US employment figures are finally out, giving the EUR a onetime chance to recover the ground lost since the year started: the US created just 74K new jobs, and while unemployment rate decreased to 6.7%, closing in on the 6.5% FED’s threshold to consider raising the Fed funds rate, dollar fell down across the board.

Why? Because the decreasing unemployment rate, is a consequence of the labor force participation rate tumbling to 62.8%, its worst level since January 1978. And despite the FED has been firmly ignoring the number, market players can’t see how, now, the Central Bank will be willing to continue removing facilities programs.

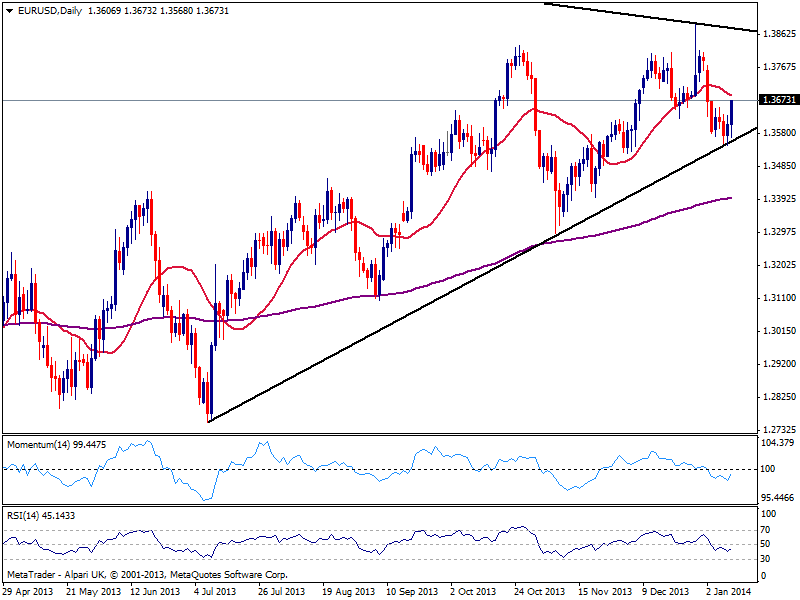

The EUR then, can blossom again, particularly as this week low against the dollar found support to the tip in a still bullish 20 SMA. Also, the daily chart shows price managed to held this week above a daily ascendant trend line coming from past July low at 1.2754, now around 1.3560. In this same time frame, indicators hold below their midlines, albeit lost their downward potential and turned higher, approaching their midlines, while 20 SMA offers now dynamic resistance around 1.3690: this is then the first level to overcome to confirm more EUR/USD gains, looking for a probable retest of the monthly descendant trend line coming from its all time high of 1.6038, now around 1.3860.

As for the downside, as long as the mentioned ascendant trend line holds, buyers will dominate the scene, maintaining the buy-the-dips game alive.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains need to clear 0.6400

AUD/USD rose for the third day in a row, approaching the key 0.6400 resistance on the back of the acute pullback in the US Dollar amid mounting recession concerns and global trade war fear.

EUR/USD: Powell and the NFP will put the rally to the test

EUR/USD gathered extra steam and advanced to multi-month peaks near 1.1150, although the move fizzled out somewhat as the NA session drew to a close on Thursday.

Gold looks offered near $3,100

Prices of Gold remain on the defensive on Thursday, hovering around the $3,100 region per troy ounce and retreating from earlier all-time peaks near the $3,170 level, all against the backdrop of investors' assessment of "Liberation Day".

Interoperability protocol hyperlane reveals airdrop details

The team behind interoperability protocol Hyperlane shared their upcoming token airdrop plans happening at the end of the month. The airdrop will occur on April 22, and users can check their eligibility to receive $HYPER tokens via a portal provided by the Hyperlane Foundation by April 13, the team shared in a press release with CoinDesk.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.