Polkadot consolidates before new all-time highs

- Polkadot price moves sideways after hitting the $55 value area.

- The market appears to be coming to Polkadot to correct instead of Polkadot moving lower.

- Downside movement may be more limited than its peers.

Polkadot price shows that it may not experience a steep retracement if there is a pullback in the cryptocurrency market. A pullback is still likely, but the move would be within the recently traded price action range. Therefore, Polkadot may be positioning for a breakout earlier than the rest of the market, continuing its behavior as a cryptocurrency market leader.

Polkadot price congestion could be an early sign of future bullish momentum

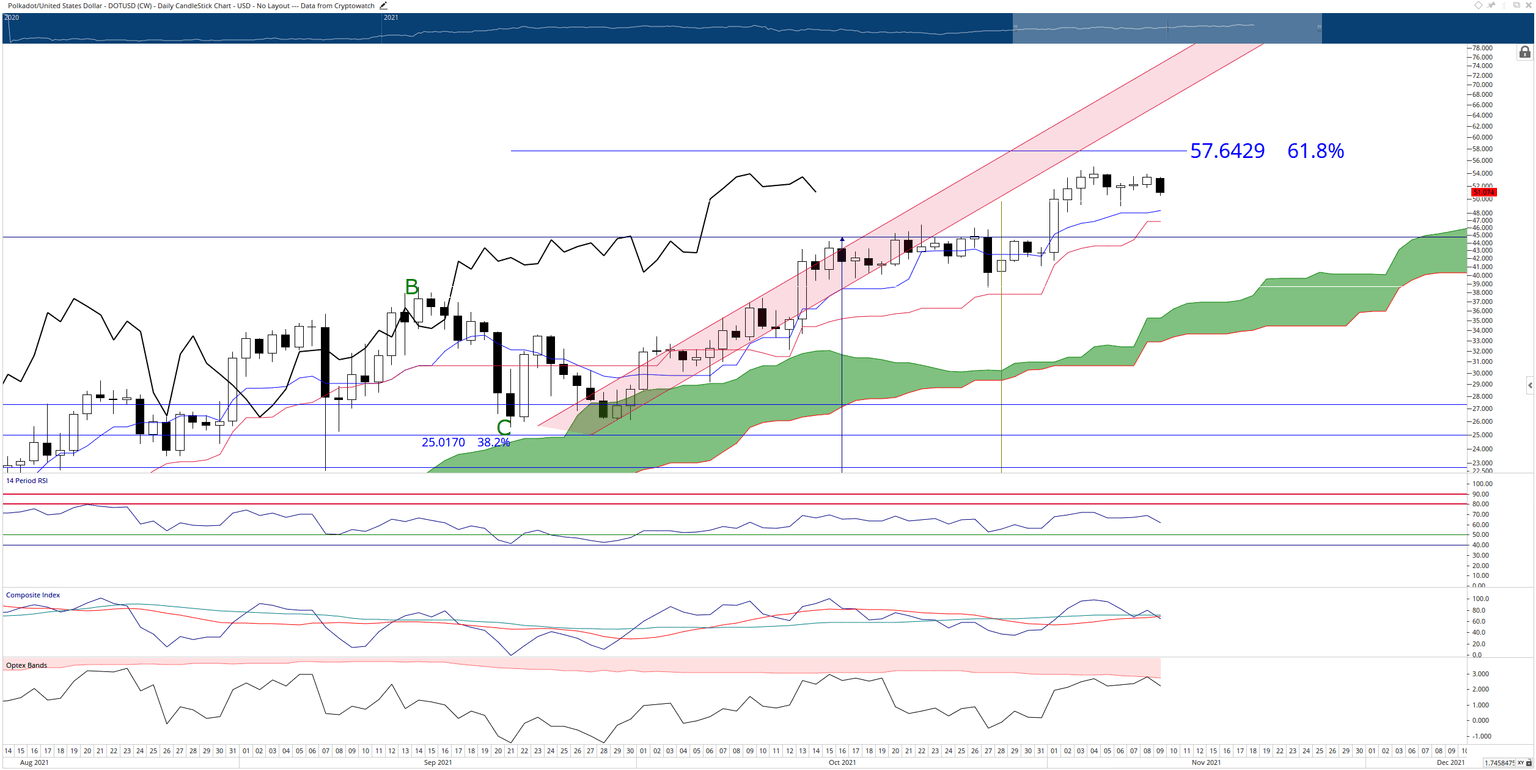

Polkadot price has an uncommon kind of behavior to it. It recently had sizable gaps between the close and the Tenkan-Sen, indicating that strong near-term pullbacks were likely to occur. Instead, Polkadot has traded sideways, and the least expected reaction to Tenkan-Sen and price gaps has occurred: the Tenkan-Sen rose to equilibrium with Polkadot. This means that less time is needed and that Polkadot should expect less volatility to begin its next swing higher.

How long will traders need to wait until Polkadot price can continue its bull run? Perhaps not as long as one would think. The Relative Strength Index is in neutral territory, so it can sustain any bullish breakout. Likewise, the Composite Index is at a neutral level but crossing below both of its averages – that could warn of some selling pressure soon. Finally, the Optex Bands are at extremes and are just now moving lower from those extreme overbought conditions.

DOT/USD Daily Ichimoku Chart

Buyers may want to wait until there is a close above the 61.8% Fibonacci expansion at $57.64. Any move to that level over the next week would likely position Polkadot’s oscillators back into overbought conditions. In addition, hodlers will want to be careful of any drop below the Kijun-Sen at $46 over the next week. A close below the Kijun-Sen could trigger intense selling pressure, especially if that close occurs between today and Friday. Because the Optex Bands are just coming off extreme overbought levels and the Composite Index is crossing below its moving averages at a neutral level, any close at or below $46 could trigger a selloff.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.