The morning belongs to Canada which reports CPI

Outlook:

In the US today, we get the house price index and Dec existing home sales, forecast up to a 5.43 million annual pace from 5.35 million in Nov. We also get the Chicago Fed index.

But most of the morning belongs to Canada, which reports CPI, Nov wholesale sales, new home prices, and the BoC policy meeting outcome (at 10 am ET). As noted yesterday, the BoC is expected to change nothing and give no fresh clues. It’s in wait-and-see mode and data dependent, just not today’s data. It may sound silly, but we bet if Prince Harry moves to Canada, the economy will perk up. A whole new generation of Canadians will be named Archie.

The BoC stance is probably a lot more complicated than “data dependent.” For one thing, now that Nafta 2.0 has been passed, you’d think the Canadian economy would see rising capital investment and other measures showing trade optimism. If not, why not? Either Nafta didn’t matter that much in the first place or the outcome was already baked in. The answer lies with the market watching the central bank, and central banks are taking the stance that there is nothing they can do about politically motivated trade issues so it’s hands-off.

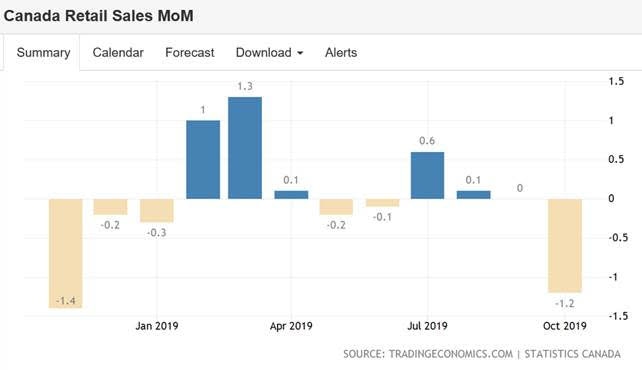

What the central bank can do is watch consumer sentiment as it plays out in obvious places like housing and retail sales. The last retail sales data is from October—see the chart—and not happy. But for this tax year, Canadians are getting a bigger exemption for personal income taxes, and so the question is whether they run right out and spend it, as US consumers always do. Or do they save it? The tax savings are not visible yet this early in the year, but you can bet your bottom dollar the BoC has estimates.

Bottom line, the BoC may well sound optimistic and upgrade its outlook, if mildly. Those expecting gloom, additional rate cuts and a falling CAD can end up with egg on their face.

We are seeing the same thing in the UK with the CBI industrial trends survey posting the biggest gain ever and casting doubt on that rate cut being priced in. Strangely, there are still big, bad contentious issues. The US wants the UK to back off taxing its digital giants or it will face trade consequences, to which the UK said “forget it.” But at the same time, PM Boris has high hopes for a new trade deal with the US, and soon, that will give Britain a favored status.

This is sufficiently illogical as to merit attention. A number of reasons and scenarios present themselves, but the top one is a perception that the UK is not afraid of Trump anymore, if it ever was. This is one benefit of Boris, perhaps the main one. To a certain extent, Canada is in the same place. It’s relying on its own fiscal stimulus and not dictates from south of the border to manage its economy. France may have folded on the digital tax, but France is still suffering from a massive strike and a beleaguered leader. Besides, France has a different relationship with its exports and attributes national pride to things like wine.

If Trump’s bullying is starting to lose its power, that will change the risk-on/risk-off landscape considerably. We can still expect outrageous and stupid conduct from the White House, but the rest of the world shrugging it off means the dollar loses some of its safe-haven patina. Food for thought.

Politics: The Senate impeachment trial of Trump began yesterday and it was one blundering bit of claptrap after another. Each side blathered on for a full 12 hours, debating the Dems’ calls for amendments to the Senate Rules allowing witnesses and documents (11 of them). All were rejected on party lines. At one point the Chief Justice called for decorum, but we missed it because we had to leave the screen after a short while. If these people are the best and brightest, we are in deep trouble and that’s a gloomy deduction we don’t want to make. Speechifying is not good argumentation. Speaker 1 says something stupid, but Speaker 2 just delivers his/her prepared speech and doesn’t rebut Speaker 1 right away. Bah.

Some of the “arguments” are so dumb that any sensible 6th grader can spot them. First up is the Dems’ endless repetition of the offenses and the Plubs’ talking only about the “process” instead. They seem to think that nobody will think to ask whether Trump performed those offenses if only they can make this House action (or failure to act) the focus. But surely it matters whether the charges are true. There are no Plubs saying Trump is innocent.

Then there is the stupid argument that if it’s not a crime named in the statute books, it’s not impeachable. The 6th grader knows that the Constitution was adopted before there were any statutes, criminal or otherwise. The Founders knew perfectly well what they meant by high crimes and misdemeanors, and Hamilton wrote about them at length. The one thing the Dems got right was including the statement that Trump’s conduct is exactly what the Framers feared the most.

Trump is going to win, of course, because McConnell has rigged the jury. But the public knows it. If the Senate does not clean up its act and persists in refusing to deliver some substance, the public is very likely to throw those bums out. If the Senate does deliver some substance and it’s compelling—as it should be, from Bolton, for example—acquittal will still reflect the jury was rigged and they were getting the wool pulled over their eyes. As a general rule, voters don’t like being treated so dismissively. So, either way, next November’s Senate races could be another Dem rout like the midterms.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports, including the Traders Advisories, send $3.95 to [email protected] using Paypal.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat