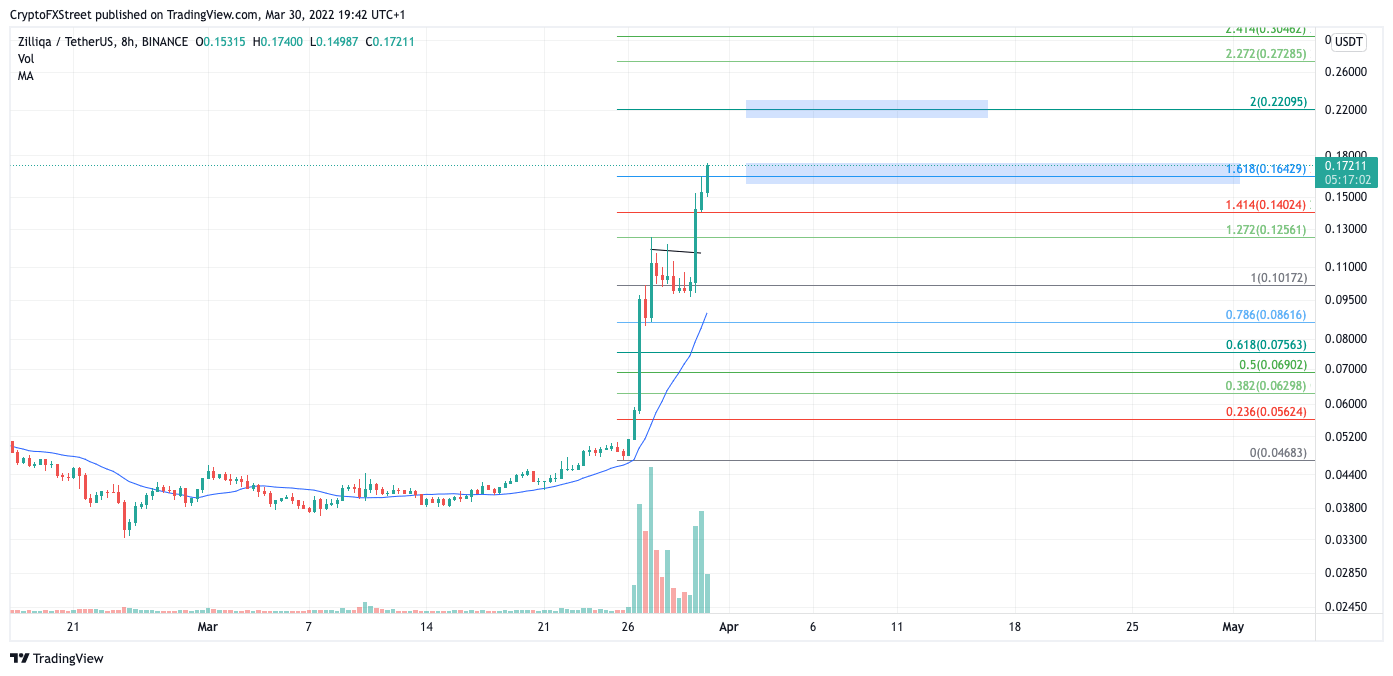

- ZIL price has tapped the 1.618 Fibonacci level

- Invalidation for the bullish thesis will be a closing candle below $0.125

Zilliqa price has been one of the best performing cryptocurrencies to hodl this month as the digital asset has rallied by more than 280%. Further gains are possible, but traders should be careful about a spike in profit-taking.

Also read: AMC stock falls 13% after FXStreet profit call on Wednesday

Zilliqa price has traders in a frenzy

Zilliqa price is currently hovering above $0.17, a price level that seemed astronomically distant from the March 21’st opening price of $0.04. The 8-hour chart suggests the uptrend will continue as ZIL price has printed a large bullish engulfing candle. The ramping volume pattern also confounds further gains on the horizon.

ZIL price has one caveat to the current price action. The Fibonacci retracement indicator surrounding the largest impulsive wave within the rally suggests the 1.618 level at $0.165 plays a lot of importance on Zilliqa price. Traders aware of the prominent 1.618 Fib level will likely have their trailing stop losses around this price point to secure profit. This scenario warrants market makers to hunt for liquidity around the current ZIL price.

Traders should expect sideways price action and, at worst, a deeper correction into potentially $0.14 in the short term for market makers to collect liquidity.

ZIL/USDT 8-Hour Chart

More bullish price action can occur for Zilliqa price if the bulls can print a closing candle above $0.17 on the 8-hour chart. Bulls will need more buying volume for this equation to transpire. If this happens, the next target for ZIL price will be $0.22, representing a 40% rise above the current price]

An Invalidation for the bullish thesis will be a closing candle below $0.125 on the 8-hour chart. Investors would likely be encouraged to take profits if this were to occur, pushing Zilliqa price into $0.09 and potentially $0.07.

Author

FXStreet Team

FXStreet