USD/JPY Forecast: Risk aversion opens doors for a slide sub-104.00

USD/JPY Current price: 104.48

- Speculative interest concerned about resurgent coronavirus contagions.

- US Treasury yields edged lower for a third consecutive day, pressuring USD/JPY.

- USD/JPY is technically bearish, may accelerate its decline once below 104.30.

The USD/JPY pair is ending Tuesday with losses, a few pips above its monthly low of 104.33. Speculative index kept selling the greenback as the US presidential election looms and political tensions mount in the country. Adding to the bearish case, global indexes spent the day under pressure on the back of resurgent coronavirus outbreaks, while US Treasury yields were also under pressure falling for a third consecutive day. The Japanese macroeconomic calendar had nothing to offer this Tuesday and will remain empty this Wednesday.

USD/JPY short-term technical outlook

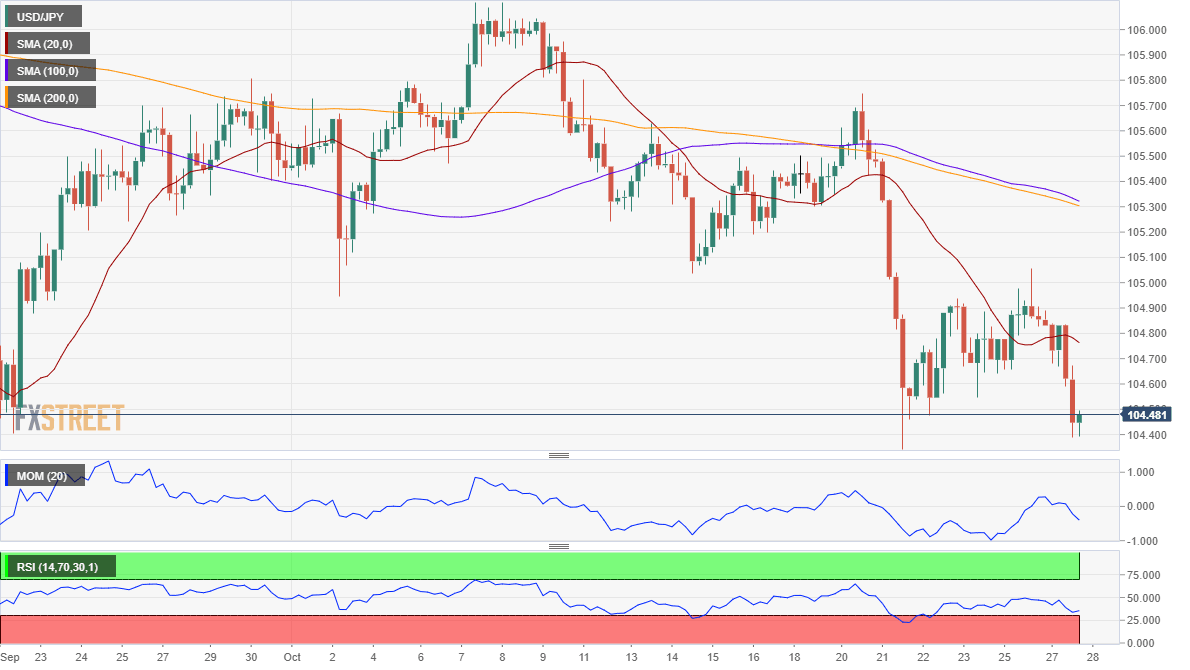

The USD/JPY pair is bearish in the short-term, and will likely extend its decline on a break below 104.30, the immediate support level. The 4-hour chart shows that it has broken below its 20 SMA, which is slowly grinding lower below the larger ones. The Momentum indicator in the mentioned time frame holds within negative levels while the RSI indicator is bouncing just modestly from oversold readings, with no signs of extending its advance.

Support levels: 104.30 103.95 103.50

Resistance levels: 104.70 105.05 105.40

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.