DOT price analysis: Where is Polkadot headed ahead of ETH Denver 2023

- Polkadot ecosystem is gearing up for its BUIDLing summit in ETH Denver 2023 starting February 28.

- DOT price is currently in a short-term uptrend, bulls are targeting the $9 level.

- A decline below $6.45 will invalidate the bullish thesis for the altcoin.

Polkadot ecosystem is preparing for its summit at the ETH Denver 2023 event. DOT started its short-term uptrend on December 30, 2023 and bulls are targeting the $9 level for the altcoin.

Also read: Does massive expenditure on crypto lobbying influence token prices? A look at Binance Coin and XRP

Polkadot gears up for BUIDLing summit at ETH Denver 2023

Polkadot is a network that enables blockchains to exchange messages and perform transactions without a trusted third-party. The DOT blockchain is gearing up for its lineup of events at ETH Denver 2023. Between February 28 and March 5, the Polkadot team has set a BUIDLing summit, conference program and community side events.

1/ It's less than a week before the Polkadot ecosystem joins #ETHDenver 2023.

— Polkadot (@Polkadot) February 24, 2023

Check this thread for the latest info on the Polkadot #BUIDLing summit, conference program, and community side events.

Events dates: February 28 - March 5

To register: https://t.co/fOhV0Uk44v pic.twitter.com/xrDEieLPVf

The token’s team is preparing for a day full of talks and panels on all things Polkadot, featuring developers, and lead engineers in the ecosystem.

DOT price is in an uptrend, targeting the $9 level

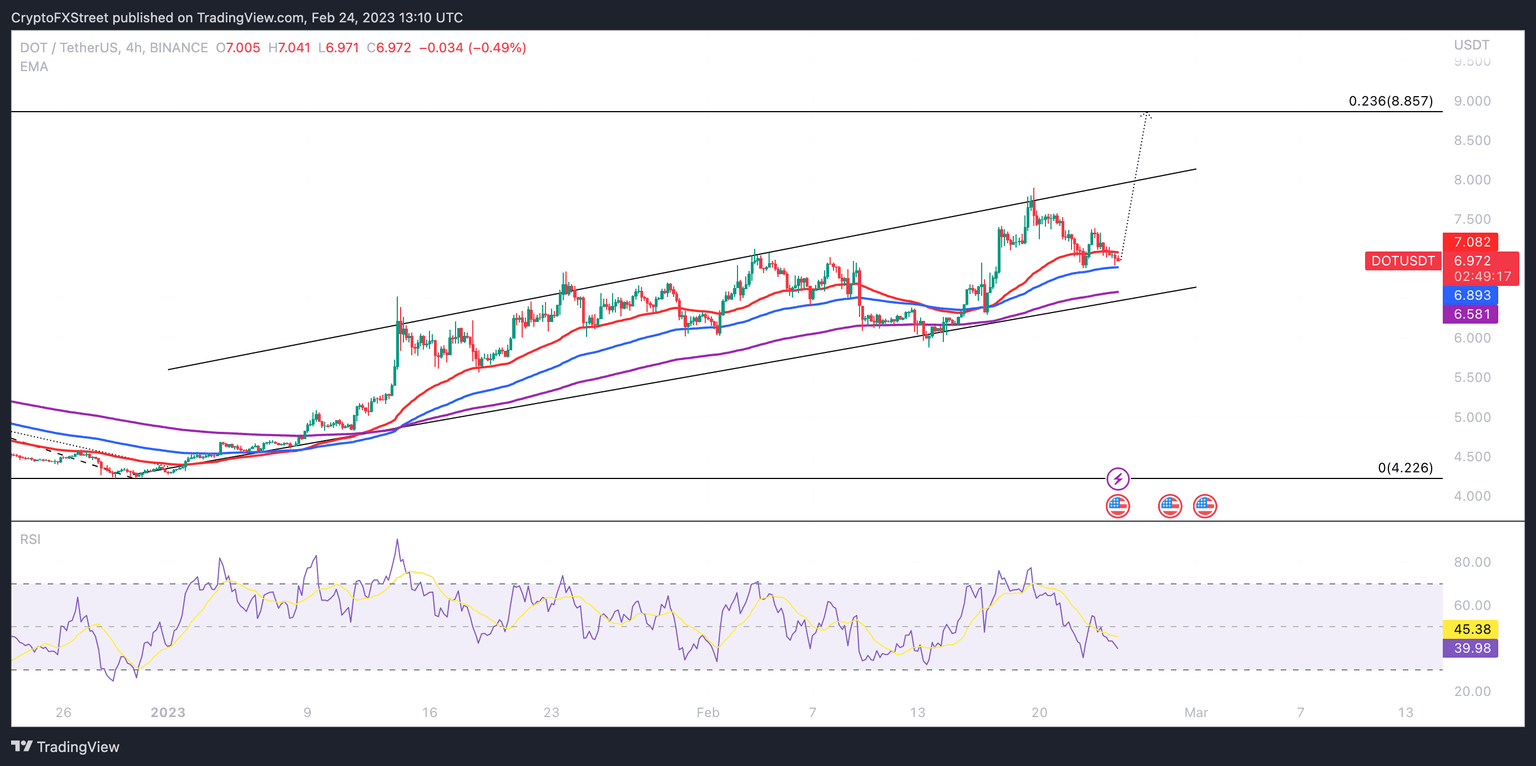

Polkadot’s native token DOT is in a short-term uptrend that started in January 2023. DOT price is in an ascending channel, where Polkadot’s native token recently tested the upper trendline as resistance at $7.74.

DOT is changing hands at $6.94 and the trend remains bullish. The token is likely to rebound to the upper trendline and a break above $7.74 could trigger a run up to the $8.85 level, that represents a 23.6% Fibonacci Retracement.

A continuation of DOT’s uptrend could push it to the $9 target.

DOT/USDT price chart

A decline below the three Exponential Moving Averages (EMAs), the 50, 100 and 200-day represented in the chart above, could invalidate the bullish thesis. The downside target is the lower trendline of the ascending channel at $6.45.

Relative Strength Index (RSI), the momentum oscillator currently reads 39.13 and it is heading towards the oversold territory. This implies there is room for further price rally in DOT, the token may be currently undervalued.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.