Ethereum Price Prediction: ETH roars back to $4,000

- A historical technical level offers ETH buyers a good entry point.

- Ethereum acts as a perfect buy-the-dip asset.

- Expect further upside for the altcoin towards $4,000.

Ethereum (ETH) stayed the course of other cryptocurrencies, under pressure from Bitcoin earlier this week. But with this dip comes the opportunity for buyers to pick up Ethereum and add to the portfolio.

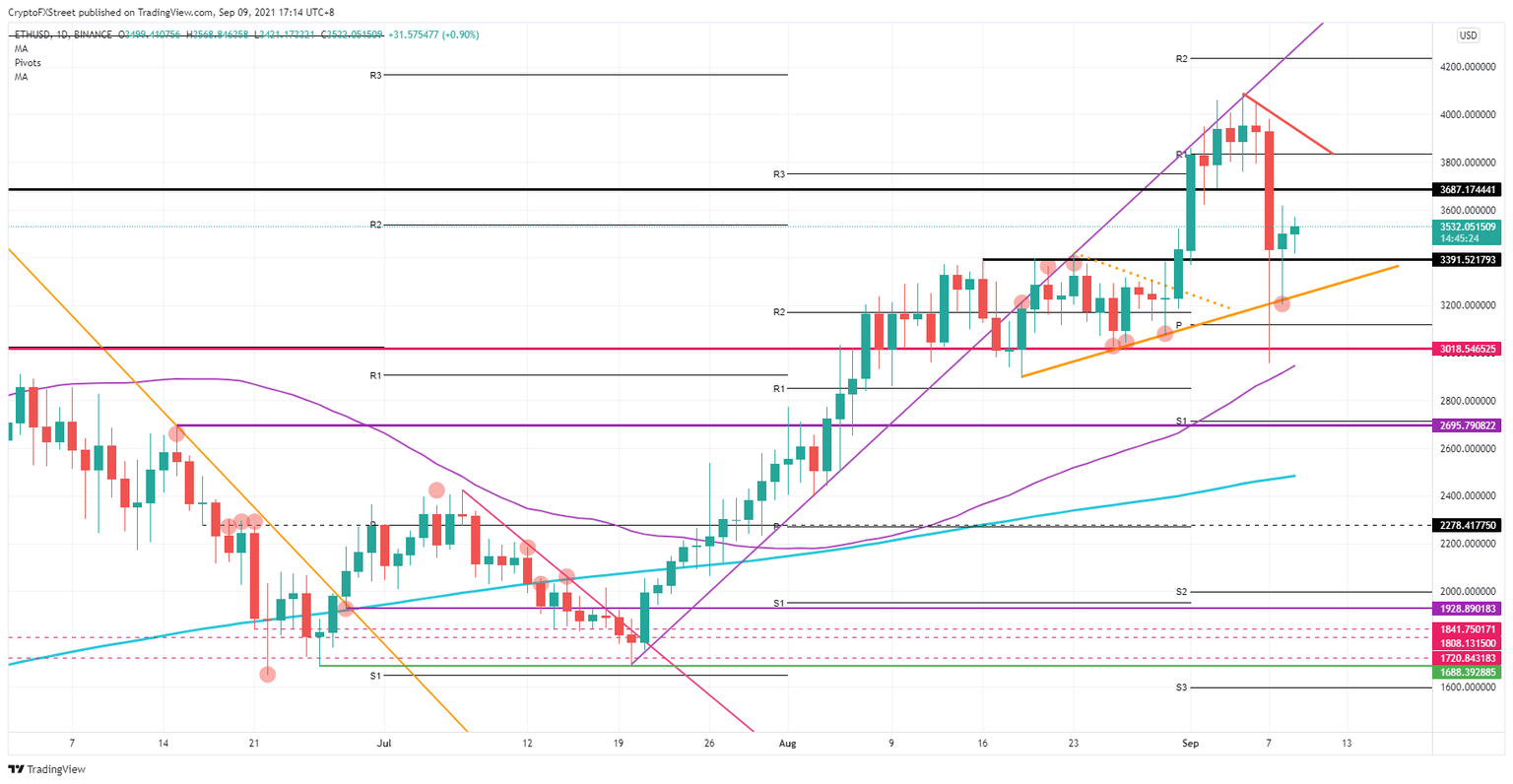

Buyers scratched their heads after seeing the price action in Ethereum on September 7. Not a real clean entry point could be found for ETH as the 55-day Simple Moving Average (SMA) was too far of the fat $2,898.56 level, and buyers were reluctant to jump in at $3,018.54 in the risk that price action could continue further down in the days to come.

The next best entry came the day after September 8, with the orange ascending trend line at $3,200. This trend line originated from August 19 and was initially part of a symmetrical triangle formation that caused the jump higher on August 30.

Extending that trend line offered Ethereum a base at $3,212.56 as an entry point after the dust settled on the negative wave in cryptocurrencies. Price action since then looks healthy and shows that buyers are regaining control and have gotten in at some excellent entry points.

Ethereum price action looks healthy for more upside

The fact that price action in Ethereum can even trade above $3,391.52 on Thursday – without a firm retest of that level – shows that buyers are eagerly still flocking in to go long and are adding Ethereum to their portfolio.

On the upside, the next significant level to watch and observe how price action in Ethereum will behave is $3,687.17. That was the launching point on September 3, which pushed price action to new highs for the year. So, this is a level that will need to be watched if it can act again as an ETH launching path, or if it will be used by sellers as a push to drive prices down again.

Considerable importance will be on the red descending trend line. That trend line does not hold much importance with just one test, but with the monthly R1 resistance level below $3,835.33. That should be a level to watch that could cause temporarily limited upside for the bulls.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.