Crude

The price of oil fell only slightly yesterday after Petro Poroshenko clearly won last weekend’s election in Ukraine. The frontmonth contract on Brent (ICE) is thus still trading at elevated prices despite the fact that Poroshenko’s victory could somehow calm the tense situation in the country in weeks to come. On the other hand, the fighting between pro-Russian rebels and government forces was the fiercest so far yesterday when they fought for the control over Donetsk airport and the situation in Libya remains unresolved.

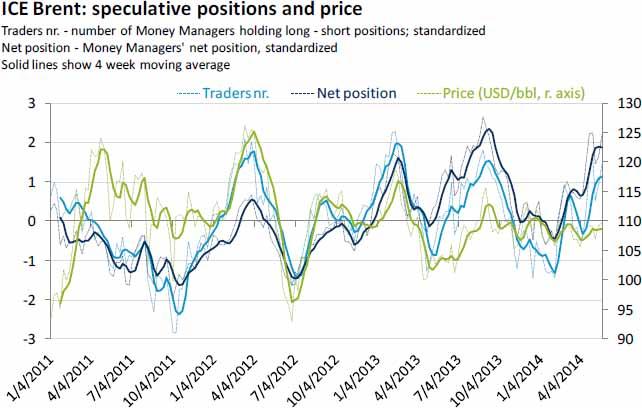

Quite interesting data confirming the bullish mood prevailing in the market was released by the ICE yesterday. The latest Commitment of Traders report unveiled that the difference between the number of speculative traders who are holding long and short positions remained relatively large last week as well as net position which was also seen close to a ten-month high. Although this might signal that the price of oil might be under modest downward pressure in weeks to come (due to calmer situation in Ukraine which might lead to rebalancing of risks), ongoing tensions between Libyan government rebels and upcoming meeting of the European Central Bank might to a large extent offset such effects.

Chart of the day:

Money managers positions (4 week moving averages) in Brent futures reached a ten-month high last week.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD remains offered and below 1.1300

EUR/USD is feeling the squeeze, revisiting the area around 1.1280 as the US Dollar gains extra momentum on Tuesday. Mixed domestic data from Industrial Production and Economic Sentiment haven't done the Euro any favours either.

GBP/USD keeps the bullish stance in the low-1.3200s

After hitting fresh six-month peaks near 1.3250, GBP/USD is now under a tepid selling pressure due to a strong comeback in the Greenback, causing it to retreat toward the 1.3200 support area. Next on the UK docket are inflation figures, expected to be released on Wednesday.

Gold embarks on a consolidative move around $3,200

Gold is holding its own on Tuesday, trading just above $3,200 per troy ounce as it bounces back from earlier losses. While a more upbeat risk sentiment is bolstering the rebound, lingering concerns over a deepening global trade rift have prevented XAU/USD from rallying too aggressively.

XRP, Dogecoin and Mantra traders punished for bullish bets, will altcoins recover?

Altcoins are recovering on Tuesday as the dust settles on US President Donald Trump’s tariff announcements last week. The President has repeatedly changed his mind on several tariff-related concerns, ushering volatility in Bitcoin and altcoin prices.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.