US Consumer Confidence Rises Slightly in February

Consumer confidence, as measured by the Conference Board saw a modest increase in February. The data showed that the consumer confidence index rose to 130.7 from a downward revised 130.4 in January. The data was below estimates of 132.5. The markets brushed aside the data, amid more important global narratives prevailing at the moment.

German Economic Growth Stalls in Q4

Germany’s economic growth in the final three months of 2019 stagnated. The data, provided by statistics agency Destatis showed that GDP was flat on the quarter. This comes after a 0.2% increase in the previous quarter. The revised estimates were also unchanged from the preliminary estimates released a few weeks ago.

Is the EUR/USD Reversing the Trend?

The common currency is once again on the front foot picking up some bullish momentum. The gains come following prices bottoming out near the 1.0800 handle. After establishing support at 1.0840, the current gains will see EURUSD testing 1.0897. Further gains will depend on how price reacts to this resistance level.

Oil Maintains Bearish Trend on Economic Weakness

Crude oil prices continue to remain bearish. Price fell sharply on Monday after many other countries reported on the coronavirus. OPEC member nations including Russia are due to meet at the end of next week. However, prospects of a production cut remain questionable. This arises due to the disagreements between Russia and Saudi Arabia.

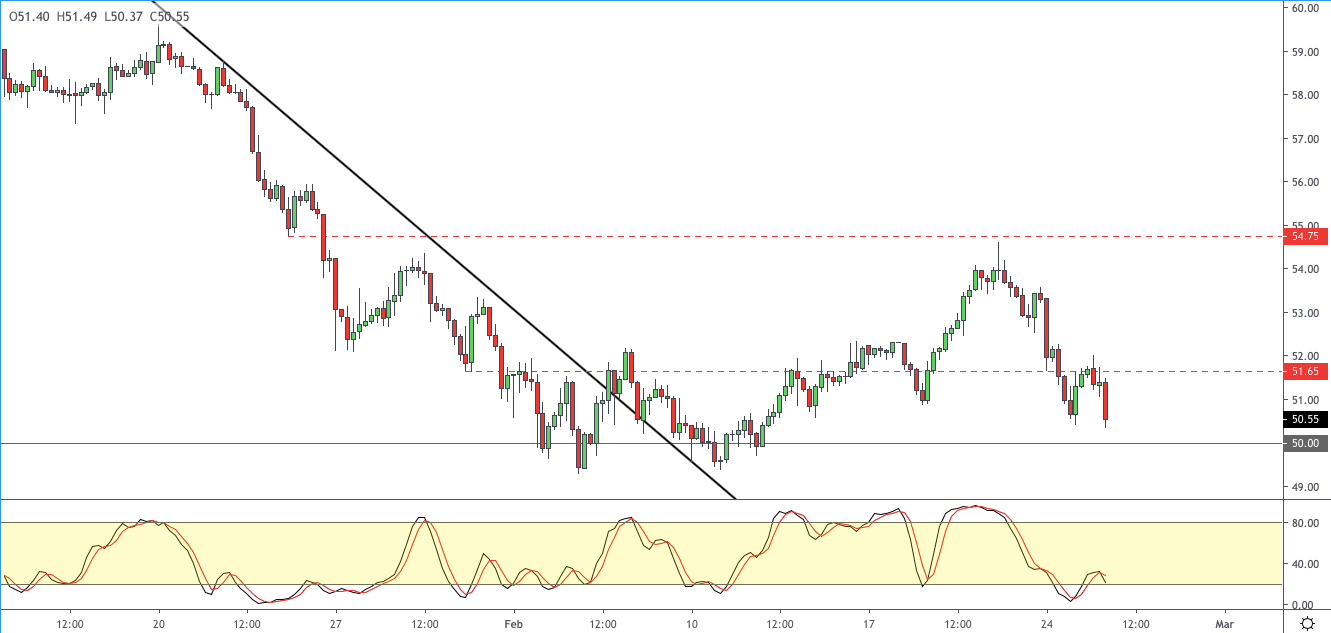

WTI Crude Oil Back in a Slump

Oil prices are bearish, losing over 1.5% on an intraday basis. This follows the strong declines from the day before. After failing to break the resistance level at 51.65, WTI crude oil is inching lower. We expect a test of 50.00 level in the near term once again. However, there are some early signs of a bullish divergence forming, which indicates that the declines could be overdone.

Gold Retreats from a Seven-Year High

The precious metal was trading a tad weaker on Tuesday. However, price action indicates that the market is well-positioned. Fears of an economic slowdown, amid muted central bank monetary policy, has pushed investors into the safe-haven asset.

Will Gold Rebound from the Correction?

XAU/USD is down over 0.70% on an intraday basis. This comes right after price rose to a seven-year high. However, it is too early to write off the rally. Depending on the fundamentals, the direction might very well change. For now, minor support looks to be forming near 1645.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.