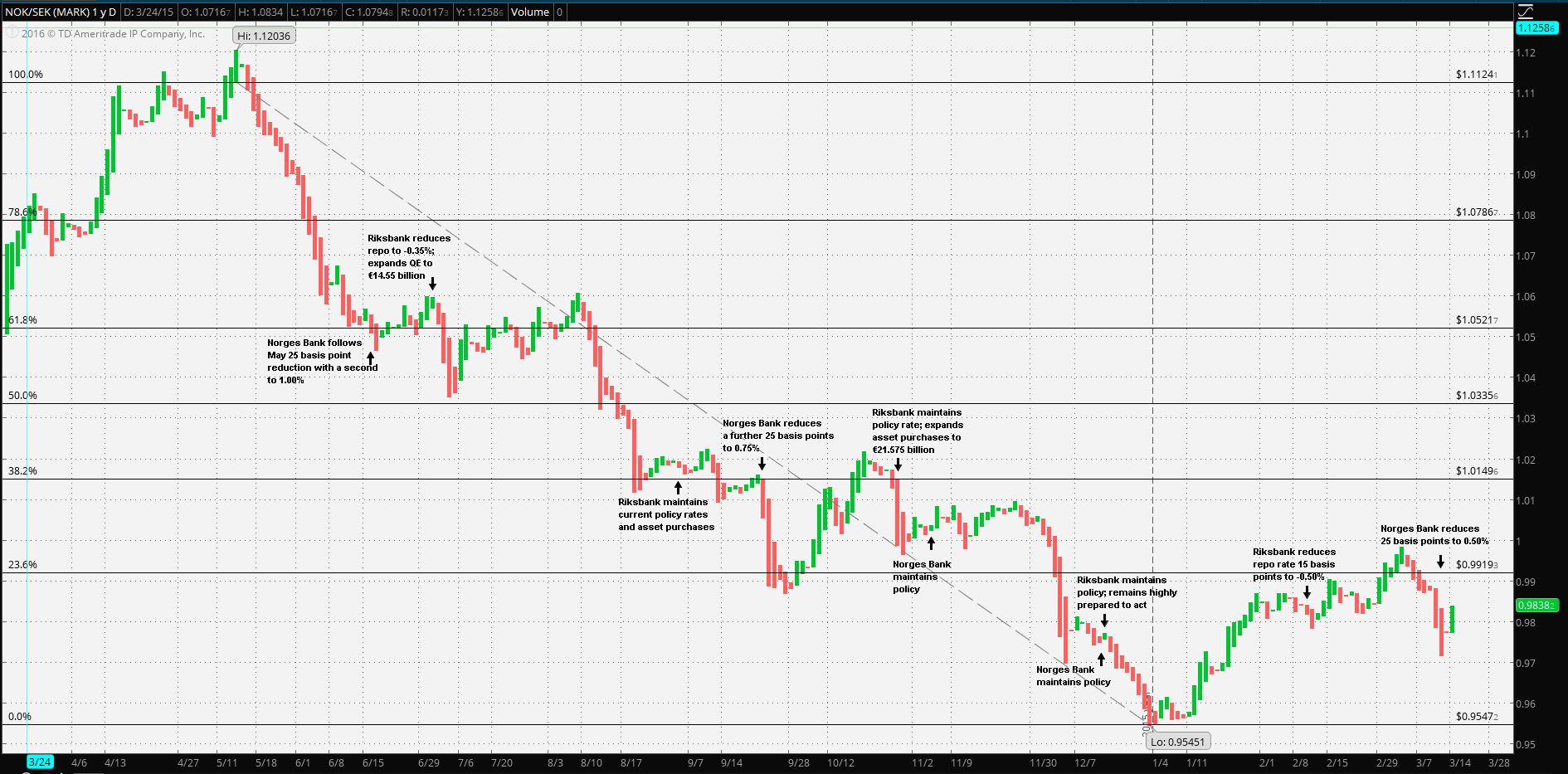

The disproportionality is even more pronounced when the Riksbank asset purchase program is taken into account. One possibility verified by the concerns voiced by Norges Bank’s Governor Øystein Olsen, may have to do with the slowdown in Norway’s economy driving energy sectori. “...Developments in the Norwegian economy have been weaker than foreseen and unemployment is expected to edge up...” Importantly, Governor Olsen made a point of noting that “...The krone depreciation has pushed up consumer price inflation. There are prospects that wage growth will be lower in 2016 than in 2015...” Norway is one of the few nations in Europe experiencing inflation. Unfortunately, as the Norges Bank Governor alluded to, an expected consequence of declining wages is declining spending. The potential for recession seems to be increasing as long as Norway’s energy sector remains depressed.

The combination of declining wage growth does give Norges Bank the leverage to lower further in spite of an already depreciated Krone. Governor Olsen outlined the risks versus the necessity of lowering interest rates toward the zero bound; a condition his regional neighboring central banks have been contending with for at least the past year. “...Lower interest rates could increase financial system vulnerabilities. As the key policy rate approaches a lower bound, the uncertainty surrounding the effects of monetary policy increases. This now suggests proceeding with greater caution in interest rate setting...” Governor Olsen has not ruled out negative rates, if considered necessary: “...Should the Norwegian economy be exposed to new major shocks, the Executive Board will, however, not exclude the possibility that the key policy rate may turn negative...”

It’s interesting to note the economic contrast made by neighboring Riksbank Governor Stefan Ingves particularly with regards to Sweden’s economyi. From the 27 October meeting, Riksbank noted that “...Economic activity in Sweden is strengthening and inflation is showing a clear upward trend...” Riksbank made clear its concerns over global central bank policies, in particular, “... inflation abroad is deemed to be slightly lower and many central banks are expected to pursue an expansionary monetary policy for a longer time. International interest rates are therefore expected to remain very low. Swedish monetary policy needs to take this into consideration. Otherwise the krona risks strengthening earlier and more rapidly than forecast, which would lead to a slower increase in the prices of imported goods and services and lower demand for Swedish exports...” This didn’t necessarily mean Norway, not by far. Norway still has a positive benchmark rate, whereas Sweden is already well negative. The main concern for the Swedish economy is with its dominate trading partner, the Eurozone. Riksbank seemed to have reversed its strengthening against the Euro for the first 6 weeks of 2016, however, the trend reversed almost immediately after Riksbank took further action and was trending towards its 52 week best against the Euro before the trend was broken.

The Norwegian Krone has been steadily weakening against its major trade partner Eurozone and this makes sense. Norway exports petroleum almost entirely to Europe and it accounts for nearly 65% of total Norwegian exports: crude, semi-refined, and fully refined and petroleum gases. The combination of collapsed oil prices, too much ongoing global production and lower demand is heavily weighing on the Norwegian economy. Further, markets have been alarmed by Norges Banks’ liquidation of sovereign held assetsi. To be sure, the Norges Bank fund was designed with that purpose in mind: to support the economy in lean times. However, include the reduction of the key rate by 25 basis points plus clear statements on future actions and FX markets interpret it all as a devaluation of the Krone.

Conversely, Sweden’s economy is doing relatively well. Sweden’s major exports are better diversified and include mostly machinery, electrical-mechanical equipment, transportation equipment, metals, chemicals, wood and a variety of products. Further, Sweden’s major export partners include the relatively strong economies of Germany, UK and the United States, followed by the Nordic countries and then the EU in general.

Also, it’s not unreasonable to conclude that the combined effect of the Swedish asset purchase program plus the ECB asset purchase program is creating demand and decreasing market liquidity for high quality Swedish sovereigns. So demand is not as much for yield as it may be for capital appreciation or a stable asset to further leverage; hence demand for the Krona.

The Riksbank statement makes it clear that it recognizes the underlying strength of the Krona and no doubt will take measured steps to correct it. However, this will be difficult as the ECB continues with QE and capital outflows from Norway weaken the Krone.

Hence, it’s not unreasonable to expect the Norwegian Krone to continue weakening versus the Swedish Krona, with perhaps a few interruptions along the way.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.